- China

- /

- Real Estate

- /

- SHSE:601155

Seazen Holdings Co., Ltd (SHSE:601155) Held Back By Insufficient Growth Even After Shares Climb 42%

Seazen Holdings Co., Ltd (SHSE:601155) shareholders have had their patience rewarded with a 42% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

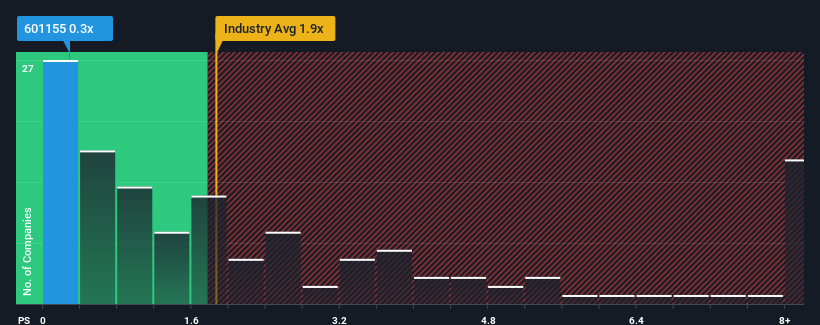

In spite of the firm bounce in price, Seazen Holdings may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Real Estate industry in China have P/S ratios greater than 1.9x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Seazen Holdings

How Seazen Holdings Has Been Performing

Seazen Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Seazen Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Seazen Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 2.7% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 40% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 22% as estimated by the eight analysts watching the company. That's not great when the rest of the industry is expected to grow by 10%.

In light of this, it's understandable that Seazen Holdings' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Seazen Holdings' P/S Mean For Investors?

The latest share price surge wasn't enough to lift Seazen Holdings' P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Seazen Holdings maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Seazen Holdings' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Seazen Holdings that you need to be mindful of.

If these risks are making you reconsider your opinion on Seazen Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601155

Seazen Holdings

Engages in the development and sale of real estate properties in China.

Moderate growth potential with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026