- China

- /

- Real Estate

- /

- SHSE:600773

Revenues Tell The Story For Tibet Urban Development and Investment Co.,LTD (SHSE:600773) As Its Stock Soars 26%

Tibet Urban Development and Investment Co.,LTD (SHSE:600773) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 45% in the last twelve months.

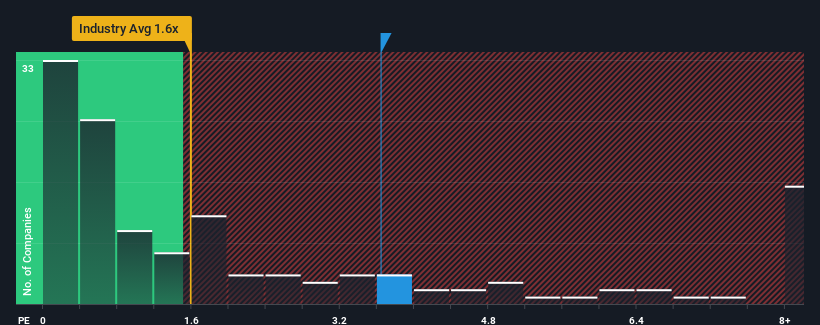

After such a large jump in price, given around half the companies in China's Real Estate industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Tibet Urban Development and InvestmentLTD as a stock to avoid entirely with its 3.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Tibet Urban Development and InvestmentLTD

What Does Tibet Urban Development and InvestmentLTD's P/S Mean For Shareholders?

For example, consider that Tibet Urban Development and InvestmentLTD's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Tibet Urban Development and InvestmentLTD, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Tibet Urban Development and InvestmentLTD?

The only time you'd be truly comfortable seeing a P/S as steep as Tibet Urban Development and InvestmentLTD's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. Still, the latest three year period has seen an excellent 56% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

When compared to the industry's one-year growth forecast of 9.3%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Tibet Urban Development and InvestmentLTD's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does Tibet Urban Development and InvestmentLTD's P/S Mean For Investors?

Shares in Tibet Urban Development and InvestmentLTD have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Tibet Urban Development and InvestmentLTD maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Tibet Urban Development and InvestmentLTD that you need to be mindful of.

If you're unsure about the strength of Tibet Urban Development and InvestmentLTD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Urban Development and InvestmentLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600773

Tibet Urban Development and InvestmentLTD

Develops, operates, manages, and sells real estate properties in China.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026