Stock Analysis

Loss-making Shandong Sinobioway Biomedicine (SZSE:002581) sheds a further CN¥462m, taking total shareholder losses to 50% over 1 year

Investing in stocks comes with the risk that the share price will fall. Anyone who held Shandong Sinobioway Biomedicine Co., Ltd. (SZSE:002581) over the last year knows what a loser feels like. In that relatively short period, the share price has plunged 50%. Notably, shareholders had a tough run over the longer term, too, with a drop of 47% in the last three years. Unfortunately the share price momentum is still quite negative, with prices down 16% in thirty days. But this could be related to poor market conditions -- stocks are down 6.9% in the same time.

After losing 6.8% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Shandong Sinobioway Biomedicine

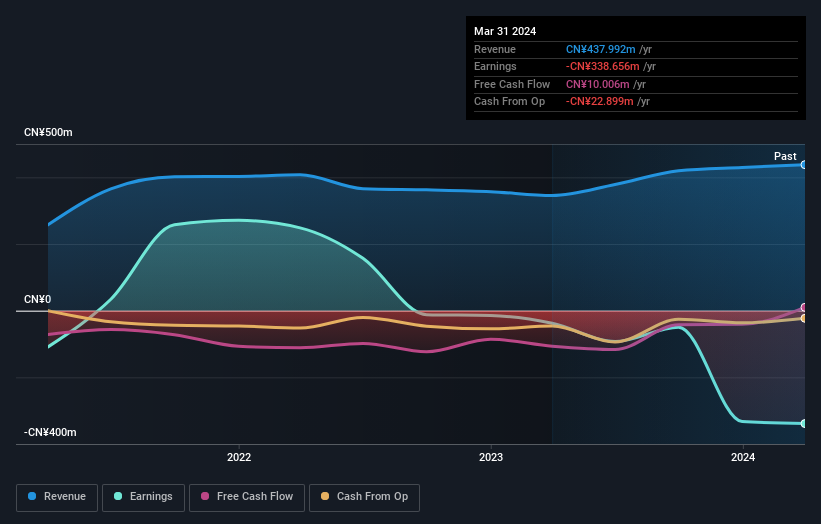

Shandong Sinobioway Biomedicine isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last year Shandong Sinobioway Biomedicine saw its revenue grow by 27%. That's definitely a respectable growth rate. Meanwhile, the share price tanked 50%, suggesting the market had much higher expectations. It is of course possible that the business will still deliver strong growth, it will just take longer than expected to do it. To our minds it isn't enough to just look at revenue, anyway. Always consider when profits will flow.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Shandong Sinobioway Biomedicine stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Shandong Sinobioway Biomedicine shareholders are down 50% for the year. Unfortunately, that's worse than the broader market decline of 16%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 6% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Shandong Sinobioway Biomedicine better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Shandong Sinobioway Biomedicine you should be aware of.

We will like Shandong Sinobioway Biomedicine better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Shandong Sinobioway Biomedicine is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Shandong Sinobioway Biomedicine is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002581

Shandong Sinobioway Biomedicine

Shandong Sinobioway Biomedicine Co., Ltd.

Adequate balance sheet with weak fundamentals.