- Hong Kong

- /

- Metals and Mining

- /

- SEHK:340

3 Asian Penny Stocks With Market Caps Under US$2B To Watch

Reviewed by Simply Wall St

As global markets continue to experience fluctuations, with notable developments in regions like China and Japan, investors are increasingly looking for opportunities that can offer potential growth. Penny stocks, often associated with smaller or newer companies, present a unique chance for investors willing to explore beyond the well-known names. Despite their vintage label, these stocks can provide surprising value when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.80 | THB3.75B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.96 | HK$2.41B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.54 | HK$952.52M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.625 | SGD253.31M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.78 | THB2.87B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.91 | SGD11.45B | ✅ 5 ⚠️ 1 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.70 | THB9.5B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD4.05 | SGD1.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.475 | SGD177.95M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 974 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Tongguan Gold Group (SEHK:340)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tongguan Gold Group Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and related products in China with a market cap of HK$8.80 billion.

Operations: The company generates revenue primarily from its gold mining operations, amounting to HK$1.69 billion.

Market Cap: HK$8.8B

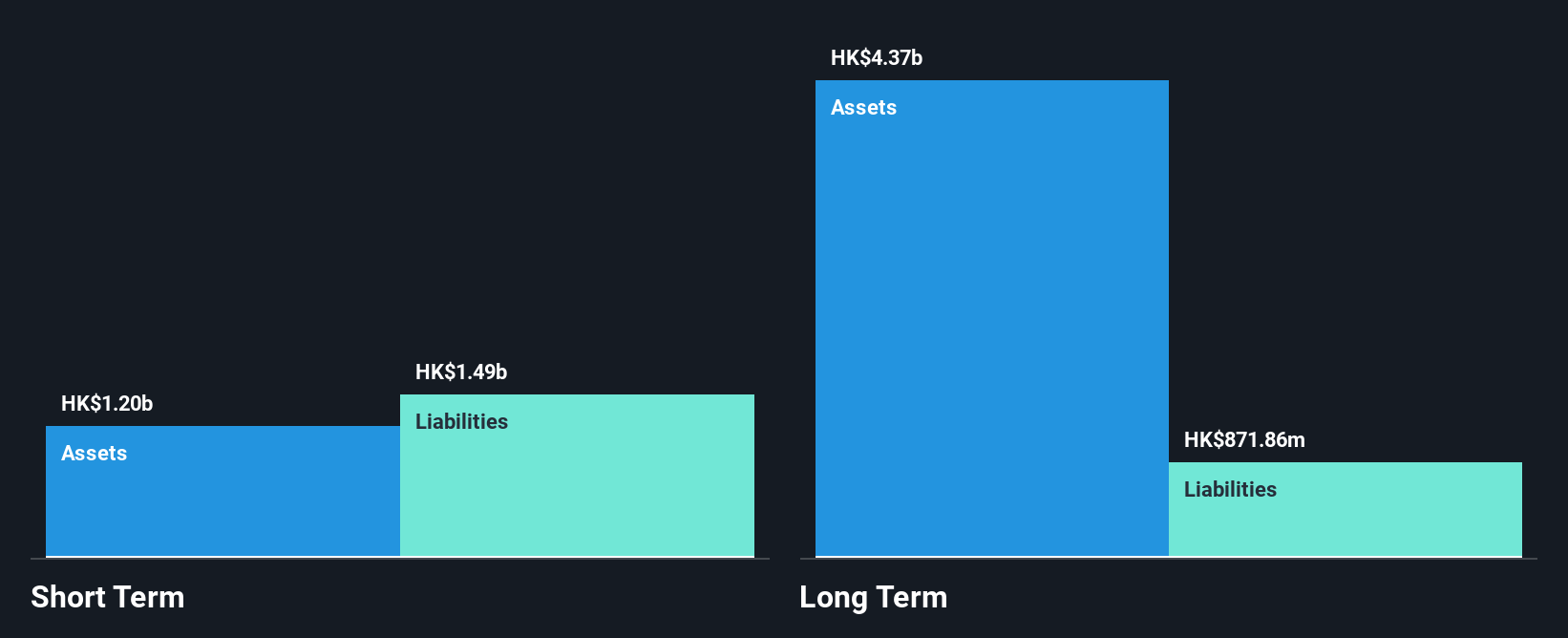

Tongguan Gold Group has shown significant financial growth, with earnings for the half year ending June 30, 2025, reaching HK$342.64 million, a substantial increase from HK$91.96 million in the previous year. The company's revenue is primarily driven by its gold mining operations, totaling HK$1.69 billion annually. Despite an increased debt-to-equity ratio over five years to 20.4%, Tongguan's interest payments are well-covered by EBIT at 19.8 times coverage and its debt is well-supported by operating cash flow at 77.8%. The management team and board are experienced with average tenures of over eight years each.

- Take a closer look at Tongguan Gold Group's potential here in our financial health report.

- Gain insights into Tongguan Gold Group's future direction by reviewing our growth report.

Hour Glass (SGX:AGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Hour Glass Limited is an investment holding company involved in the retailing and distribution of watches, jewelry, and other luxury products across several countries including Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of SGD1.30 billion.

Operations: The company generates SGD1.17 billion in revenue from its operations in the retailing and distribution of watches, jewelry, and other luxury products.

Market Cap: SGD1.3B

Hour Glass Limited, with a market cap of SGD1.30 billion, operates in the luxury retail sector across multiple Asian markets. Despite trading at 37.9% below estimated fair value and having high-quality past earnings, the company faces challenges such as a decline in net profit margins from 13.8% to 11.7% and negative earnings growth over the past year compared to industry averages. However, its financial health is robust with interest payments well-covered by EBIT (46.1x), more cash than total debt, and short-term assets exceeding both long-term liabilities and short-term liabilities significantly, indicating strong liquidity management. Recent strategic moves include a share buyback program funded internally or through borrowings, reflecting confidence in future prospects despite an unstable dividend track record and low return on equity at 14.5%.

- Unlock comprehensive insights into our analysis of Hour Glass stock in this financial health report.

- Gain insights into Hour Glass' historical outcomes by reviewing our past performance report.

Zhejiang Sunflower Great Health (SZSE:300111)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Sunflower Great Health Co., Ltd. operates in the health industry and has a market cap of CN¥5.93 billion.

Operations: The company generates its revenue primarily from the Pharmaceutical Industry, amounting to CN¥318.91 million.

Market Cap: CN¥5.93B

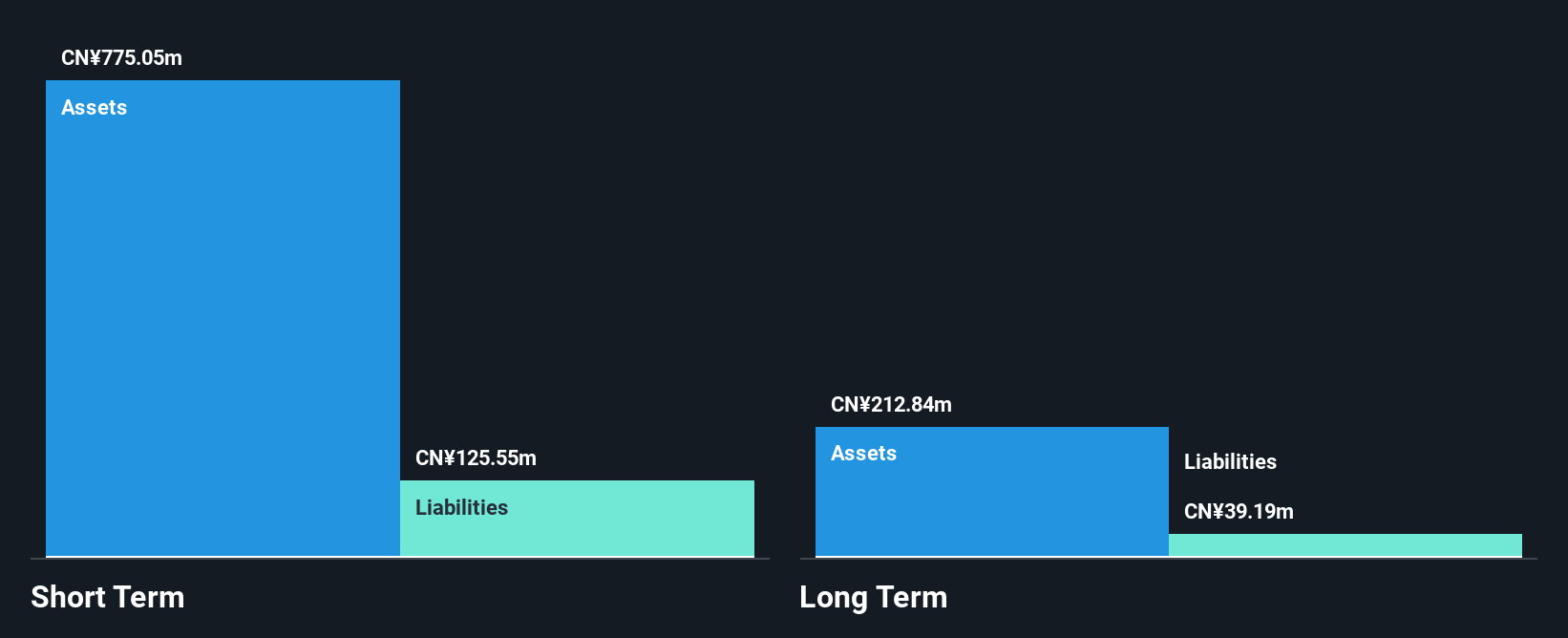

Zhejiang Sunflower Great Health Co., Ltd., with a market cap of CN¥5.93 billion, operates in the health sector, generating CN¥318.91 million from its pharmaceutical activities. The company is debt-free and has not diluted shareholders over the past year, indicating financial prudence. However, it faces challenges such as declining net profit margins (currently 2.2% compared to 9.6% last year) and negative earnings growth (-79.4%). Despite these hurdles, its short-term assets significantly exceed liabilities, providing a cushion for operational needs. Recent developments include proposed amendments to its articles of association at an upcoming general meeting.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Sunflower Great Health.

- Learn about Zhejiang Sunflower Great Health's historical performance here.

Next Steps

- Gain an insight into the universe of 974 Asian Penny Stocks by clicking here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tongguan Gold Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:340

Tongguan Gold Group

An investment holding company, engages in the exploration, mining, processing, smelting, and sale of gold and related products in China.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives