Undiscovered Gems In Global And 2 Other Promising Small Caps With Growth Potential

Reviewed by Simply Wall St

As global markets soar to record highs, buoyed by favorable trade deals and robust growth in the services sector, small-cap stocks have also shown resilience amid this positive sentiment. In this environment of optimism, identifying promising small-cap companies with strong fundamentals and growth potential can offer unique opportunities for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| BioDlink International | 54.00% | 61.14% | 50.47% | ★★★★★☆ |

| Sing Investments & Finance | 0.29% | 9.07% | 12.24% | ★★★★☆☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Hunan Hualian China Industry (SZSE:001216)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hunan Hualian China Industry Co., Ltd. focuses on the research, design, development, production, and sale of ceramic products in China with a market capitalization of CN¥4.27 billion.

Operations: The company's revenue is primarily derived from the production and sale of ceramic products. It operates with a market capitalization of CN¥4.27 billion, indicating its scale within the industry.

Hunan Hualian China Industry, a small cap player, has shown promising signs with its earnings growing by 14% over the past year, outpacing the Consumer Durables industry. The company seems to be in a strong financial position as it earns more interest than it pays and holds more cash than its total debt. Despite an increase in its debt-to-equity ratio from 3.8% to 5% over five years, concerns are mitigated by high-quality earnings and a price-to-earnings ratio of 22x, which is favorable compared to the CN market average of 43x. Recently approved dividends indicate confidence in ongoing profitability.

- Navigate through the intricacies of Hunan Hualian China Industry with our comprehensive health report here.

Understand Hunan Hualian China Industry's track record by examining our Past report.

Tibet Cheezheng Tibetan Medicine (SZSE:002287)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tibet Cheezheng Tibetan Medicine Co., Ltd. operates in the pharmaceutical industry, specializing in traditional Tibetan medicine, with a market cap of CN¥13.82 billion.

Operations: The company generates revenue primarily from the pharmaceutical industry, focusing on traditional Tibetan medicine. It experiences fluctuations in its net profit margin, reflecting varying levels of profitability over different periods.

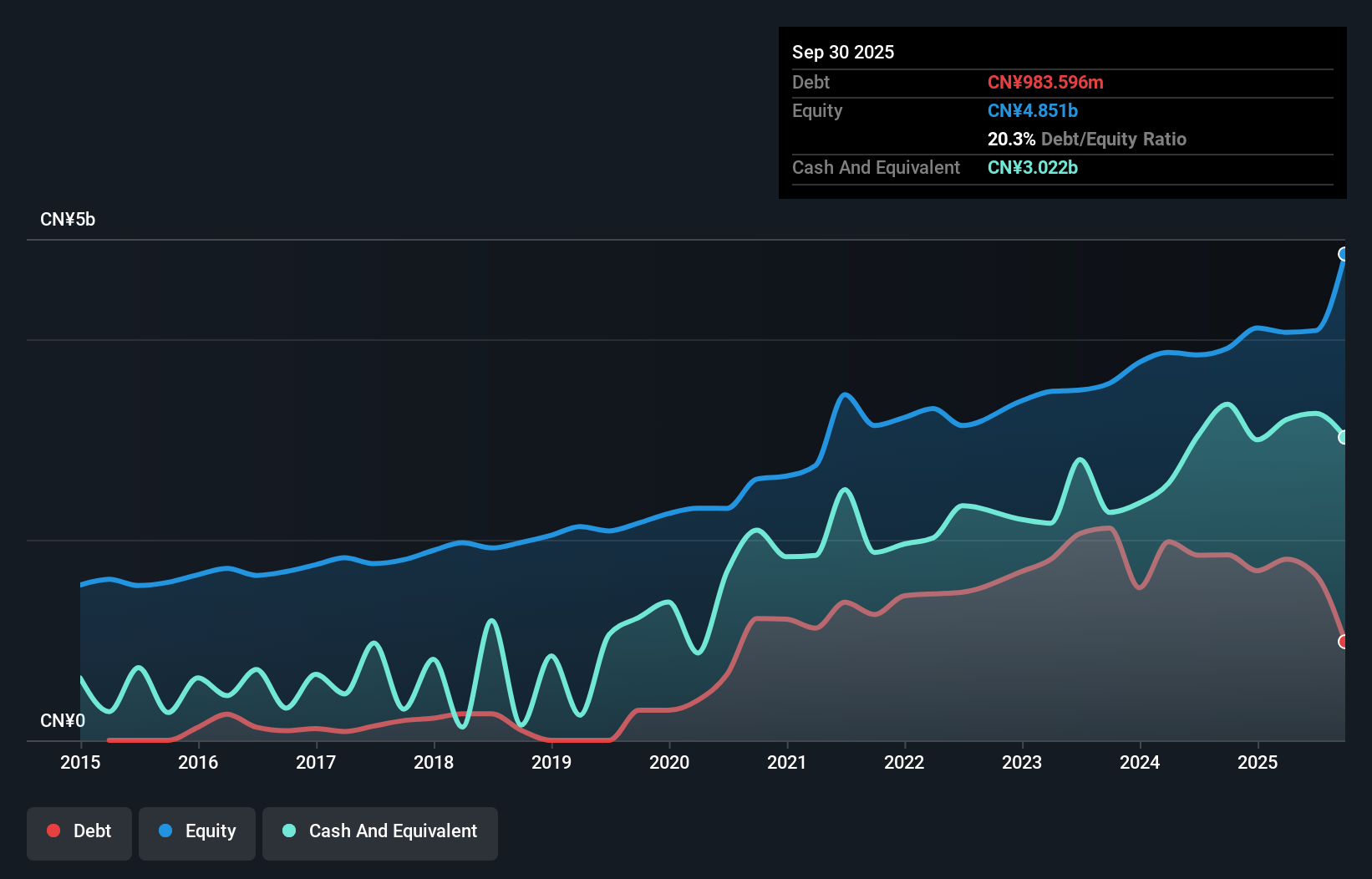

Tibet Cheezheng Tibetan Medicine, a nimble player in the pharmaceutical sector, has shown solid financial health with earnings growth of 3.4% over the past year, outpacing the industry's -2.5%. The company reported half-year sales of CNY 1.18 billion and net income of CNY 358.06 million, both up from last year’s figures. Despite a rising debt to equity ratio from 17.3% to 44.4% over five years, its interest payments are well covered by EBIT at 22 times coverage, indicating strong operational performance. Additionally, recent share buybacks totaling CNY 58.92 million suggest confidence in its valuation below fair value estimates by nearly 19%.

GuangDong Suqun New MaterialLtd (SZSE:301489)

Simply Wall St Value Rating: ★★★★★☆

Overview: GuangDong Suqun New Material Co., Ltd. is involved in the research, development, production, and sale of functional materials in China with a market cap of CN¥6.40 billion.

Operations: The company generates revenue primarily through the sale of functional materials. It has a market cap of approximately CN¥6.40 billion.

GuangDong Suqun New Material Ltd. has shown impressive growth with earnings increasing by 16.8% over the past year, outpacing the electrical industry average of -0.5%. Despite a drop in net profit margin from 12% to 8.1%, the company remains profitable and its debt level is manageable, with more cash than total debt on hand. However, its share price has been highly volatile recently, which may concern some investors. Recent events include proposed changes to company bylaws and a decrease in dividends for 2024, indicating potential strategic shifts that could impact future performance positively or negatively.

Turning Ideas Into Actions

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 3159 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Cheezheng Tibetan Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002287

Tibet Cheezheng Tibetan Medicine

Tibet Cheezheng Tibetan Medicine Co., Ltd.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives