- China

- /

- Real Estate

- /

- SHSE:600675

Take Care Before Jumping Onto China Enterprise Company Limited (SHSE:600675) Even Though It's 25% Cheaper

China Enterprise Company Limited (SHSE:600675) shares have had a horrible month, losing 25% after a relatively good period beforehand. Indeed, the recent drop has reduced its annual gain to a relatively sedate 3.0% over the last twelve months.

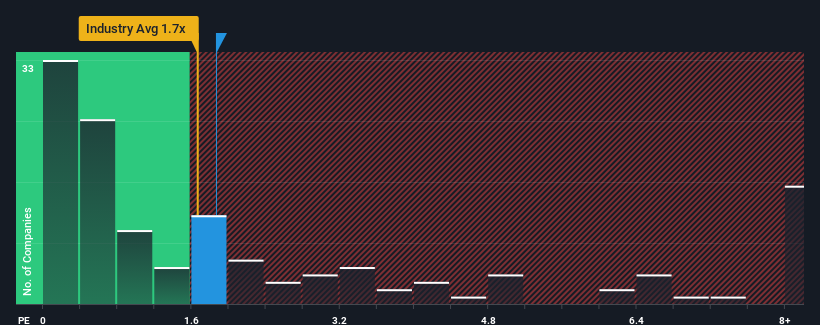

Although its price has dipped substantially, it's still not a stretch to say that China Enterprise's price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" compared to the Real Estate industry in China, where the median P/S ratio is around 1.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for China Enterprise

How China Enterprise Has Been Performing

China Enterprise certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think China Enterprise's future stacks up against the industry? In that case, our free report is a great place to start.How Is China Enterprise's Revenue Growth Trending?

In order to justify its P/S ratio, China Enterprise would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 202%. The latest three year period has also seen a 16% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 51% over the next year. That's shaping up to be materially higher than the 9.0% growth forecast for the broader industry.

With this information, we find it interesting that China Enterprise is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does China Enterprise's P/S Mean For Investors?

China Enterprise's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, China Enterprise's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with China Enterprise (at least 1 which can't be ignored), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600675

China Enterprise

Engages in the real estate development and operation activities in China.

Good value with adequate balance sheet.

Market Insights

Community Narratives