Optimism around Guiyang Xintian PharmaceuticalLtd (SZSE:002873) delivering new earnings growth may be shrinking as stock declines 11% this past week

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Guiyang Xintian Pharmaceutical Co.,Ltd. (SZSE:002873) share price slid 31% over twelve months. That contrasts poorly with the market decline of 10%. Longer term investors have fared much better, since the share price is up 14% in three years. On top of that, the share price is down 11% in the last week.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Guiyang Xintian PharmaceuticalLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

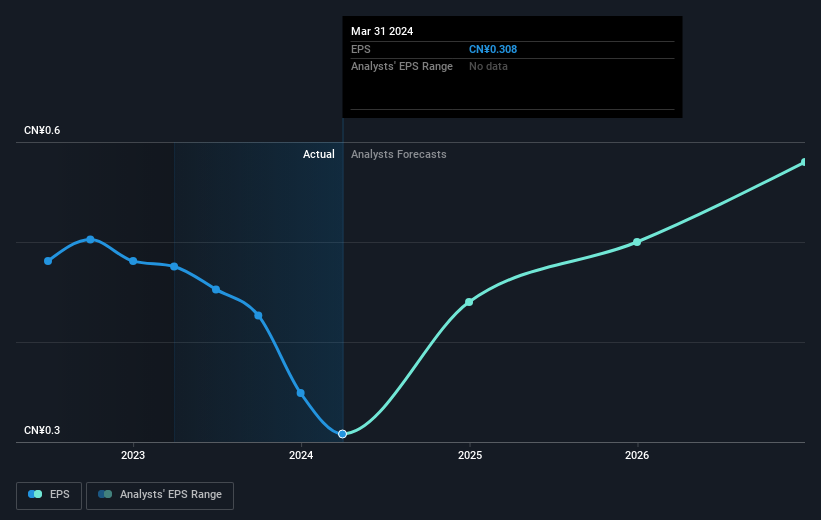

Unhappily, Guiyang Xintian PharmaceuticalLtd had to report a 35% decline in EPS over the last year. This proportional reduction in earnings per share isn't far from the 31% decrease in the share price. So it seems that the market sentiment has not changed much, despite the weak results. Rather, the share price has approximately tracked EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Guiyang Xintian PharmaceuticalLtd's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 10% in the twelve months, Guiyang Xintian PharmaceuticalLtd shareholders did even worse, losing 31% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 5% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Guiyang Xintian PharmaceuticalLtd better, we need to consider many other factors. Take risks, for example - Guiyang Xintian PharmaceuticalLtd has 3 warning signs (and 1 which can't be ignored) we think you should know about.

But note: Guiyang Xintian PharmaceuticalLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002873

Guiyang Xintian PharmaceuticalLtd

Engages in the research and development, production, and sale of new Chinese patent medicines for various diseases in China.

Reasonable growth potential second-rate dividend payer.