- China

- /

- Real Estate

- /

- SZSE:000058

Undiscovered Gems In Asia To Watch In September 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of interest rate adjustments and economic slowdowns, smaller-cap stocks in Asia are drawing attention for their potential resilience and growth opportunities. In this environment, identifying promising stocks involves assessing their ability to adapt to shifting economic conditions, capitalize on regional developments, and maintain robust financial health amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bonny Worldwide | 44.21% | 17.85% | 41.97% | ★★★★★★ |

| Soft-World International | NA | -1.48% | 5.58% | ★★★★★★ |

| Triocean Industrial Corporation | 47.31% | 46.98% | 79.47% | ★★★★★★ |

| Wholetech System Hitech | 6.48% | 14.41% | 19.21% | ★★★★★☆ |

| Changjiu Holdings | 50.46% | 54.90% | 14.57% | ★★★★★☆ |

| Unitech Computer | 43.58% | 2.50% | 0.68% | ★★★★★☆ |

| ShareHope Medicine | 33.76% | 2.13% | -11.17% | ★★★★★☆ |

| Daewon Cable | 23.95% | 7.90% | 48.06% | ★★★★★☆ |

| Tait Marketing & Distribution | 0.69% | 8.02% | 10.61% | ★★★★★☆ |

| SBS Philippines | 29.71% | 3.10% | -49.78% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Karrie International Holdings (SEHK:1050)

Simply Wall St Value Rating: ★★★★★☆

Overview: Karrie International Holdings Limited is an investment holding company that manufactures and sells metal, plastic, and electronic products across various regions including Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe with a market capitalization of approximately HK$3.48 billion.

Operations: The company generates revenue primarily from its Metal and Plastic Business, amounting to HK$2.04 billion, and its Electronic Manufacturing Services Business, contributing HK$1.20 billion.

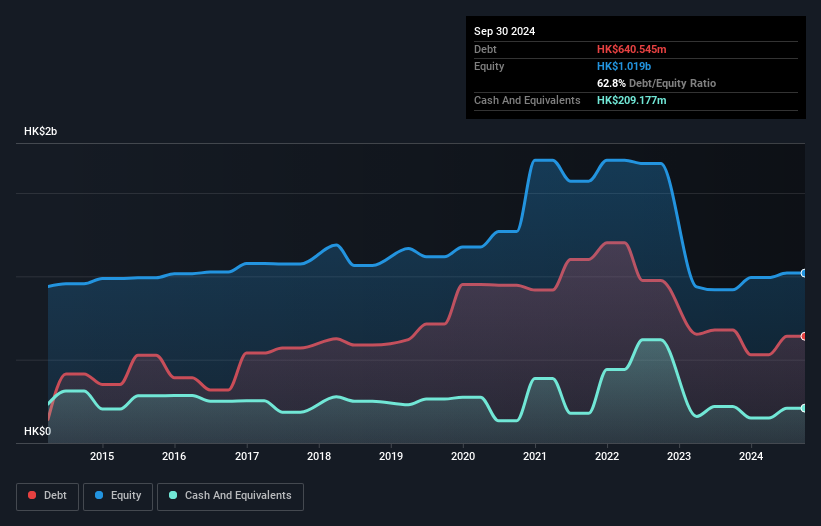

Karrie International Holdings, a notable player in the electronics sector, has shown resilience with its earnings growing 20.5% over the past year, outpacing the industry average of 8.7%. Despite a high net debt to equity ratio of 41.2%, interest payments are well covered at 8.5 times by EBIT, indicating strong financial management. The company recently declared a final dividend of HKD 0.03 per share for March-end 2025 and amended its bye-laws to modernize governance practices. With sales reaching HKD 3.23 billion from HKD 2.92 billion last year, Karrie continues to demonstrate robust performance amidst evolving market conditions.

Jiangsu Tongli Risheng Machinery (SHSE:605286)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Tongli Risheng Machinery Co., Ltd. operates in the machinery industry and has a market cap of CN¥7.44 billion.

Operations: Tongli Risheng Machinery generates revenue primarily through its machinery operations. The company's financial performance can be analyzed by examining its net profit margin, which reflects the efficiency of converting revenue into actual profit.

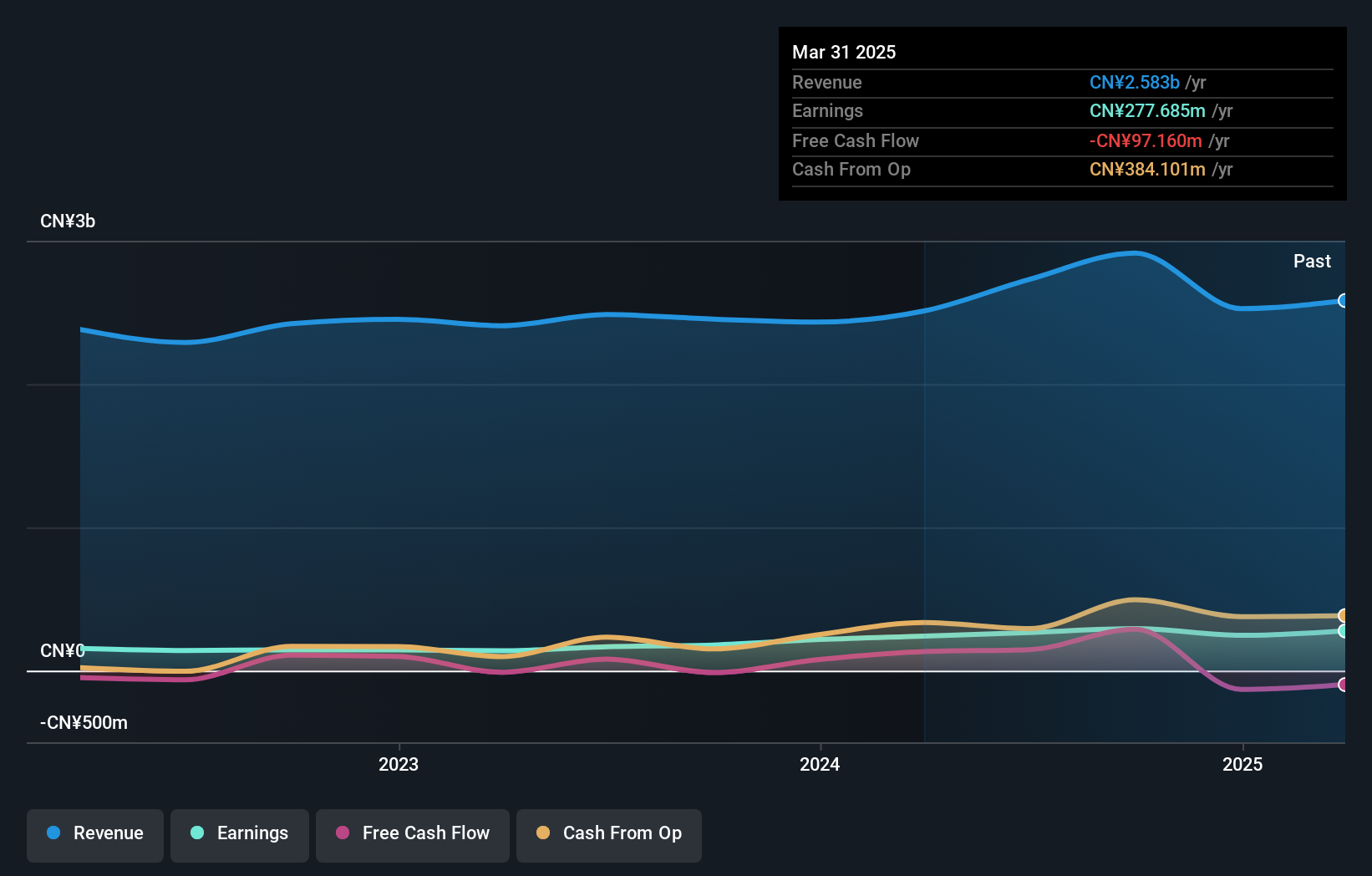

Jiangsu Tongli Risheng Machinery, a relatively small player in the machinery sector, is navigating financial challenges with its recent earnings report showing sales of CNY 1.10 billion for the first half of 2025, down from CNY 1.30 billion last year. Despite a slight dip in net income to CNY 115.85 million from CNY 122.79 million, the company seems undervalued at 85% below fair value estimates and has reduced its debt-to-equity ratio over five years from 26.1% to 17.5%. Although free cash flow remains negative, it holds more cash than total debt and covers interest payments comfortably.

Shenzhen SEGLtd (SZSE:000058)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen SEG Co., Ltd operates in China, focusing on electronic professional markets, leasing, real estate development, and property management, with a market cap of CN¥9.76 billion.

Operations: The company's primary revenue streams include property management (CN¥851.26 million) and electronic market circulation (CN¥538.62 million), with additional contributions from new energy and inspection, testing, and certification services. Real estate development generates a smaller portion of the total revenue at CN¥4.51 million.

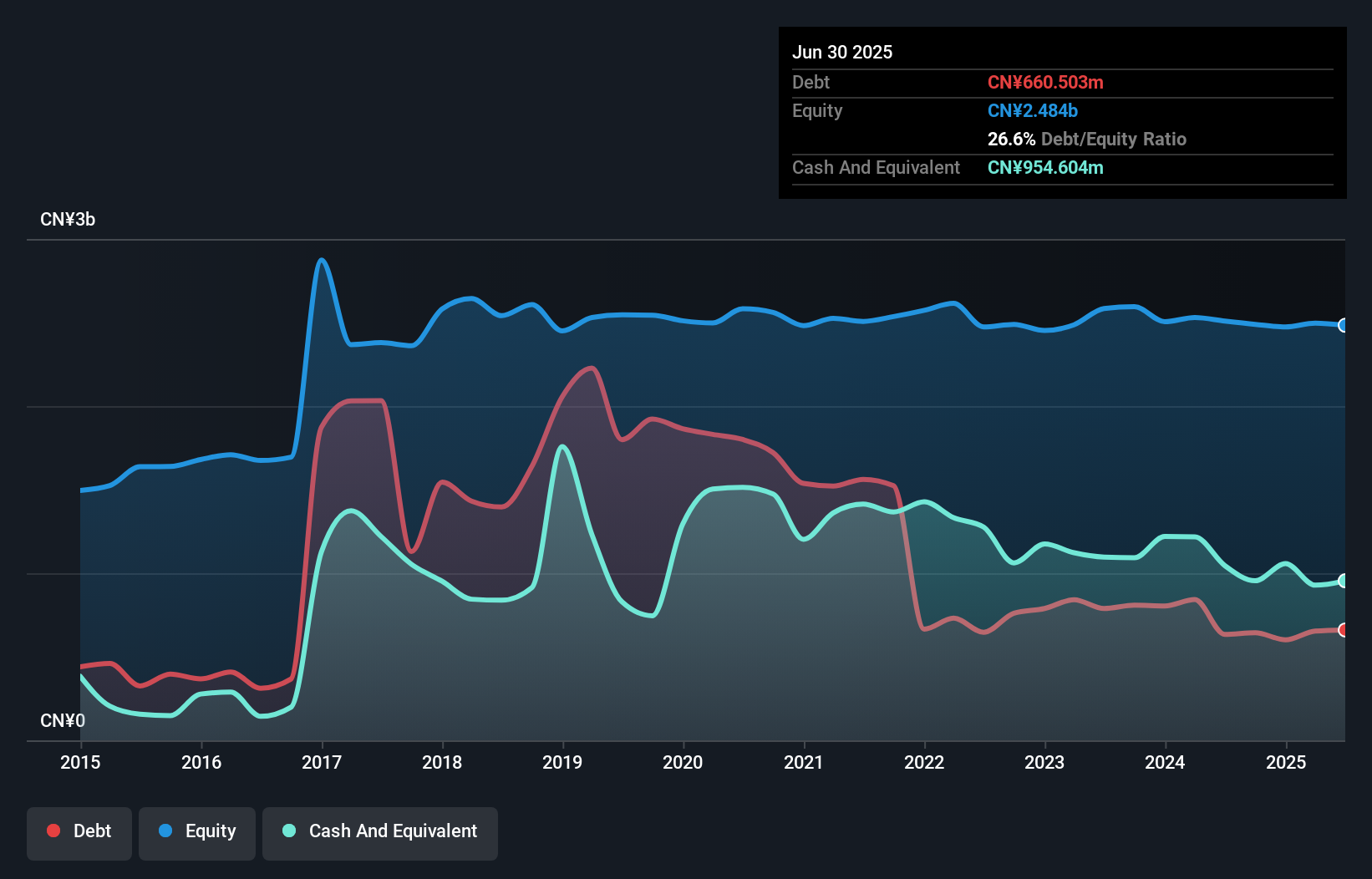

Shenzhen SEG Ltd has shown remarkable earnings growth of 1022.1% over the past year, outpacing the real estate sector's -5.4%. The company’s debt is well-managed, with interest payments covered seven times by EBIT and cash exceeding total debt. Despite a one-off loss of CN¥27.9 million affecting recent results, profitability remains strong and free cash flow is positive. Over five years, the debt-to-equity ratio improved from 69.7% to 26.6%. Recent earnings reported sales at CN¥738 million and net income at CN¥47 million for half-year 2025, slightly lower than last year's figures but still robust in context.

- Unlock comprehensive insights into our analysis of Shenzhen SEGLtd stock in this health report.

Review our historical performance report to gain insights into Shenzhen SEGLtd's's past performance.

Seize The Opportunity

- Investigate our full lineup of 2405 Asian Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000058

Shenzhen SEGLtd

Engages in the operation and management of electronic markets, property management and urban services, new energy, inspection and testing, and real estate development businesses in China.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success