Stock Analysis

Zhejiang Wolwo Bio-Pharmaceutical And Two More Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets exhibit mixed reactions to recent economic data, with small-cap indices like the Russell 2000 showing notable strength, investors are keenly observing market trends and underlying factors influencing stock movements. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often align leadership interests with shareholder goals, potentially stabilizing performance amidst market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 29.8% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 25.4% |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.5% | 60.9% |

| Vow (OB:VOW) | 31.8% | 97.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

| HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

We'll examine a selection from our screener results.

Zhejiang Wolwo Bio-Pharmaceutical (SZSE:300357)

Simply Wall St Growth Rating: ★★★★★☆

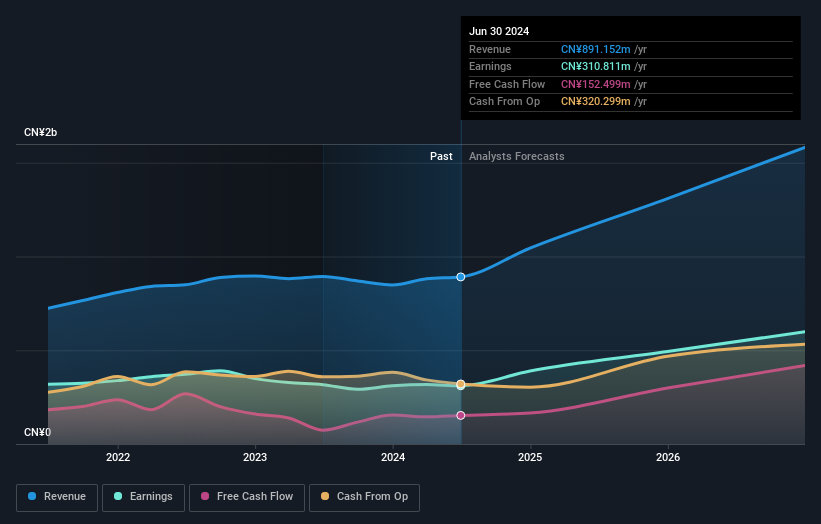

Overview: Zhejiang Wolwo Bio-Pharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, production, and sale of pharmaceutical products for allergic diseases, operating both in China and internationally, with a market capitalization of CN¥10.21 billion.

Operations: The company generates revenue primarily through its segment focused on the research, development, production, and sales of pharmaceuticals, totaling CN¥881.30 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 22.8% p.a.

Zhejiang Wolwo Bio-Pharmaceutical is trading 37.7% below its estimated fair value, indicating potential undervaluation. The company's earnings and revenue are forecasted to grow at 22.79% and 21.2% per year respectively, outpacing the Chinese market averages of 22.2% for earnings and 13.7% for revenue growth. However, its Return on Equity is expected to be low at 16.8%, and recent dividend track records show instability with multiple decreases in payouts over recent months, reflecting potential concerns about its financial sustainability.

- Navigate through the intricacies of Zhejiang Wolwo Bio-Pharmaceutical with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Zhejiang Wolwo Bio-Pharmaceutical is priced higher than what may be justified by its financials.

Porton Pharma Solutions (SZSE:300363)

Simply Wall St Growth Rating: ★★★★☆☆

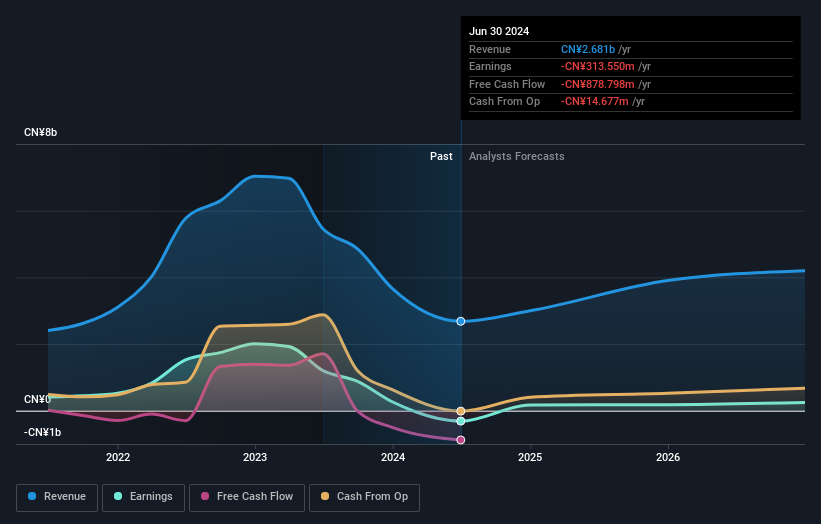

Overview: Porton Pharma Solutions Ltd. specializes in manufacturing and selling small molecule active pharmaceutical ingredients, dosage forms, and biologics to pharmaceutical companies across China, the United States, and Europe, with a market capitalization of approximately CN¥6.58 billion.

Operations: The firm generates revenue primarily through the production and sale of small molecule APIs, dosage forms, and biologics.

Insider Ownership: 27%

Earnings Growth Forecast: 73.4% p.a.

Porton Pharma Solutions is poised for profitability within three years, aligning with above-average market growth expectations. However, its forecasted revenue growth of 14.2% annually, though outpacing the Chinese market's 13.7%, is modest compared to broader industry benchmarks. Recent developments include securing a two-year contract from the Enabling Technologies Consortium to enhance drug manufacturing efficiencies—a positive indicator of innovation and industry trust despite recent dividend cuts and a substantial year-over-year earnings drop reported in April 2024.

- Dive into the specifics of Porton Pharma Solutions here with our thorough growth forecast report.

- Our expertly prepared valuation report Porton Pharma Solutions implies its share price may be lower than expected.

Hubei Feilihua Quartz Glass (SZSE:300395)

Simply Wall St Growth Rating: ★★★★★☆

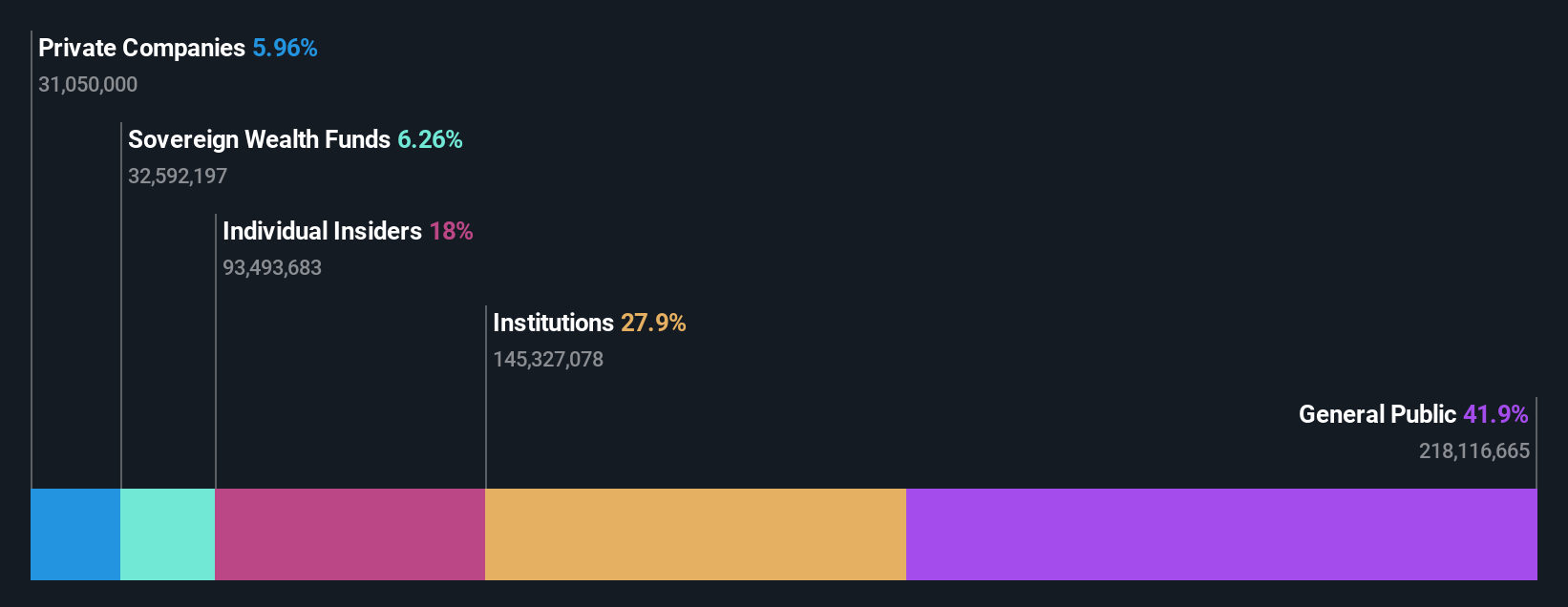

Overview: Hubei Feilihua Quartz Glass Co., Ltd. is a global manufacturer and seller of quartz material and quartz fiber products, with a market capitalization of approximately CN¥15.44 billion.

Operations: The company's revenue from the non-metallic mineral products manufacturing industry totals approximately CN¥1.93 billion.

Insider Ownership: 17.9%

Earnings Growth Forecast: 24.7% p.a.

Hubei Feilihua Quartz Glass is experiencing robust earnings growth, with forecasts predicting a 24.7% increase annually, outpacing the broader Chinese market's 22.2%. Despite this, its return on equity is expected to remain low at 17%. Recent activities include a share buyback program where the company repurchased shares worth CNY 33.69 million and increased dividends to CNY 2.10 per 10 shares for 2023, reflecting confidence from management amidst fluctuating quarterly revenues and profits.

- Click to explore a detailed breakdown of our findings in Hubei Feilihua Quartz Glass' earnings growth report.

- Our valuation report unveils the possibility Hubei Feilihua Quartz Glass' shares may be trading at a premium.

Next Steps

- Navigate through the entire inventory of 1437 Fast Growing Companies With High Insider Ownership here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Zhejiang Wolwo Bio-Pharmaceutical is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300357

Zhejiang Wolwo Bio-Pharmaceutical

A biopharmaceutical company, engages in the research, development, production, and sale of pharmaceutical products for the diagnosis and treatment of allergic diseases in China and internationally.

High growth potential with excellent balance sheet.