- China

- /

- Semiconductors

- /

- SZSE:002371

NAURA Technology Group's (SZSE:002371) investors will be pleased with their incredible 384% return over the last five years

For many, the main point of investing in the stock market is to achieve spectacular returns. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the NAURA Technology Group Co., Ltd. (SZSE:002371) share price. It's 383% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. It's also up 11% in about a month.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for NAURA Technology Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

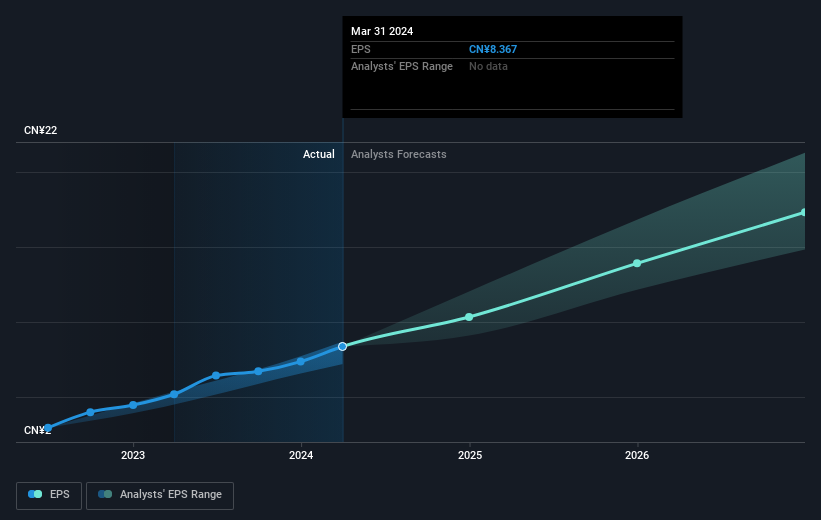

Over half a decade, NAURA Technology Group managed to grow its earnings per share at 74% a year. The EPS growth is more impressive than the yearly share price gain of 37% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that NAURA Technology Group has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at NAURA Technology Group's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that NAURA Technology Group has rewarded shareholders with a total shareholder return of 2.5% in the last twelve months. And that does include the dividend. Having said that, the five-year TSR of 37% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Is NAURA Technology Group cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NAURA Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002371

NAURA Technology Group

Engages in the research and development, production, sale, and technical services of semiconductors in the People's Republic of China.

Flawless balance sheet with high growth potential.