- China

- /

- Electronic Equipment and Components

- /

- SZSE:300188

Exploring High Growth Tech Stocks This November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps and economic indicators like U.S. initial jobless claims reaching a seven-month low, investor sentiment appears buoyant despite geopolitical uncertainties. In this environment, high growth tech stocks attract attention for their potential to capitalize on technological advancements and robust demand, making them intriguing options for those seeking dynamic investment opportunities in the ever-evolving market landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.49% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| CD Projekt | 21.17% | 29.59% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Wanda Film Holding (SZSE:002739)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wanda Film Holding Co., Ltd. focuses on the investment, construction, and operation of movie theaters across China, Australia, and New Zealand with a market cap of CN¥26.72 billion.

Operations: Wanda Film generates revenue primarily through its extensive network of movie theaters in China, Australia, and New Zealand. The company's financial performance is significantly influenced by the operational efficiency and profitability of these theaters.

Wanda Film Holding has demonstrated a notable resilience in a challenging market, with revenue growth forecasted at 16.7% annually, outpacing the Chinese market's average of 13.8%. Despite recent setbacks in net income dropping to CNY 168.69 million from last year's CNY 1,114.95 million, the company is poised for recovery with earnings expected to surge by 94.1% per year. This growth trajectory is supported by strategic R&D investments aimed at enhancing technological capabilities and content quality, crucial for staying competitive in the dynamic entertainment industry.

- Click here to discover the nuances of Wanda Film Holding with our detailed analytical health report.

MeiG Smart Technology (SZSE:002881)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MeiG Smart Technology Co., Ltd. focuses on the research and development, production, and sale of Internet of Things terminals and wireless communication modules and solutions both in China and internationally, with a market cap of CN¥6.25 billion.

Operations: MeiG Smart Technology generates revenue primarily through the sale of Internet of Things terminals and wireless communication modules. The company operates both domestically in China and internationally, leveraging its expertise in R&D to offer comprehensive solutions.

MeiG Smart Technology has demonstrated robust growth, with revenue surging by 19.7% this year, surpassing the Chinese market average of 13.8%. This growth is underpinned by a strategic emphasis on R&D, which saw an investment increase to enhance technological capabilities; these expenses are critical for maintaining competitive advantage in the rapidly evolving tech landscape. Moreover, earnings are expected to accelerate at an impressive rate of 33% annually. The company recently concluded a share repurchase plan and announced significant corporate governance updates during its extraordinary shareholders meeting, reflecting strong management confidence in its operational strategy and future outlook.

- Delve into the full analysis health report here for a deeper understanding of MeiG Smart Technology.

Gain insights into MeiG Smart Technology's past trends and performance with our Past report.

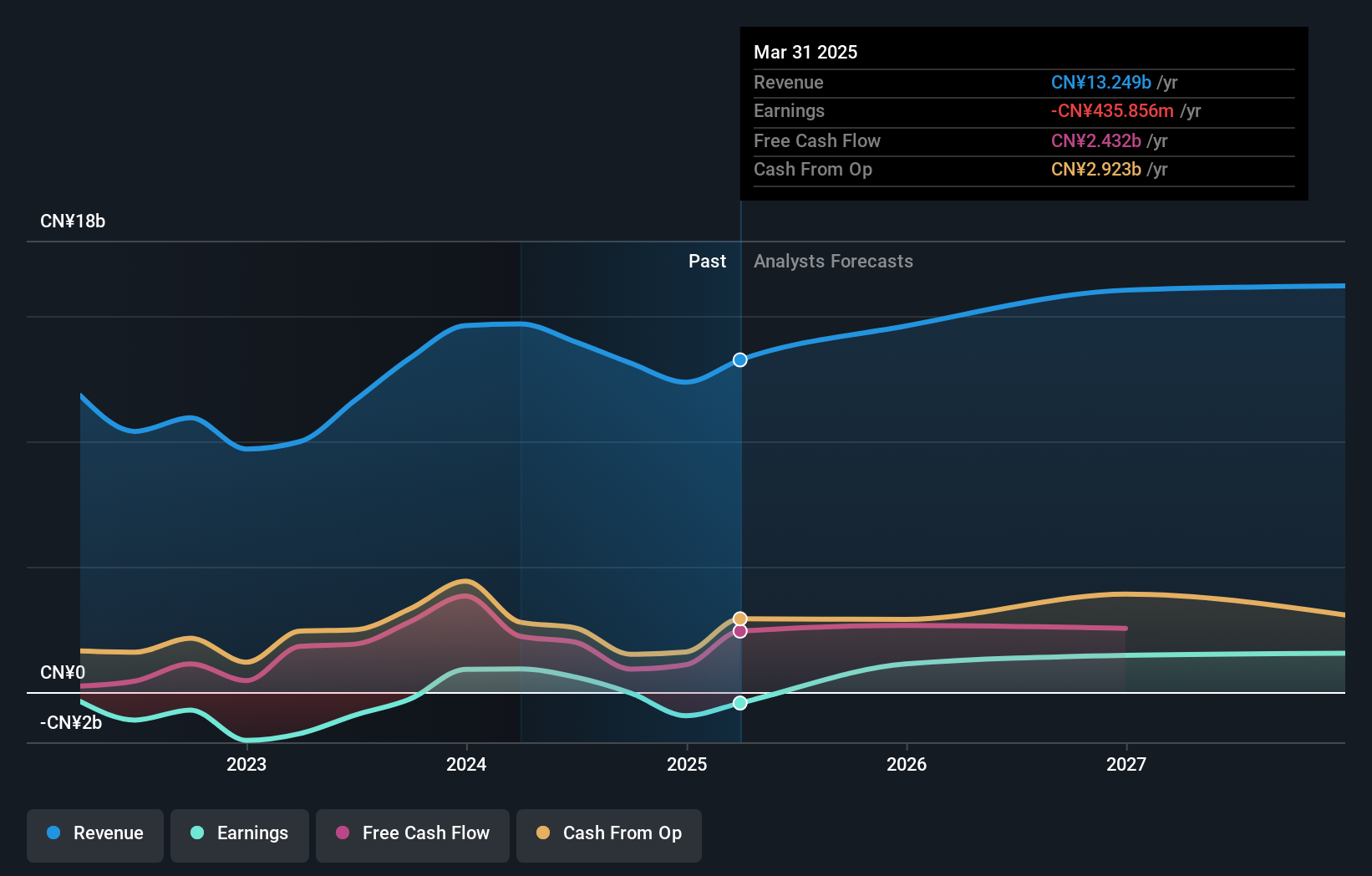

SDIC Intelligence Xiamen Information (SZSE:300188)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SDIC Intelligence Xiamen Information Co., Ltd. operates in the technology sector with a market capitalization of CN¥12.74 billion.

Operations: The company generates revenue primarily through its technology-related services and products. It operates within the technology sector, contributing to its market presence with a market capitalization of CN¥12.74 billion.

SDIC Intelligence Xiamen Information has shown resilience with a notable revenue increase to CNY 897.38 million from CNY 750.49 million year-over-year, despite a challenging fiscal environment marked by a net loss reduction from CNY 397.09 million to CNY 241.83 million. This growth trajectory, pegged at an ambitious 22.6% annually, surpasses the broader Chinese market's average of 13.8%. The company is also on a path to profitability with earnings expected to grow by an impressive 65.7% annually over the next three years, underpinned by strategic investments in R&D which are crucial for sustaining innovation and competitive edge in tech development. The firm’s commitment to research and development is evident from its recent financial strategies aimed at bolstering technological advancements rather than just maintaining status quo—this approach could significantly influence its standing in the high-tech sector long-term. With these robust investment plans in place, SDIC Intelligence Xiamen Information is not only navigating through immediate fiscal hurdles but also setting the stage for sustained future growth in an increasingly digital global market.

Turning Ideas Into Actions

- Take a closer look at our High Growth Tech and AI Stocks list of 1285 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300188

SDIC Intelligence Xiamen Information

SDIC Intelligence Xiamen Information Co., Ltd.

High growth potential with adequate balance sheet.