Shandong Weida Machinery And 2 Other Asian Small Caps with Promising Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of renewed U.S.-China trade tensions and economic uncertainties, investors are increasingly looking towards small-cap stocks in Asia for potential opportunities. In this environment, identifying companies that demonstrate resilience and growth potential amid geopolitical challenges can be key to uncovering promising investments.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Woori Technology Investment | NA | 11.06% | -3.63% | ★★★★★★ |

| Guangzhou Devotion Thermal Technology | 6.90% | -5.77% | 22.35% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.94% | 1.09% | ★★★★★★ |

| Tohoku Steel | NA | 5.45% | 0.39% | ★★★★★★ |

| Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou | 12.09% | -20.53% | 52.26% | ★★★★★★ |

| Wholetech System Hitech | 6.48% | 14.41% | 19.21% | ★★★★★☆ |

| Shenzhen Keanda Electronic Technology | 3.22% | -6.05% | -14.83% | ★★★★★☆ |

| CTCI Advanced Systems | 33.93% | 20.38% | 21.25% | ★★★★★☆ |

| Jinlihua Electric | 53.05% | 9.84% | 44.18% | ★★★★★☆ |

| Mirai Semiconductors | 46.15% | 10.52% | 56.25% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shandong Weida Machinery (SZSE:002026)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shandong Weida Machinery Co., Ltd. specializes in the manufacture and sale of drill chucks both in China and internationally, with a market cap of CN¥7.19 billion.

Operations: Weida Machinery generates revenue primarily from the sale of drill chucks, catering to both domestic and international markets. The company's net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and cost management.

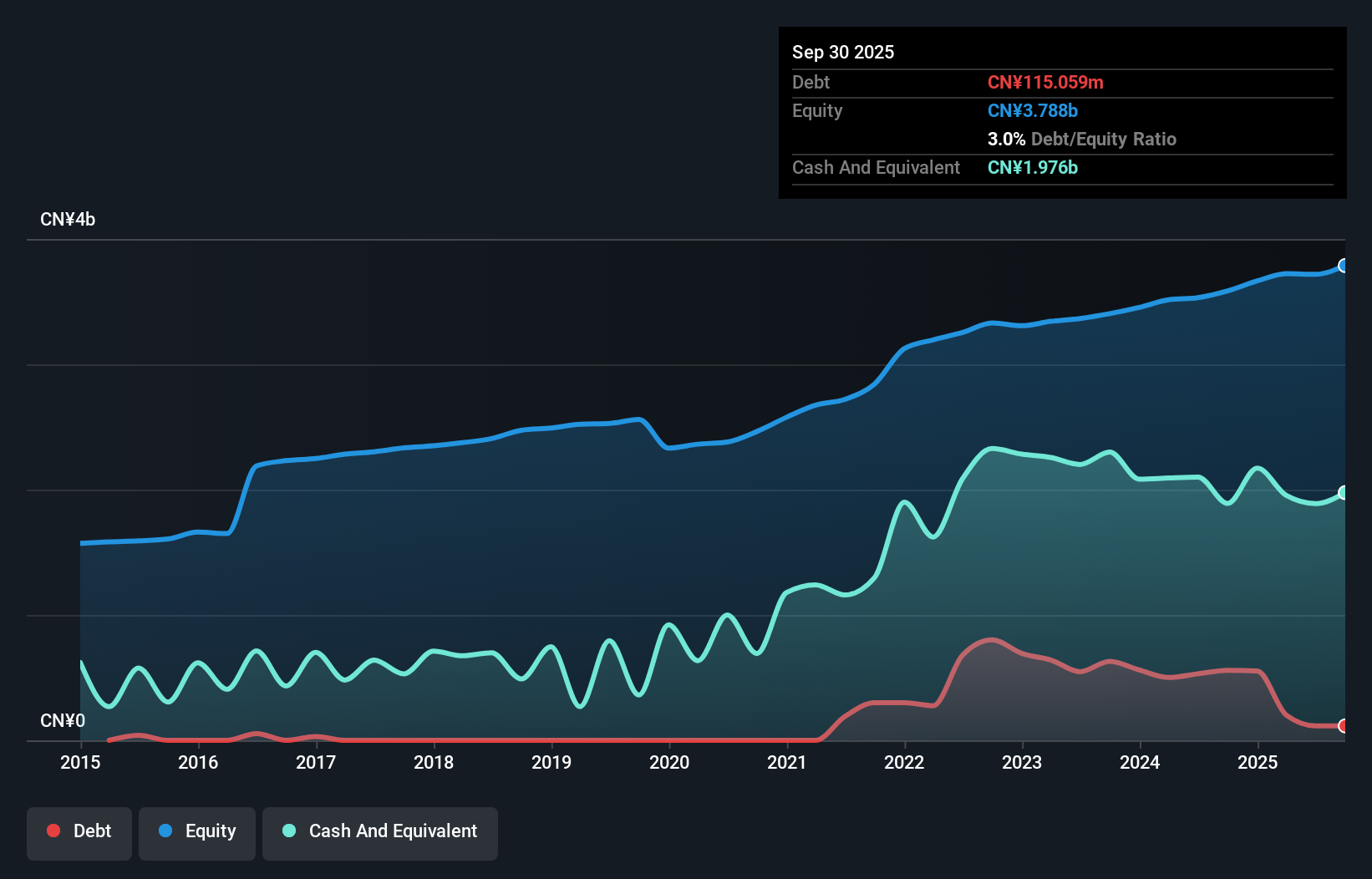

Shandong Weida Machinery, a promising player in the machinery sector, has demonstrated impressive earnings growth of 31.1% over the past year, outpacing the industry average of 3.8%. The company's debt to equity ratio rose from 0% to 3.1% over five years, yet it remains well-covered for interest payments with more cash than total debt. Trading at a value estimated to be 6.2% below its fair price, Weida reported net income of CNY 157.87 million for the first half of 2025 despite lower sales figures compared to last year, reflecting resilience and potential for continued profitability amidst strategic changes in company structure and governance.

- Click here to discover the nuances of Shandong Weida Machinery with our detailed analytical health report.

Assess Shandong Weida Machinery's past performance with our detailed historical performance reports.

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Jolly Pharmaceutical Co., LTD is involved in the research, production, and marketing of Chinese medicinal products both domestically and internationally, with a market cap of CN¥13.21 billion.

Operations: Zhejiang Jolly Pharmaceutical Co., LTD generates revenue primarily through the sale of Chinese medicinal products. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

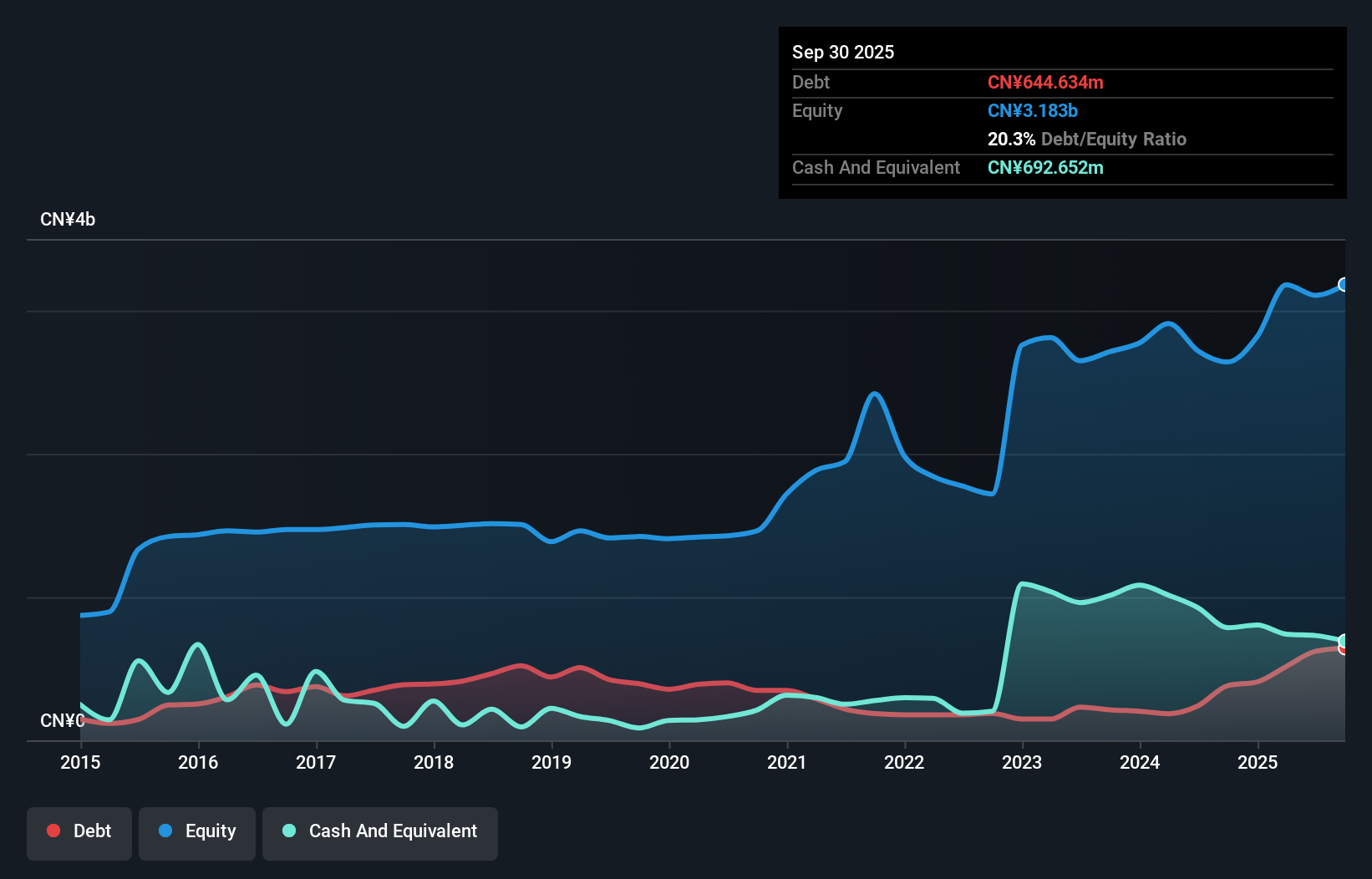

Zhejiang Jolly Pharma, a dynamic player in the pharmaceutical space, has been making waves with its impressive financial metrics. The company reported net income of CNY 373.5 million for the first half of 2025, up from CNY 296.05 million a year earlier, showcasing robust growth. Its debt-to-equity ratio improved significantly over five years from 28.1% to 20%. Moreover, earnings grew by an impressive 21.6% last year and are forecasted to continue at a similar pace annually (21.2%). Trading at a substantial discount of 41.2% below estimated fair value suggests potential upside for investors seeking value opportunities in Asia's pharmaceutical sector.

- Dive into the specifics of Zhejiang Jolly PharmaceuticalLTD here with our thorough health report.

Learn about Zhejiang Jolly PharmaceuticalLTD's historical performance.

AnHui Jinchun Nonwoven (SZSE:300877)

Simply Wall St Value Rating: ★★★★★☆

Overview: AnHui Jinchun Nonwoven Co., Ltd. specializes in the production and sale of nonwoven products, with a market capitalization of CN¥4.25 billion.

Operations: The company generates revenue primarily from the production and sale of nonwoven products. Its financial performance includes a focus on managing costs effectively, with particular attention to maintaining a competitive net profit margin.

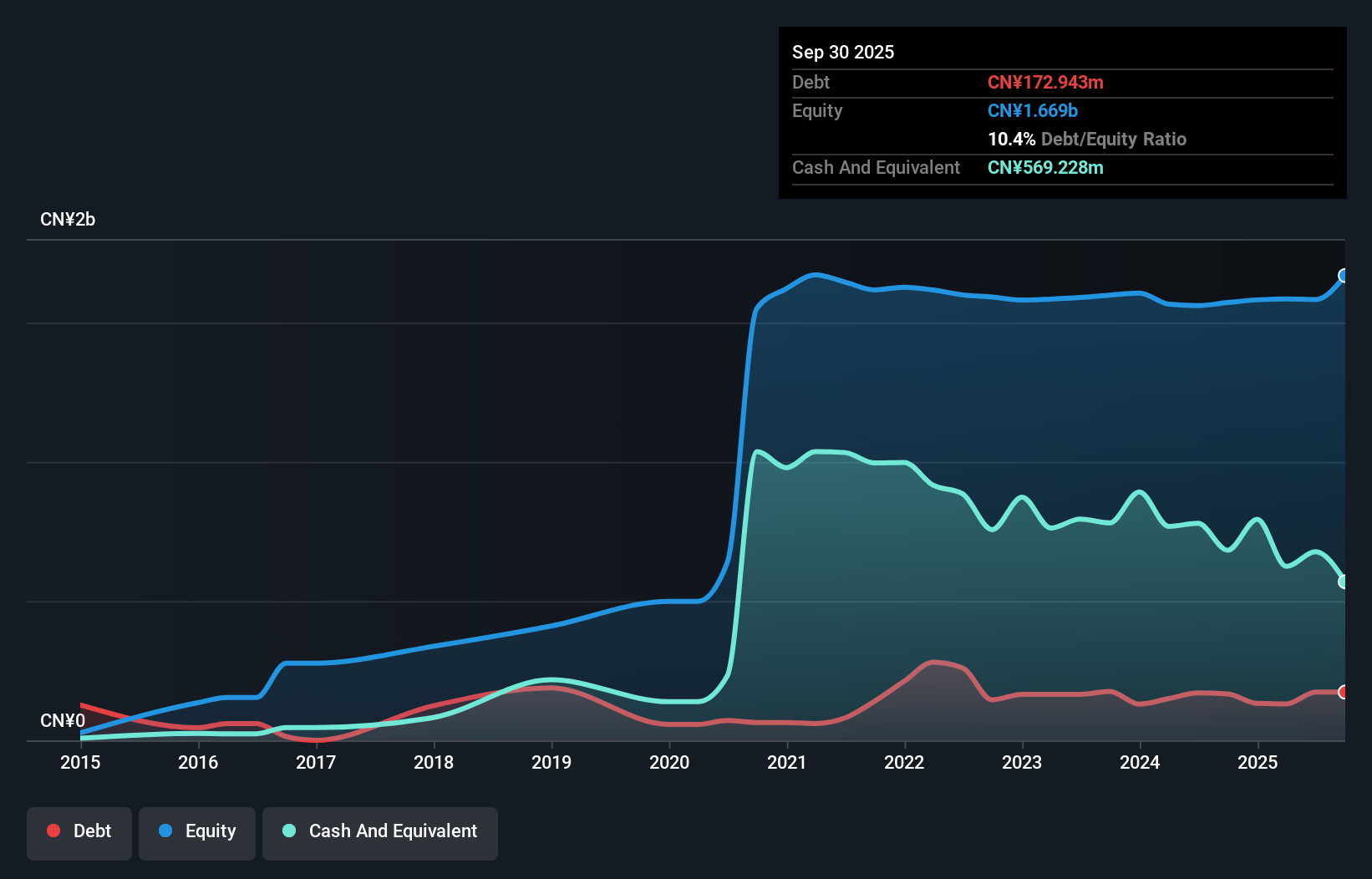

AnHui Jinchun Nonwoven, a small player in the industry, has shown remarkable earnings growth of 96.4% over the past year, outpacing its peers in the luxury sector. Despite a volatile share price recently, their net income surged to CN¥15.42 million for the first half of 2025 from CN¥1.73 million last year. The company repurchased 400,000 shares worth CN¥8.93 million this year as part of its ongoing buyback program announced earlier in April. However, it's important to note that high-quality earnings are impacted by significant one-off gains amounting to CN¥13 million over the last year ending June 2025.

- Unlock comprehensive insights into our analysis of AnHui Jinchun Nonwoven stock in this health report.

Explore historical data to track AnHui Jinchun Nonwoven's performance over time in our Past section.

Taking Advantage

- Dive into all 2373 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jolly PharmaceuticalLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300181

Zhejiang Jolly PharmaceuticalLTD

Engages in the research, production, and marketing of Chinese medicinal products in the People’s Republic of China and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives