As global markets react to favorable trade deals and shifts in economic indicators, the Asian market is experiencing a renewed focus with potential opportunities emerging amidst these developments. In this dynamic environment, identifying stocks that demonstrate resilience and growth potential can be key to uncovering hidden gems within the region's diverse landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Araya Industrial | 17.96% | 3.77% | 10.32% | ★★★★★★ |

| Tibet Development | 48.40% | -0.31% | 52.09% | ★★★★★★ |

| Zhe Jiang Dayang Biotech Group | 29.02% | 8.38% | -9.33% | ★★★★★☆ |

| TOMONY Holdings | 58.26% | 7.99% | 14.24% | ★★★★★☆ |

| Suzhou Chunqiu Electronic Technology | 46.46% | 3.33% | -19.72% | ★★★★★☆ |

| Dong Fang Offshore | 34.42% | 39.61% | 41.66% | ★★★★★☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 34.13% | 1.81% | 9.01% | ★★★★☆☆ |

| Renxin New MaterialLtd | 8.41% | 17.79% | -34.07% | ★★★★☆☆ |

| Tibet TourismLtd | 27.63% | 9.10% | 17.00% | ★★★★☆☆ |

| Synic SolutionLtd | 70.76% | 6.08% | 55.66% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

HARBIN GLORIA PHARMACEUTICALS (SZSE:002437)

Simply Wall St Value Rating: ★★★★★★

Overview: Harbin Gloria Pharmaceuticals Co., Ltd focuses on the research, development, production, and sale of pharmaceutical products primarily in China with a market capitalization of CN¥8.13 billion.

Operations: Harbin Gloria Pharmaceuticals generates revenue through the sale of pharmaceutical products in China. The company's cost structure includes expenses related to research, development, and production. Its financial performance is highlighted by a notable gross profit margin trend.

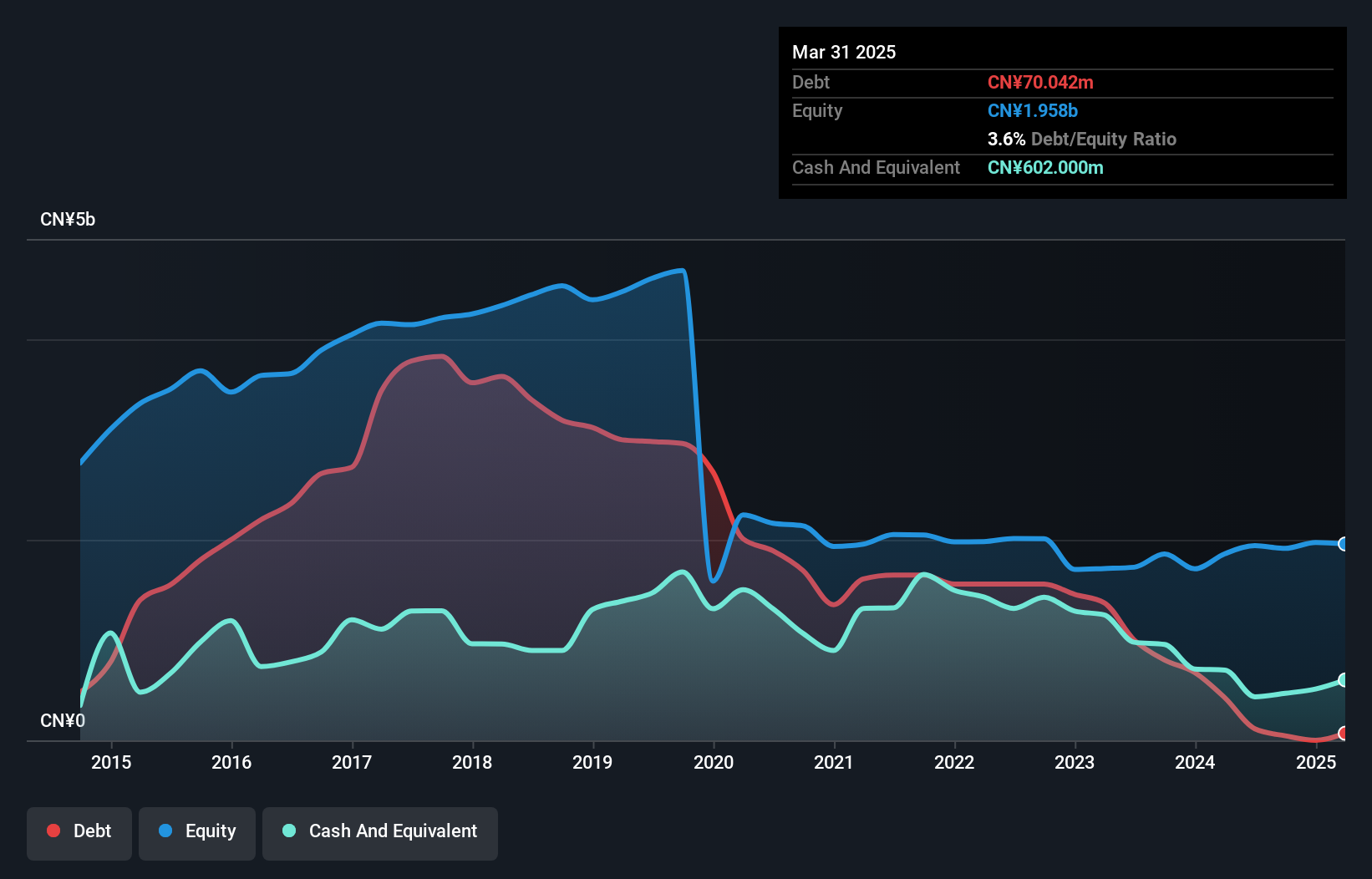

Harbin Gloria Pharmaceuticals, a modest player in the pharmaceutical sector, exhibits a compelling financial profile. Its price-to-earnings ratio of 33.8x undercuts the CN market average of 42.5x, suggesting potential value for investors. The company has significantly improved its debt position, with a debt-to-equity ratio dropping from 89.4% to just 3.6% over five years, indicating prudent financial management. Earnings have surged by 57.8% in the past year alone, outpacing the industry average of -2.5%. However, recent volatility in share price may warrant caution for risk-averse investors seeking stability.

Shenzhen Jove Enterprise (SZSE:300814)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Jove Enterprise Limited focuses on the research and development, production, and sales of printed circuit boards (PCB) in China with a market capitalization of CN¥7.27 billion.

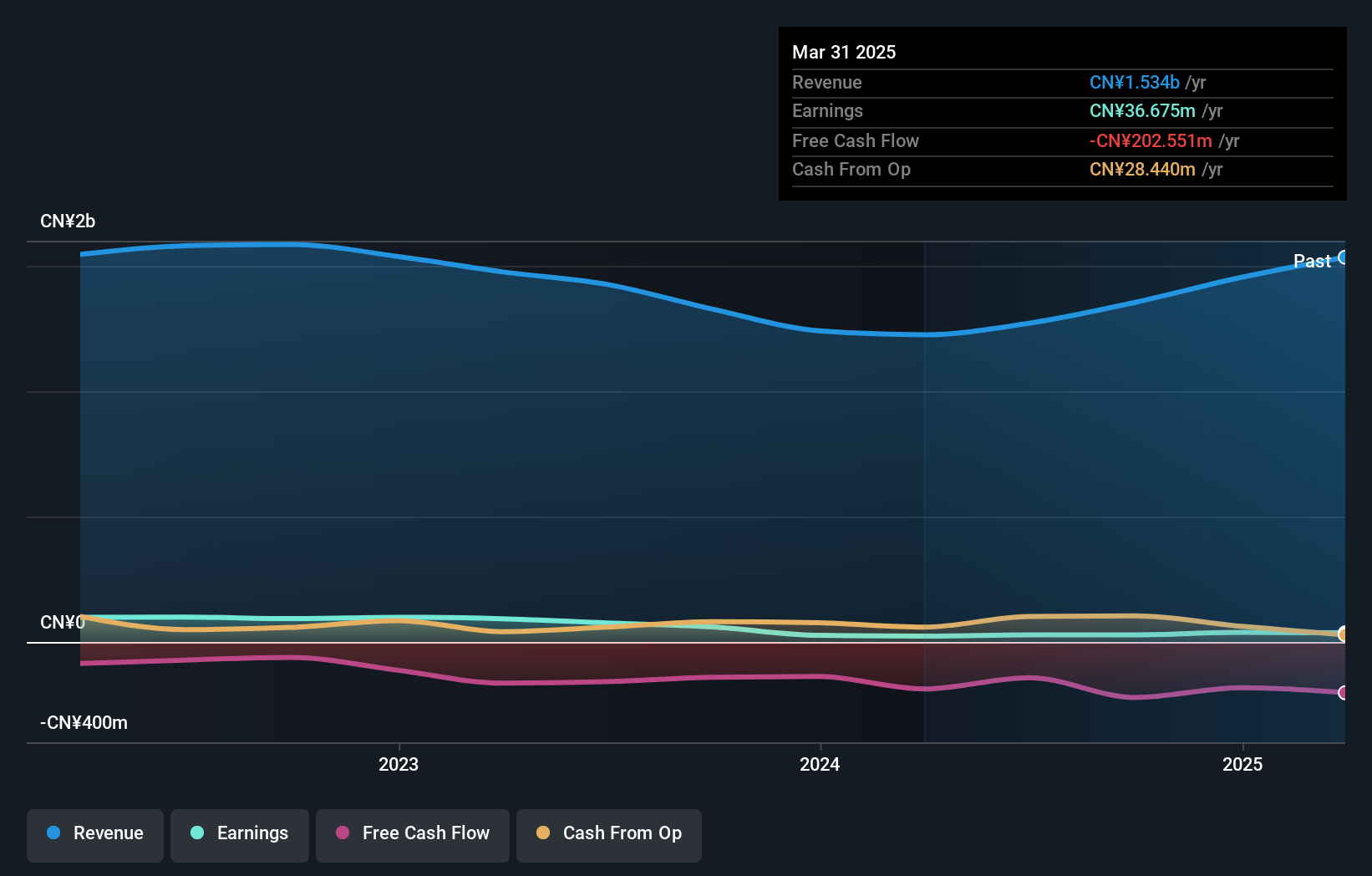

Operations: The company's primary revenue stream is derived from the production of printed circuit boards, generating CN¥1.53 billion.

Shenzhen Jove Enterprise is navigating a complex landscape with its earnings growing impressively by 58.7% over the past year, outpacing the Electronic industry’s modest 2.8% rise. However, its debt-to-equity ratio has surged from 5.2 to 41.4 over five years, indicating rising leverage concerns despite having more cash than total debt—a positive sign for liquidity management. The company’s recent AGM led to amendments in bylaws and a reduced dividend payout of CNY1 per 10 shares, reflecting cautious capital distribution strategies amidst volatile share price movements in recent months.

Thunder Tiger (TWSE:8033)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Thunder Tiger Corp. is a company that, along with its subsidiaries, engages in the production and sale of remote-controlled vehicles and medical devices across Taiwan, the Americas, and other international markets with a market capitalization of NT$14.55 billion.

Operations: Thunder Tiger generates revenue primarily from its Remote Control Model Department, contributing NT$870.81 million, and its Dental Medical Department, adding NT$362.01 million. The Sterile Packaging Department also plays a role with NT$153.75 million in revenue.

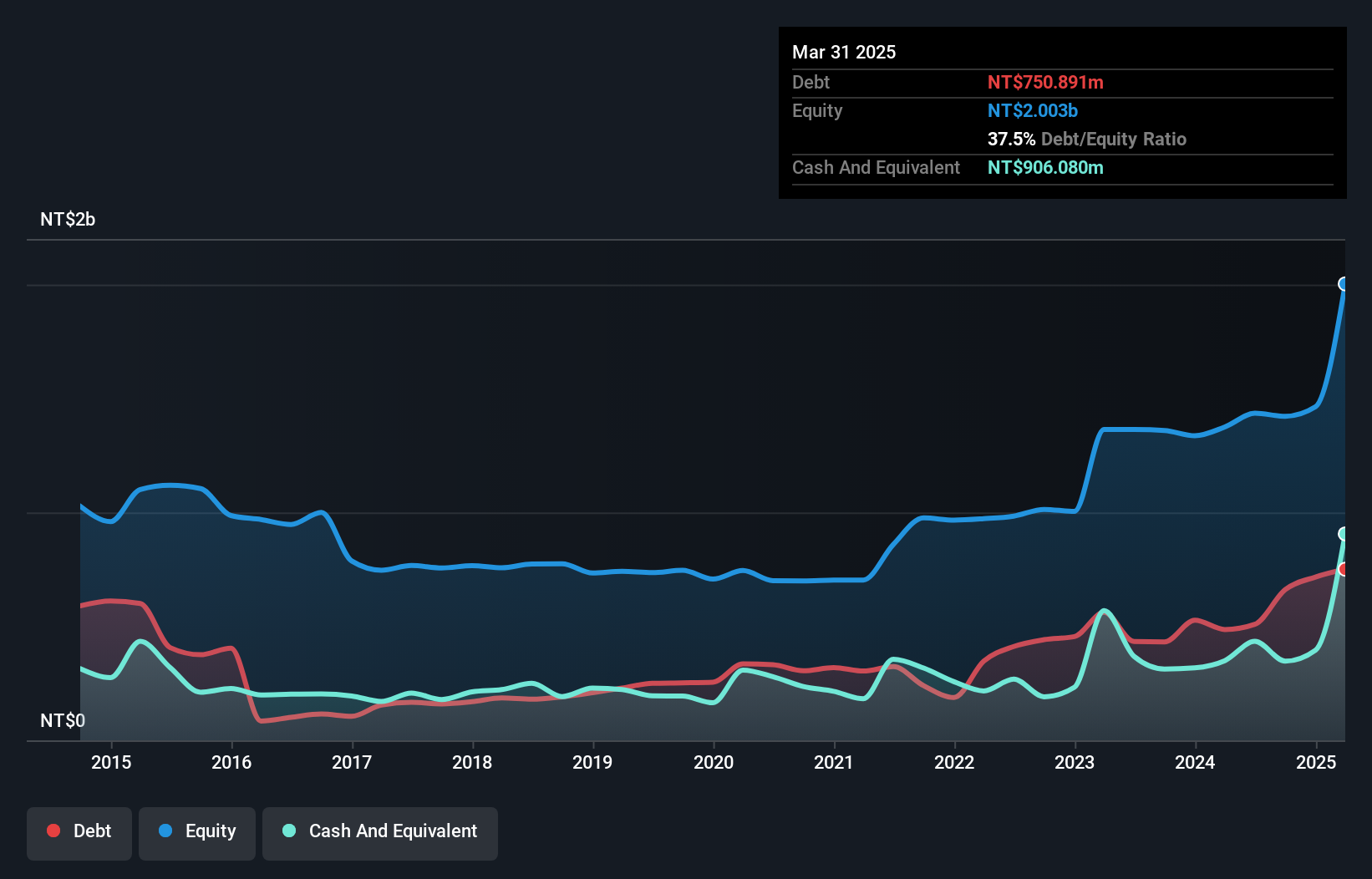

Thunder Tiger, a compact player in the market, reported notable earnings growth of 653% over the past year, outpacing the Leisure industry's 53%. Their recent first-quarter performance saw sales rise to TWD 335.32 million from TWD 286.43 million last year, with net income climbing to TWD 36.5 million from TWD 24.04 million. Despite these gains, interest payments are not well covered by EBIT at just 1.3x coverage, and free cash flow remains negative. However, their debt-to-equity ratio improved from 45% to 37% over five years and they hold more cash than total debt—indicating financial resilience amidst volatility.

- Click here to discover the nuances of Thunder Tiger with our detailed analytical health report.

Gain insights into Thunder Tiger's past trends and performance with our Past report.

Summing It All Up

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2606 more companies for you to explore.Click here to unveil our expertly curated list of 2609 Asian Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HARBIN GLORIA PHARMACEUTICALS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002437

HARBIN GLORIA PHARMACEUTICALS

Harbin Gloria Pharmaceuticals Co., Ltd engages in the research, development, production, and sale of pharmaceutical products primarily in the People’s Republic of China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives