Porton Pharma Solutions (SZSE:300363 investor three-year losses grow to 76% as the stock sheds CN¥677m this past week

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So spare a thought for the long term shareholders of Porton Pharma Solutions Ltd. (SZSE:300363); the share price is down a whopping 78% in the last three years. That would certainly shake our confidence in the decision to own the stock. And the ride hasn't got any smoother in recent times over the last year, with the price 52% lower in that time. The falls have accelerated recently, with the share price down 27% in the last three months.

After losing 7.8% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Porton Pharma Solutions

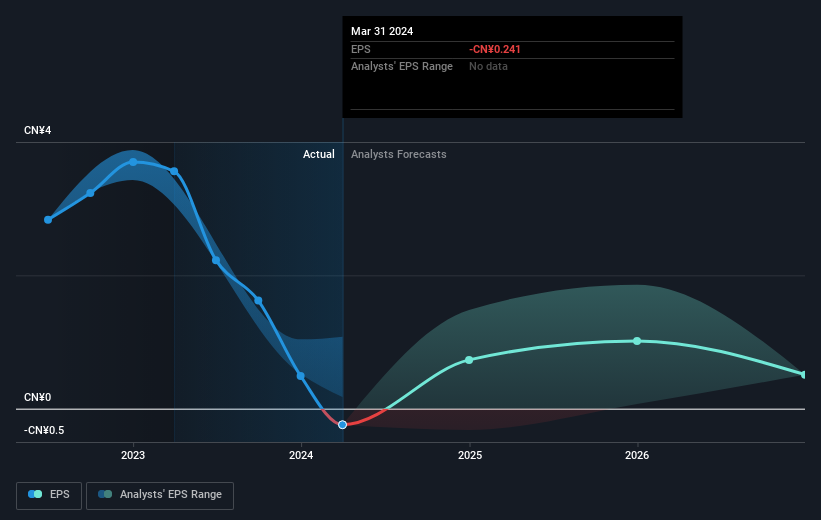

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the three years that the share price declined, Porton Pharma Solutions' earnings per share (EPS) dropped significantly, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. But it's safe to say we'd generally expect the share price to be lower as a result!

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Porton Pharma Solutions' earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 10% in the twelve months, Porton Pharma Solutions shareholders did even worse, losing 51% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 13%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Porton Pharma Solutions .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300363

Porton Pharma Solutions

Engages in the manufacture and sale of small molecule active pharmaceutical ingredients, dosage forms, and biologics to the pharmaceutical companies in China, the United States, and Europe.

Excellent balance sheet with reasonable growth potential.