- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

3 Asian Growth Stocks With Strong Insider Confidence

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals, Asian equities have shown resilience, with China's stock markets advancing despite ongoing challenges in the manufacturing sector. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.7% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

| AprilBioLtd (KOSDAQ:A397030) | 31% | 87.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

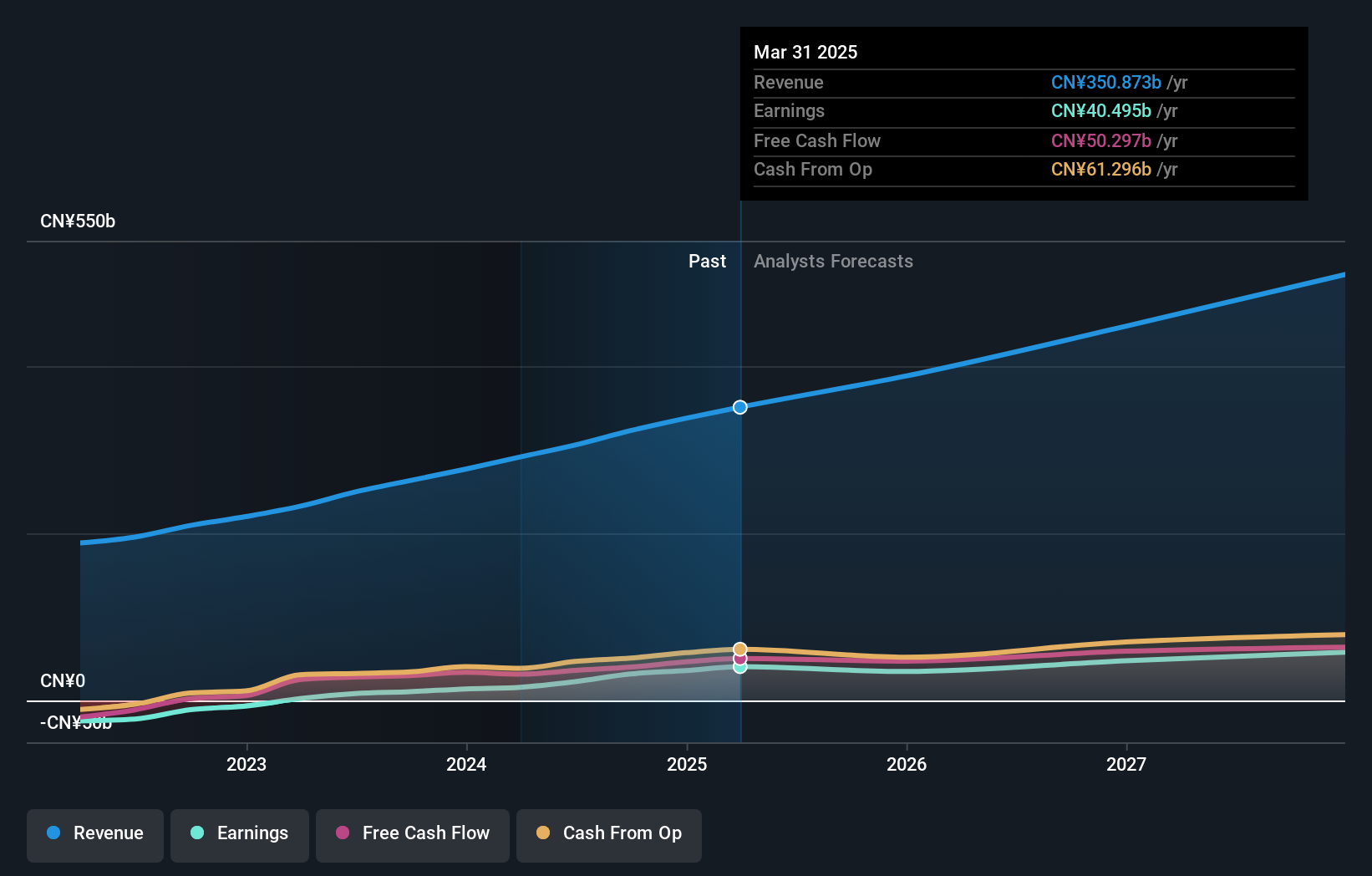

Overview: Meituan is a technology-driven retail company operating in the People's Republic of China, Hong Kong, Macao, Taiwan, and internationally with a market cap of approximately HK$648.07 billion.

Operations: The company's revenue primarily comes from its Core Local Commerce segment, generating CN¥264.61 billion, and its New Initiatives segment, contributing CN¥95.85 billion.

Insider Ownership: 11.2%

Earnings Growth Forecast: 31.7% p.a.

Meituan's earnings are expected to grow significantly at 31.7% annually, outpacing the Hong Kong market. Despite a lower Return on Equity forecast of 18.7%, the company trades at a substantial discount to its estimated fair value. Recent buybacks totaling $5.22 billion indicate confidence in future prospects, although insider buying hasn't been substantial recently. Revenue growth is forecasted at 10.9% per year, surpassing market expectations but below high-growth benchmarks.

- Dive into the specifics of Meituan here with our thorough growth forecast report.

- Our expertly prepared valuation report Meituan implies its share price may be lower than expected.

ApicHope Pharmaceutical Group (SZSE:300723)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ApicHope Pharmaceutical Group Co., Ltd., with a market cap of CN¥26.69 billion, is involved in the research and development, production, and sale of pharmaceutical drugs through its subsidiaries.

Operations: ApicHope Pharmaceutical Group Co., Ltd. generates its revenue from the research, development, production, and sale of pharmaceutical drugs.

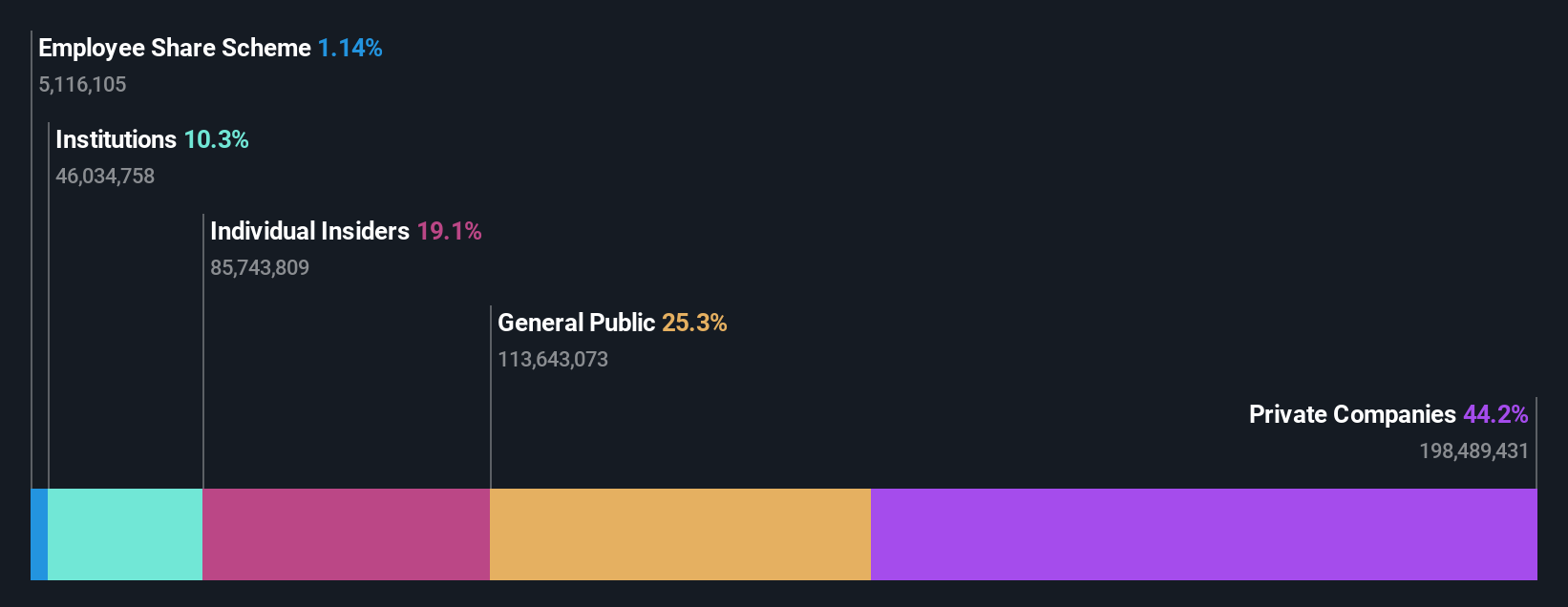

Insider Ownership: 19.1%

Earnings Growth Forecast: 99.5% p.a.

ApicHope Pharmaceutical Group's revenue is forecast to grow at 25.2% annually, outpacing the Chinese market average of 14.1%, despite recent financial setbacks including a net loss of CNY 73.54 million for H1 2025 and volatile share prices. The company is expected to become profitable within three years, surpassing average market growth rates, although its Return on Equity remains low at a forecasted 13.1%. Current debt levels are not well covered by operating cash flow.

- Get an in-depth perspective on ApicHope Pharmaceutical Group's performance by reading our analyst estimates report here.

- The analysis detailed in our ApicHope Pharmaceutical Group valuation report hints at an inflated share price compared to its estimated value.

Phison Electronics (TPEX:8299)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Phison Electronics Corp. designs, manufactures, and sells flash memory controllers and peripheral system applications globally, with a market cap of NT$171.29 billion.

Operations: The company generates revenue from its flash memory control chip design segment, amounting to NT$58.24 billion.

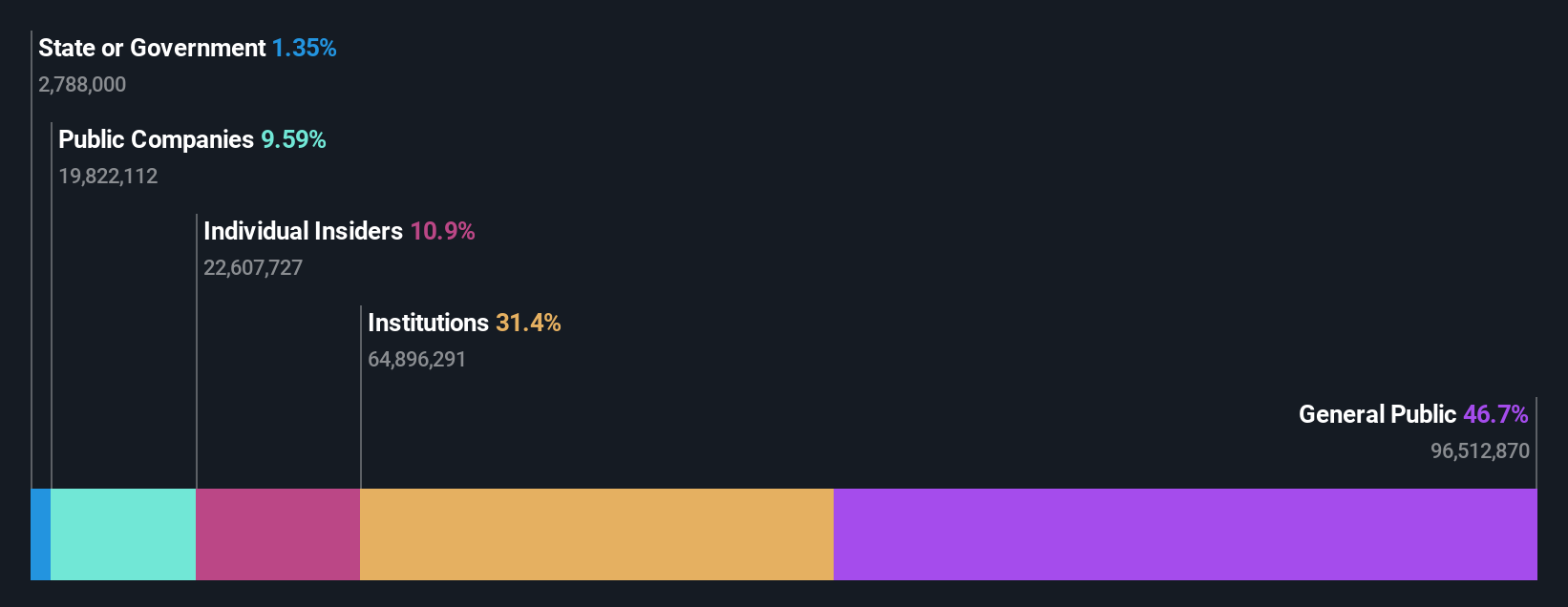

Insider Ownership: 10.9%

Earnings Growth Forecast: 25.3% p.a.

Phison Electronics, despite a volatile share price, is positioned for growth with forecasted earnings and revenue increases of 25.3% and 18.4% annually, respectively, outpacing Taiwan's market averages. Recent strategic partnerships with RedData and Supermicro enhance its storage solutions portfolio for AI and high-density workloads. However, the company's profit margins have declined from last year while dividends remain inadequately covered by free cash flows. Insider ownership levels are significant but lack recent buying activity.

- Click to explore a detailed breakdown of our findings in Phison Electronics' earnings growth report.

- Our comprehensive valuation report raises the possibility that Phison Electronics is priced lower than what may be justified by its financials.

Key Takeaways

- Investigate our full lineup of 615 Fast Growing Asian Companies With High Insider Ownership right here.

- Want To Explore Some Alternatives? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives