Global markets have recently experienced a mix of performances, with U.S. indexes showing varied results and international markets reflecting both optimism and caution amid economic policy shifts. Penny stocks, while often considered relics of past market eras, continue to offer intriguing opportunities for investors looking at smaller or newer companies that may be undervalued yet promising. By focusing on those with strong balance sheets and solid fundamentals, these stocks can provide potential growth without the usual risks associated with this investment niche.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.56 | HK$921.6M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (NasdaqGS:LX) | $4.38 | $731.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.98 | A$453.39M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.52 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.08 | SGD429.61M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.22 | MYR489.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.32 | SGD13.11B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ✅ 5 ⚠️ 0 View Analysis > |

Click here to see the full list of 3,606 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Guizhou Yibai Pharmaceutical (SHSE:600594)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guizhou Yibai Pharmaceutical Co., Ltd. is engaged in the research, development, production, and sale of pharmaceutical products in China with a market cap of CN¥3.40 billion.

Operations: The company generates its revenue primarily from the Chinese market, amounting to CN¥1.91 billion.

Market Cap: CN¥3.4B

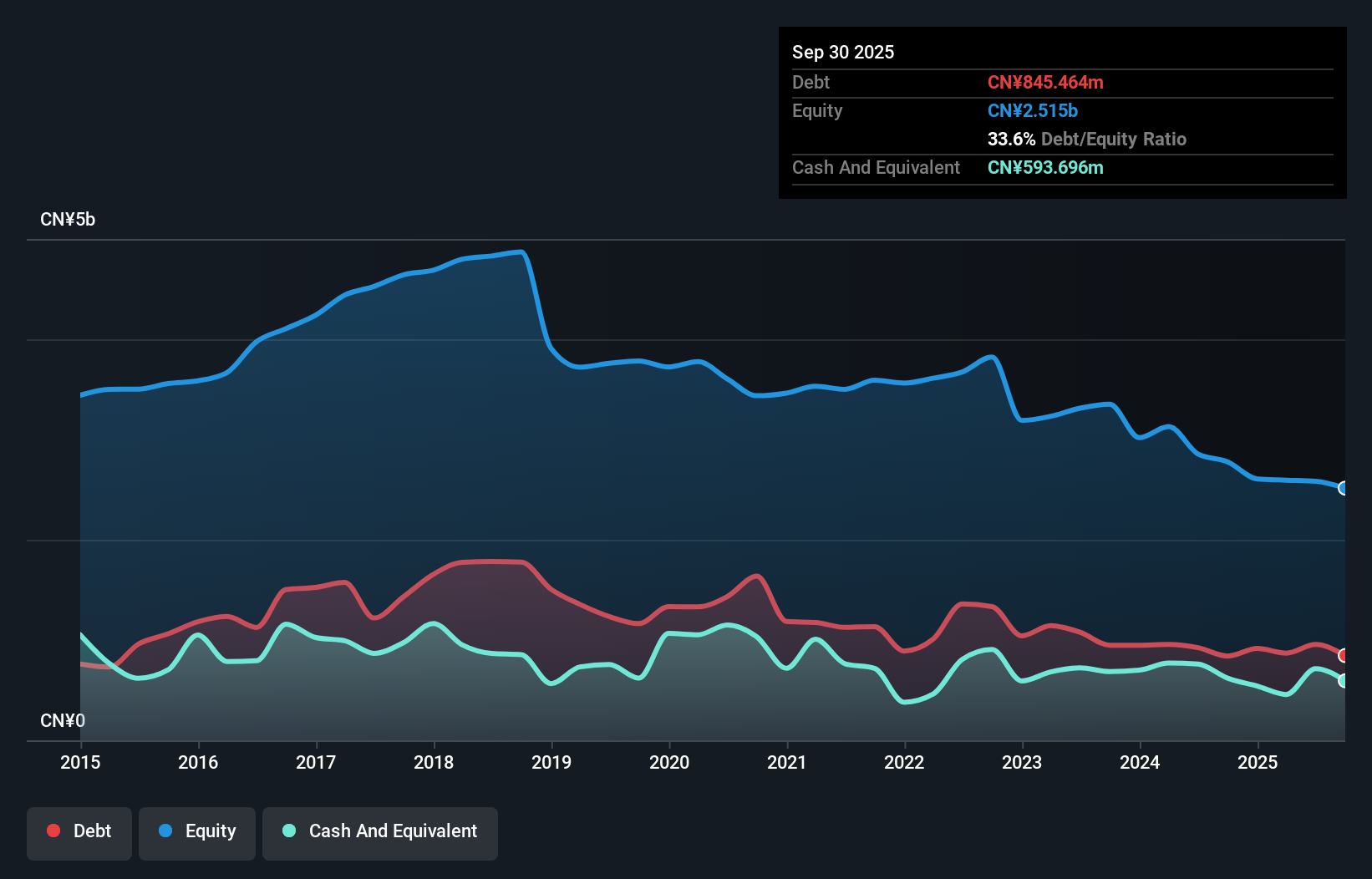

Guizhou Yibai Pharmaceutical has shown a reduction in debt to equity from 47.6% to 33.6% over the past five years, indicating improved financial management; however, its operating cash flow covers only 10.7% of its debt, which is below optimal levels for coverage. The company remains unprofitable with a negative return on equity of -9.98%, and losses have increased by a large margin annually over the past five years. Despite these challenges, Guizhou Yibai's board and management teams are experienced, and the company's short-term assets exceed both short-term and long-term liabilities, providing some financial stability amidst ongoing losses.

- Take a closer look at Guizhou Yibai Pharmaceutical's potential here in our financial health report.

- Assess Guizhou Yibai Pharmaceutical's previous results with our detailed historical performance reports.

Guizhou Xinbang Pharmaceutical (SZSE:002390)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guizhou Xinbang Pharmaceutical Co., Ltd. is engaged in the research, development, manufacturing, and sale of Chinese herbal medicines and other pharmaceutical products both in China and internationally, with a market cap of CN¥7.36 billion.

Operations: No specific revenue segments have been reported for Guizhou Xinbang Pharmaceutical.

Market Cap: CN¥7.36B

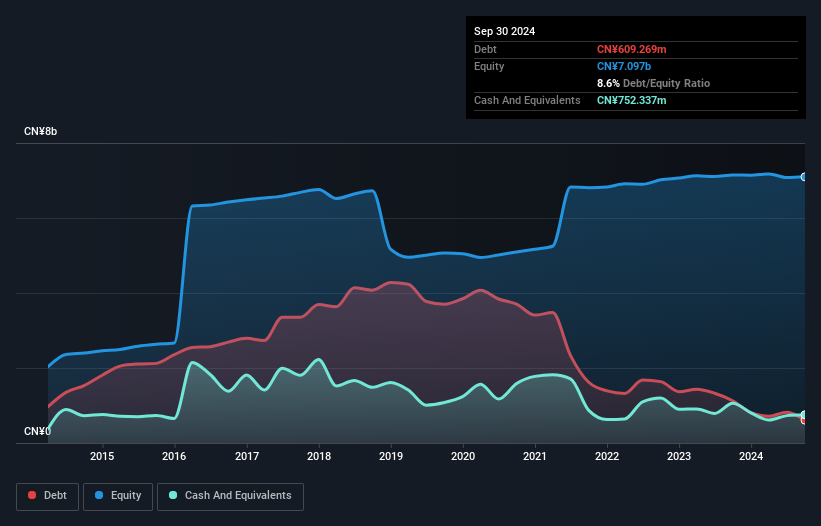

Guizhou Xinbang Pharmaceutical Co., Ltd. has demonstrated financial resilience with its operating cash flow covering 132.6% of its debt, and short-term assets exceeding both short-term and long-term liabilities, enhancing liquidity. Despite a significant reduction in the debt-to-equity ratio from 72.7% to 7.2% over five years, challenges persist with declining profit margins now at 1.3%, down from last year's 3.5%. Earnings have decreased by an average of 11% annually over five years, compounded by a recent large one-off loss impacting results. The management team is experienced, though the board's average tenure remains relatively low at 2.1 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Guizhou Xinbang Pharmaceutical.

- Explore historical data to track Guizhou Xinbang Pharmaceutical's performance over time in our past results report.

Era (SZSE:002641)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Era Co., Ltd. engages in the research, development, production, and sale of plastic pipe products in China with a market cap of CN¥5.33 billion.

Operations: The company generates revenue primarily from its Manufacturing Industry segment, which accounts for CN¥5.90 billion.

Market Cap: CN¥5.33B

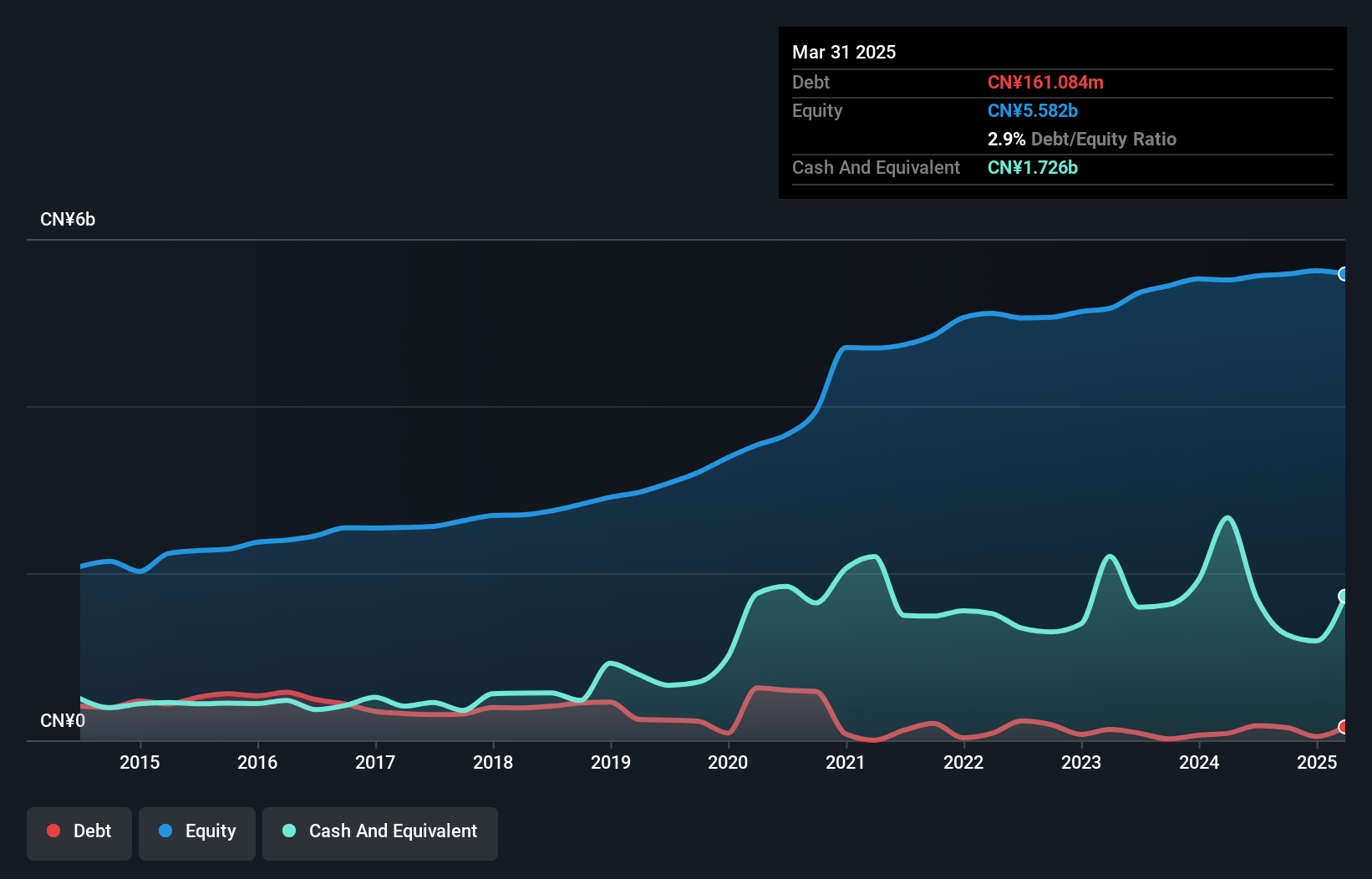

Era Co., Ltd. has shown financial stability with short-term assets of CN¥4.6 billion exceeding both short-term and long-term liabilities, while its debt-to-equity ratio has improved significantly from 14.9% to 3% over five years. However, the company faces challenges with declining profit margins, currently at 1.4%, down from last year's 3.5%, and negative earnings growth of -62.1% over the past year compared to industry averages. Despite these hurdles, Era's management team is seasoned with an average tenure of 11.3 years, and the company maintains more cash than total debt, indicating strong liquidity management practices amidst a competitive market environment.

- Click here to discover the nuances of Era with our detailed analytical financial health report.

- Explore Era's analyst forecasts in our growth report.

Summing It All Up

- Reveal the 3,606 hidden gems among our Global Penny Stocks screener with a single click here.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Era might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002641

Era

Research, develops, produces, and sells plastic pipe products in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives