- China

- /

- Real Estate

- /

- SHSE:600848

Shanghai Lingang Holdings Co.,Ltd.'s (SHSE:600848) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

Most readers would already be aware that Shanghai Lingang HoldingsLtd's (SHSE:600848) stock increased significantly by 6.4% over the past week. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Shanghai Lingang HoldingsLtd's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Shanghai Lingang HoldingsLtd

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shanghai Lingang HoldingsLtd is:

4.2% = CN¥1.4b ÷ CN¥32b (Based on the trailing twelve months to June 2024).

The 'return' is the profit over the last twelve months. So, this means that for every CN¥1 of its shareholder's investments, the company generates a profit of CN¥0.04.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Shanghai Lingang HoldingsLtd's Earnings Growth And 4.2% ROE

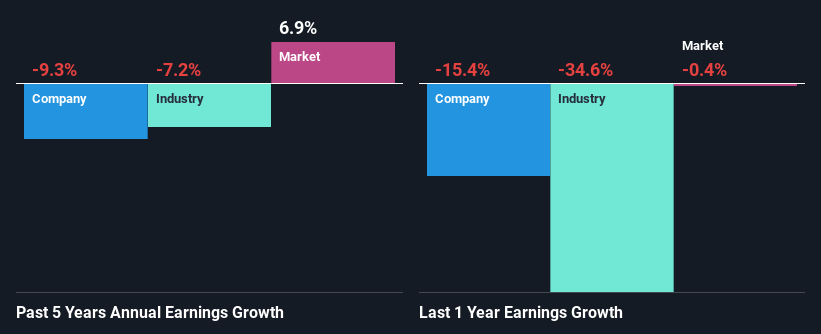

It is quite clear that Shanghai Lingang HoldingsLtd's ROE is rather low. However, when compared to the industry average of 3.3%, we do feel there's definitely more to the company. But then again, seeing that Shanghai Lingang HoldingsLtd's five year net income shrunk at a rate of 9.3% in the past five years, makes us think again. Remember, the company's ROE is quite low to begin with, just that it is higher than the industry average. So that's what might be causing earnings growth to shrink.

Next, when we compared with the industry, which has shrunk its earnings at a rate of 7.2% in the same 5-year period, we still found Shanghai Lingang HoldingsLtd's performance to be quite bleak, because the company has been shrinking its earnings faster than the industry.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Shanghai Lingang HoldingsLtd's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Shanghai Lingang HoldingsLtd Efficiently Re-investing Its Profits?

Shanghai Lingang HoldingsLtd has a high three-year median payout ratio of 50% (that is, it is retaining 50% of its profits). This suggests that the company is paying most of its profits as dividends to its shareholders. This goes some way in explaining why its earnings have been shrinking. The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run. Our risks dashboard should have the 3 risks we have identified for Shanghai Lingang HoldingsLtd.

Additionally, Shanghai Lingang HoldingsLtd has paid dividends over a period of six years, which means that the company's management is rather focused on keeping up its dividend payments, regardless of the shrinking earnings.

Conclusion

On the whole, we do feel that Shanghai Lingang HoldingsLtd has some positive attributes. Yet, the low earnings growth is a bit concerning, especially given that the company has a respectable rate of return and is reinvesting a huge portion of its profits. By the looks of it, there could be some other factors, not necessarily in control of the business, that's preventing growth. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600848

Shanghai Lingang HoldingsLtd

Develops and sells industrial carriers in China.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives