- China

- /

- Real Estate

- /

- SZSE:000042

Shenzhen Centralcon Investment Holding Co., Ltd. (SZSE:000042) Not Doing Enough For Some Investors As Its Shares Slump 25%

Shenzhen Centralcon Investment Holding Co., Ltd. (SZSE:000042) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 27% share price drop.

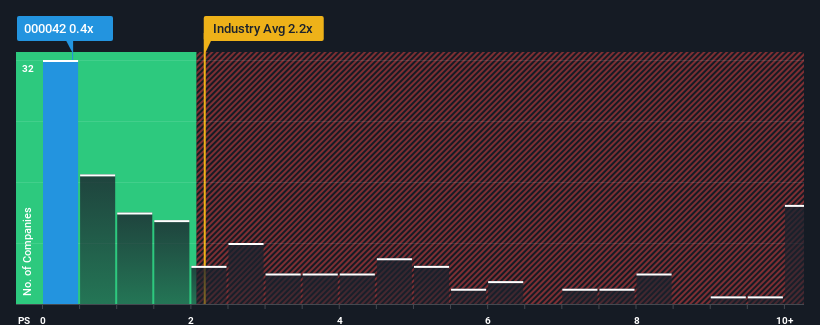

Since its price has dipped substantially, Shenzhen Centralcon Investment Holding may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Real Estate industry in China have P/S ratios greater than 2.2x and even P/S higher than 6x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Shenzhen Centralcon Investment Holding

How Shenzhen Centralcon Investment Holding Has Been Performing

Recent times have been quite advantageous for Shenzhen Centralcon Investment Holding as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shenzhen Centralcon Investment Holding will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Shenzhen Centralcon Investment Holding?

In order to justify its P/S ratio, Shenzhen Centralcon Investment Holding would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 35% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

In contrast to the company, the rest of the industry is expected to grow by 12% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Shenzhen Centralcon Investment Holding's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Shenzhen Centralcon Investment Holding's P/S

Shenzhen Centralcon Investment Holding's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shenzhen Centralcon Investment Holding confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Shenzhen Centralcon Investment Holding (1 is a bit concerning!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000042

Shenzhen Centralcon Investment Holding

Shenzhen Centralcon Investment Holding Co., Ltd.

Adequate balance sheet and fair value.

Market Insights

Community Narratives