- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2190

Three Asian Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets navigate the aftermath of the longest U.S. government shutdown in history and fluctuating economic indicators, Asian markets are experiencing their own set of challenges and opportunities, with Chinese stocks retreating amid concerns over economic momentum and Japan's indices rising on policy expectations. In this environment, identifying growth companies with substantial insider ownership can be particularly appealing to investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19.2% | 84.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 79.1% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

Here we highlight a subset of our preferred stocks from the screener.

Zylox-Tonbridge Medical Technology (SEHK:2190)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zylox-Tonbridge Medical Technology Co., Ltd. is a medical device company specializing in neuro- and peripheral-vascular interventional devices, operating both in China and internationally, with a market cap of HK$8.94 billion.

Operations: The company's revenue is primarily derived from the sales of neurovascular and peripheral-vascular interventional surgical devices, amounting to CN¥898.46 million.

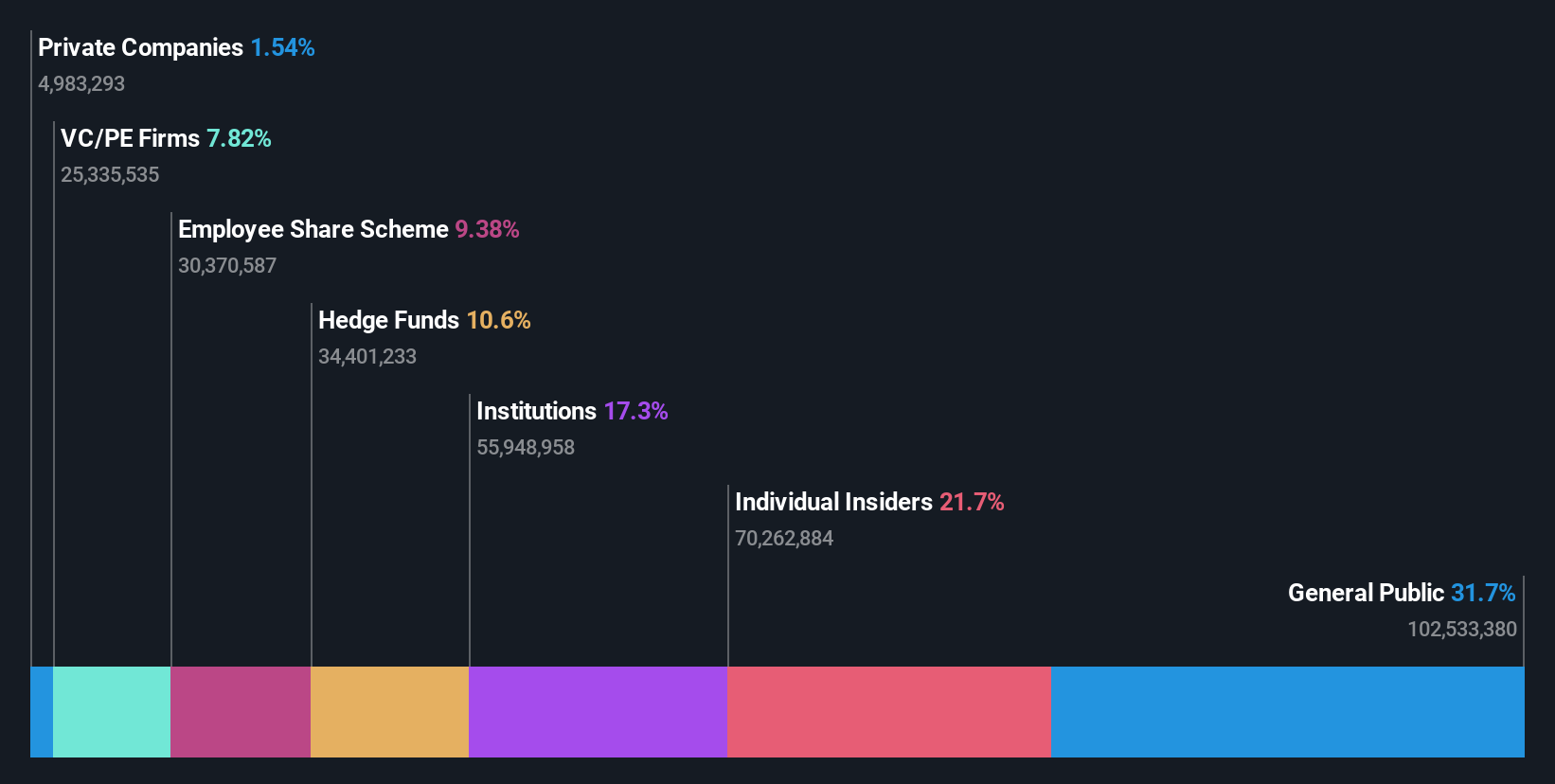

Insider Ownership: 20.8%

Earnings Growth Forecast: 36.8% p.a.

Zylox-Tonbridge Medical Technology shows promising growth potential with earnings forecasted to grow significantly at 36.85% annually, outpacing the Hong Kong market. Despite a low future return on equity, recent earnings surged by nearly 500%, and revenue is expected to grow robustly at 21.5% per year. The company completed share buybacks totaling HK$85.43 million, indicating strong confidence in its valuation as it trades slightly below estimated fair value.

- Click here to discover the nuances of Zylox-Tonbridge Medical Technology with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Zylox-Tonbridge Medical Technology is trading beyond its estimated value.

China Transinfo Technology (SZSE:002373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Transinfo Technology Co., Ltd. operates in the transportation, Internet of Things, big data, and artificial intelligence sectors with a market cap of CN¥17.73 billion.

Operations: China Transinfo Technology Co., Ltd. generates revenue through its operations in transportation, Internet of Things, big data, and artificial intelligence sectors.

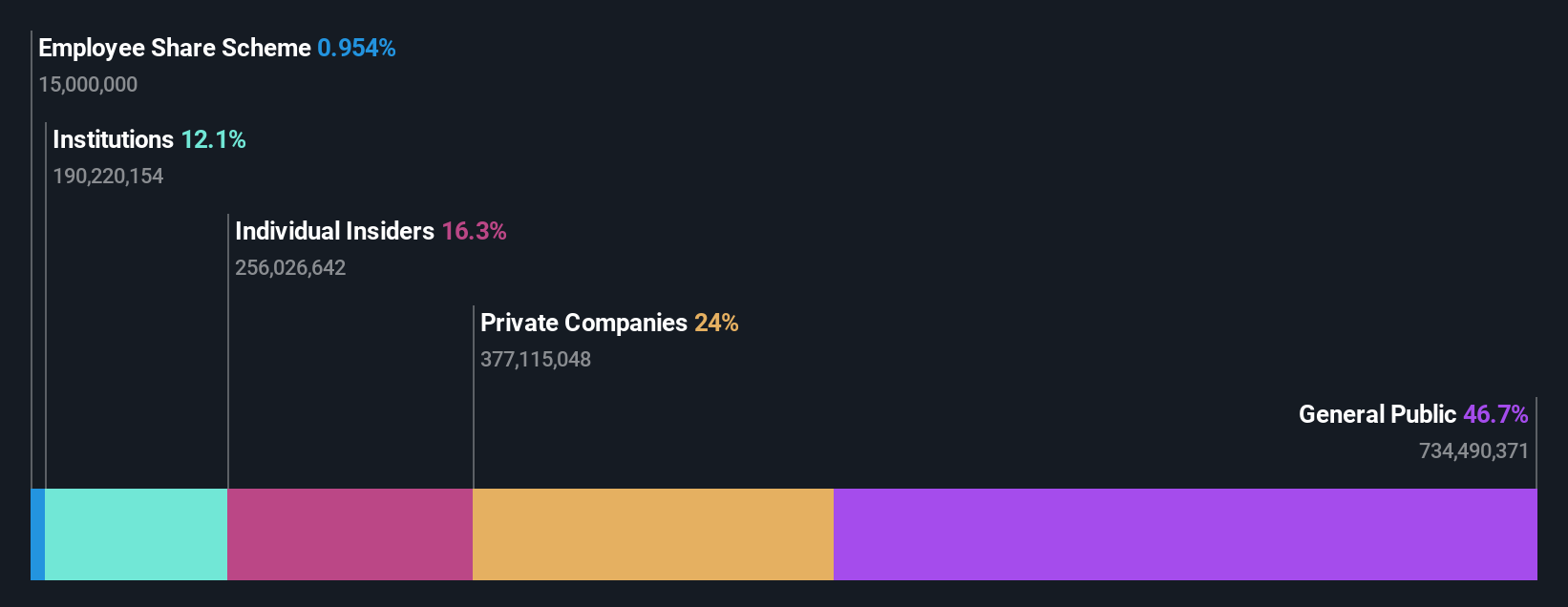

Insider Ownership: 16.3%

Earnings Growth Forecast: 106.6% p.a.

China Transinfo Technology demonstrates significant growth potential with earnings forecasted to grow over 100% annually, surpassing the market average. Recent earnings results show a remarkable increase in net income to CNY 188.94 million for the first nine months of 2025, despite a slight decline in sales. The company is trading at good value compared to peers and industry, though its future return on equity remains modest at an estimated 5.7%.

- Get an in-depth perspective on China Transinfo Technology's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility China Transinfo Technology's shares may be trading at a discount.

ApicHope Pharmaceutical Group (SZSE:300723)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ApicHope Pharmaceutical Group Co., Ltd. operates in the research, development, production, and sale of pharmaceutical drugs with a market cap of CN¥23.09 billion.

Operations: ApicHope Pharmaceutical Group Co., Ltd. generates revenue through its activities in the research, development, production, and sale of pharmaceutical drugs.

Insider Ownership: 19.1%

Earnings Growth Forecast: 93.8% p.a.

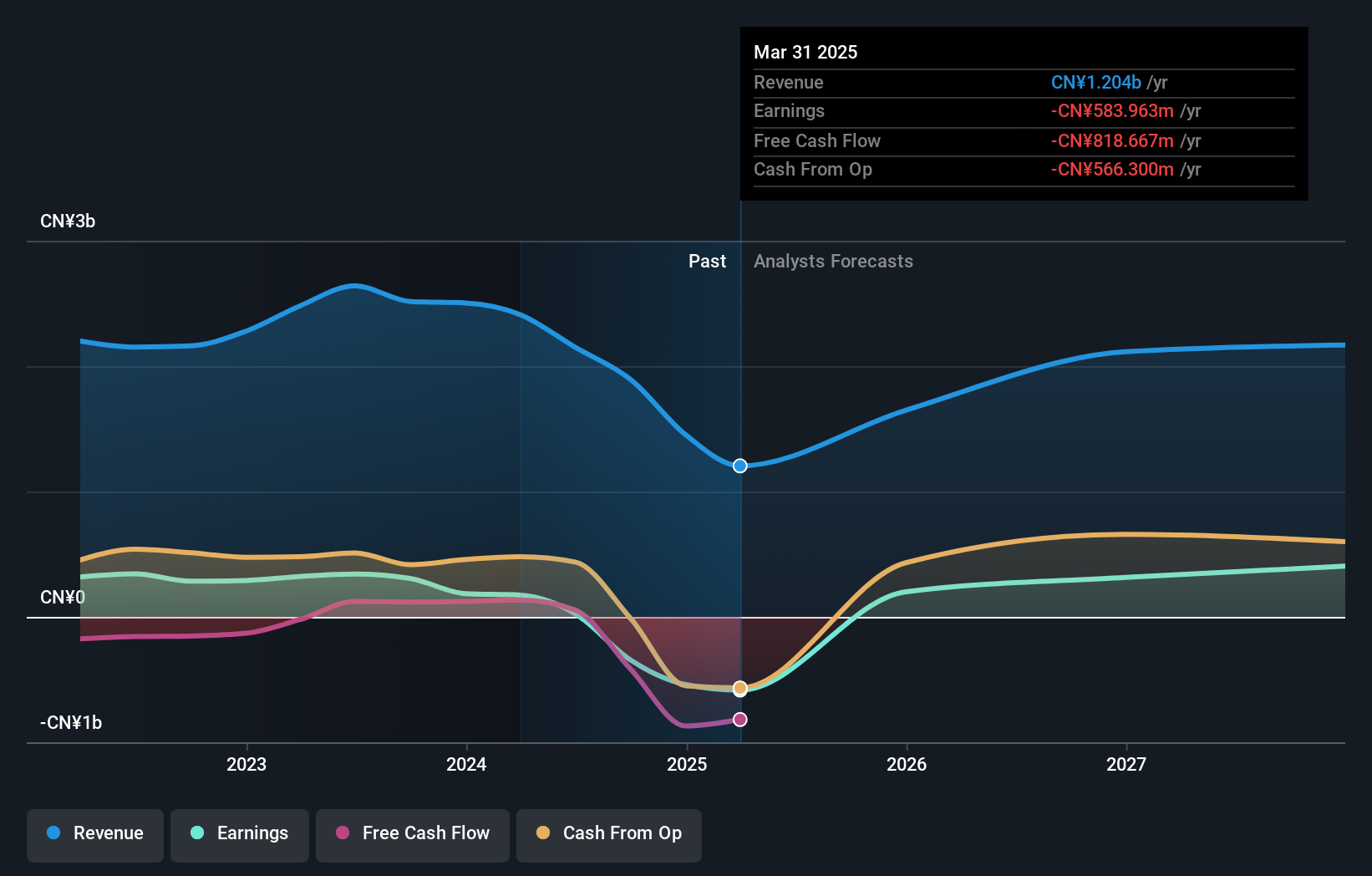

ApicHope Pharmaceutical Group faces challenges with declining sales, reporting CNY 814 million for the first nine months of 2025 compared to CNY 1.24 billion a year ago, yet it shows potential as earnings are forecasted to grow by nearly 94% annually. Despite a current net loss of CNY 136.08 million, profitability is expected within three years. Revenue growth is projected at 29% per year, outpacing the market's average growth rate in China.

- Unlock comprehensive insights into our analysis of ApicHope Pharmaceutical Group stock in this growth report.

- Our valuation report here indicates ApicHope Pharmaceutical Group may be overvalued.

Key Takeaways

- Unlock our comprehensive list of 621 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Interested In Other Possibilities? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zylox-Tonbridge Medical Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2190

Zylox-Tonbridge Medical Technology

A medical device company, provides neuro- and peripheral-vascular interventional medical devices in the People’s Republic of China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives