Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:002475

High Growth Tech Stocks To Watch In August 2024

Reviewed by Simply Wall St

As global markets react positively to the Federal Reserve's announcement of impending interest rate cuts, small-cap stocks have notably outperformed their larger counterparts, reflecting increased investor optimism. In this favorable environment, identifying high-growth tech stocks becomes crucial for those looking to capitalize on the momentum; companies with strong fundamentals and innovative capabilities are particularly worth watching.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 22.30% | 25.91% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| Scandion Oncology | 40.75% | 72.15% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| UTI | 103.56% | 122.67% | ★★★★★★ |

Click here to see the full list of 1332 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Suzhou Dongshan Precision Manufacturing (SZSE:002384)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou Dongshan Precision Manufacturing Co., Ltd. specializes in the production of electronic circuit products, precision component products, LED display devices, and touch panel and LCD modules with a market cap of CN¥36.80 billion.

Operations: Dongshan Precision generates revenue primarily from electronic circuit products (CN¥25.14 billion), touch panel and LCD modules (CN¥5.77 billion), and precision component products (CN¥4.29 billion). The LED display device segment contributes CN¥1.21 billion to the total revenue.

Suzhou Dongshan Precision Manufacturing's revenue growth of 12.9% per year is forecasted to outpace the CN market's 10.5%, reflecting robust demand in its sector. Despite a recent dip in net income to ¥560.6 million from ¥824.55 million, the company's commitment to innovation is evident with substantial R&D investments driving future prospects. With earnings expected to grow at 28.3% annually, significantly above the market average of 17%, Dongshan’s strategic focus on high-quality segments positions it well for sustained advancement in tech manufacturing.

- Dive into the specifics of Suzhou Dongshan Precision Manufacturing here with our thorough health report.

Understand Suzhou Dongshan Precision Manufacturing's track record by examining our Past report.

Luxshare Precision Industry (SZSE:002475)

Simply Wall St Growth Rating: ★★★★☆☆

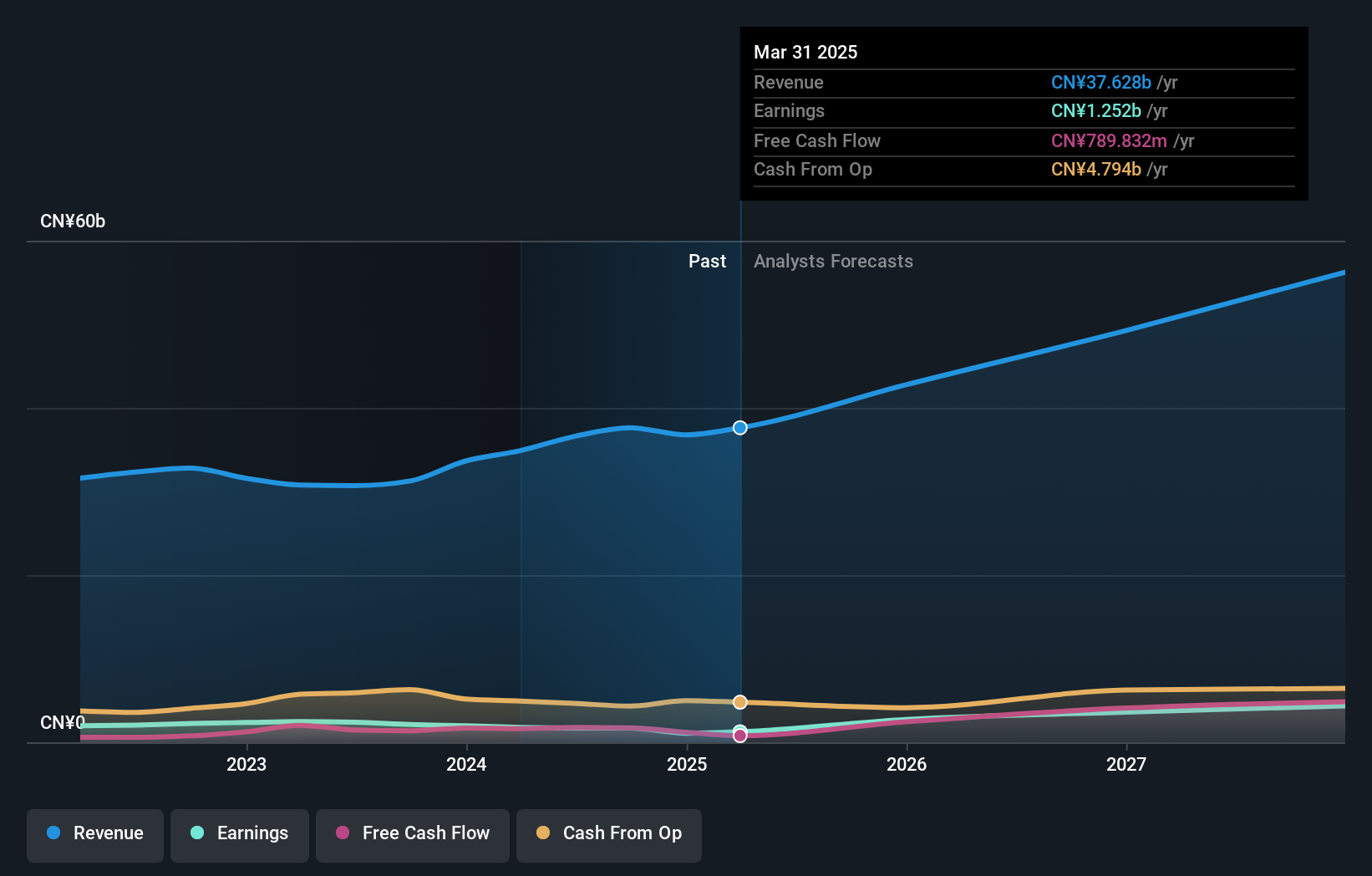

Overview: Luxshare Precision Industry Co., Ltd., together with its subsidiaries, designs, manufactures, and sells cable assembly and connector system solutions worldwide. The company has a market cap of CN¥268.18 billion.

Operations: Luxshare Precision Industry generates revenue primarily from consumer electronics (CN¥199.87 billion), automotive internet products and precision components (CN¥10.80 billion), communication interconnection products and precision components (CN¥15.87 billion), and computer interconnection products and precision components (CN¥7.68 billion). The company focuses on designing, manufacturing, and selling cable assembly and connector system solutions globally.

Luxshare Precision Industry's recent half-year earnings report highlights a revenue increase to ¥103.60 billion from ¥97.97 billion, alongside a net income rise to ¥5.40 billion from ¥4.36 billion, reflecting strong operational performance. The company's R&D expenses have been substantial, contributing 12.8% of its annual budget, underscoring its commitment to innovation in tech manufacturing and AI integration. Additionally, Luxshare's earnings are forecasted to grow at 18.8% annually, outpacing the broader CN market growth of 17%, positioning it favorably within the high-growth tech sector.

Chongqing Zhifei Biological Products (SZSE:300122)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chongqing Zhifei Biological Products Co., Ltd. (SZSE:300122) operates in the biotechnology sector, focusing on the research, development, production, and sale of vaccines with a market cap of CN¥54.51 billion.

Operations: Zhifei Biological Products generates revenue primarily from the sale of vaccines, with significant investments in research and development to support its product offerings. The company's financial performance is highlighted by a notable gross profit margin of 88.31%.

Chongqing Zhifei Biological Products reported half-year sales of ¥18.26 billion, down from ¥24.45 billion a year ago, with net income at ¥2.23 billion compared to ¥4.26 billion previously, reflecting a challenging period for the company. Despite this, earnings are forecasted to grow 20.7% annually over the next three years, outpacing the broader CN market's 17%. The company's R&D expenses have been significant at 9%, highlighting its commitment to innovation in biotech and AI integration within healthcare solutions.

- Get an in-depth perspective on Chongqing Zhifei Biological Products' performance by reading our health report here.

Learn about Chongqing Zhifei Biological Products' historical performance.

Turning Ideas Into Actions

- Gain an insight into the universe of 1332 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002475

Luxshare Precision Industry

Designs, manufactures, and sells cable assembly and connector system solutions worldwide.