Investors in Hebei Changshan Biochemical Pharmaceutical (SZSE:300255) have seen incredible returns of 317% over the past five years

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. For example, the Hebei Changshan Biochemical Pharmaceutical Co., Ltd. (SZSE:300255) share price is up a whopping 314% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. On top of that, the share price is up 132% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for Hebei Changshan Biochemical Pharmaceutical

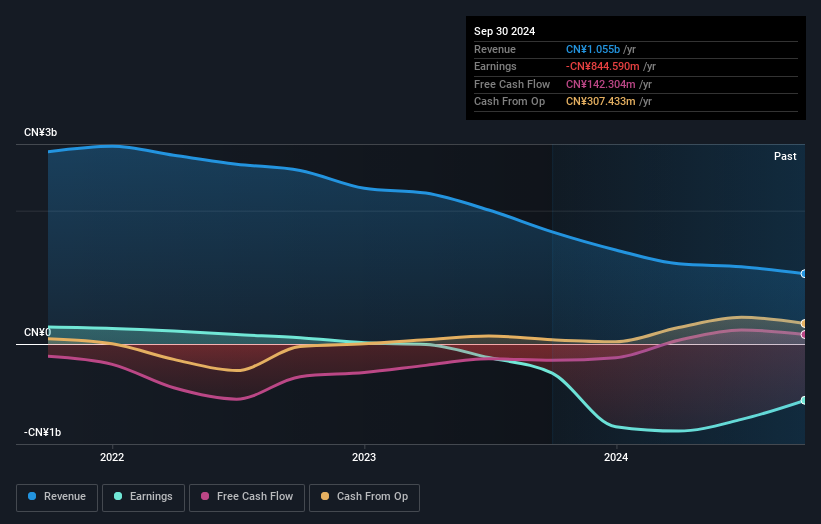

Hebei Changshan Biochemical Pharmaceutical isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last half decade Hebei Changshan Biochemical Pharmaceutical's revenue has actually been trending down at about 9.1% per year. So it's pretty surprising to see that the share price is up 33% per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Hebei Changshan Biochemical Pharmaceutical's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Hebei Changshan Biochemical Pharmaceutical's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Hebei Changshan Biochemical Pharmaceutical shareholders, and that cash payout contributed to why its TSR of 317%, over the last 5 years, is better than the share price return.

A Different Perspective

We're pleased to report that Hebei Changshan Biochemical Pharmaceutical shareholders have received a total shareholder return of 36% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 33% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Hebei Changshan Biochemical Pharmaceutical better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Hebei Changshan Biochemical Pharmaceutical .

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hebei Changshan Biochemical Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300255

Hebei Changshan Biochemical Pharmaceutical

Hebei Changshan Biochemical Pharmaceutical Co., Ltd.

Low with imperfect balance sheet.