As global markets experience a mix of record highs in major indices and fluctuating economic indicators, investors are keenly observing the performance of small-cap stocks like those in the Russell 2000, which have shown positive movement amidst broader market volatility. In this dynamic environment, identifying undiscovered gems—stocks that offer potential for growth due to solid fundamentals and strategic positioning—can be an effective way to enhance your portfolio's resilience and diversity.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | NA | 22.16% | 22.91% | ★★★★★★ |

| Saha-Union | 0.84% | 0.90% | 15.45% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Mechema Chemicals International | 55.74% | -4.23% | -5.72% | ★★★★☆☆ |

| Fengyinhe Holdings | 0.60% | 39.37% | 65.41% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Northeast Pharmaceutical Group (SZSE:000597)

Simply Wall St Value Rating: ★★★★★★

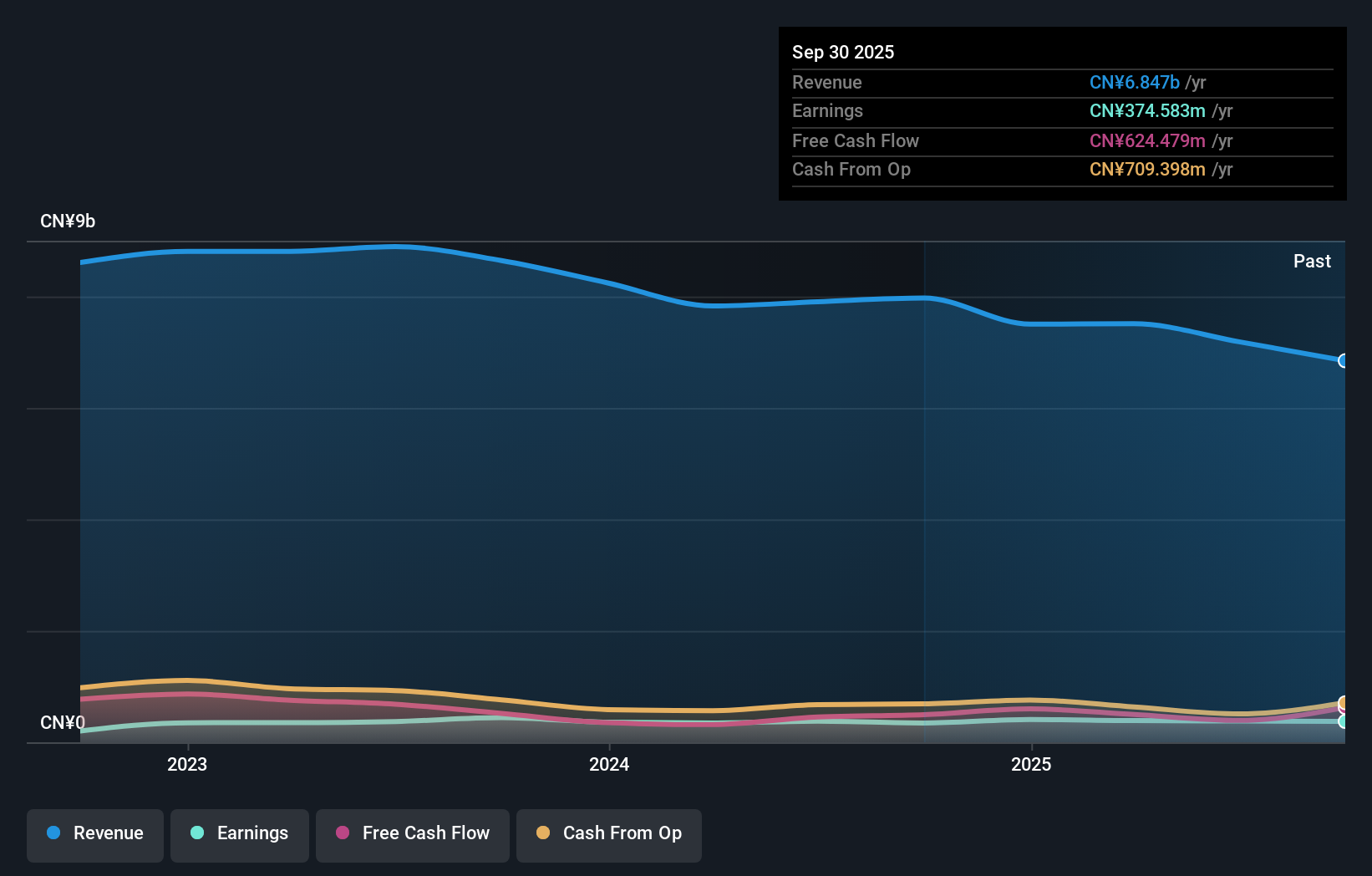

Overview: Northeast Pharmaceutical Group Co., Ltd. operates in the fields of chemical pharmaceuticals preparations, pharmaceutical business, pharmaceutical engineering, and biomedicine in China with a market cap of CN¥8.66 billion.

Operations: Northeast Pharmaceutical Group generates revenue primarily from its chemical pharmaceuticals preparations and pharmaceutical business segments. The company has observed fluctuations in its net profit margin, reflecting changes in operational efficiency and cost management.

Northeast Pharmaceutical Group is showing promising signs with its earnings growth of 12.3% over the past year, outpacing the industry average of -2.5%. The company's debt to equity ratio has impressively reduced from 94% to 37.5% in five years, indicating a stronger financial position. Its price-to-earnings ratio stands at 23.2x, which is below the CN market average of 41.8x, suggesting it could be undervalued relative to peers. Despite a drop in net income for Q1 2025 to CNY 36 million from CNY 58 million last year, it continues to generate positive free cash flow and maintain high-quality earnings.

- Click to explore a detailed breakdown of our findings in Northeast Pharmaceutical Group's health report.

Learn about Northeast Pharmaceutical Group's historical performance.

Zhubo Design (SZSE:300564)

Simply Wall St Value Rating: ★★★★★★

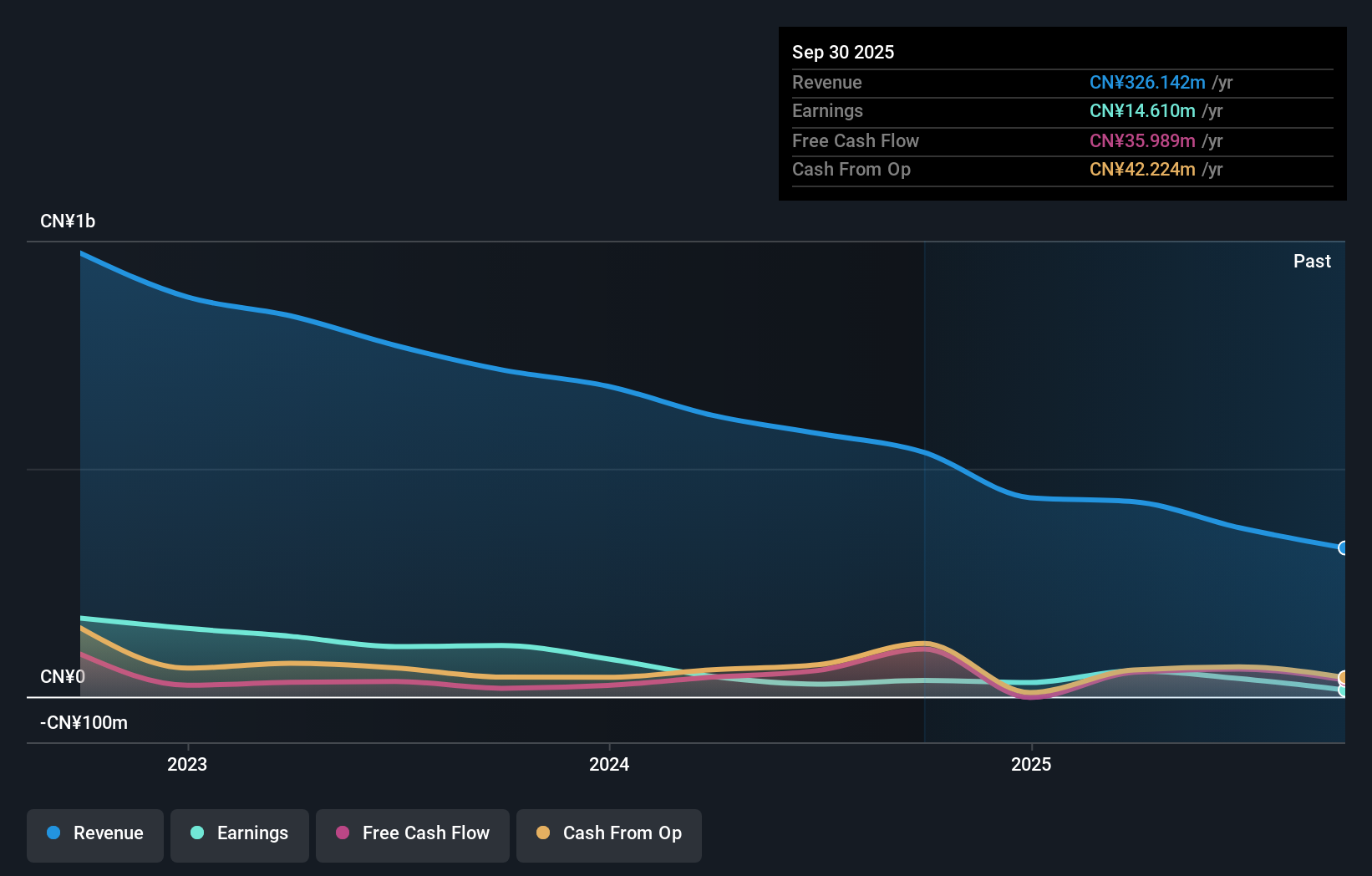

Overview: Zhubo Design Co., Ltd provides architectural design and consulting services in China, with a market cap of CN¥3.37 billion.

Operations: The company generates revenue primarily from architectural design and consulting services in China. With a market cap of CN¥3.37 billion, it focuses on providing specialized design solutions.

Zhubo Design, a smaller player in the professional services sector, has shown intriguing financial dynamics. Earnings surged 28% last year, outpacing the industry average of -0.5%, despite a 19.8% annual decrease over five years. The company remains debt-free, alleviating concerns about interest payments and allowing focus on operational growth. Recently reported sales for Q1 were CN¥57.94 million, with a net loss reduced to CN¥27.68 million from CN¥53.5 million the previous year, indicating some operational improvement amidst volatility in share price and one-off gains of CN¥58.7 million affecting recent results.

- Click here to discover the nuances of Zhubo Design with our detailed analytical health report.

Review our historical performance report to gain insights into Zhubo Design's's past performance.

Shandong University Electric Power Technology (SZSE:301609)

Simply Wall St Value Rating: ★★★★★★

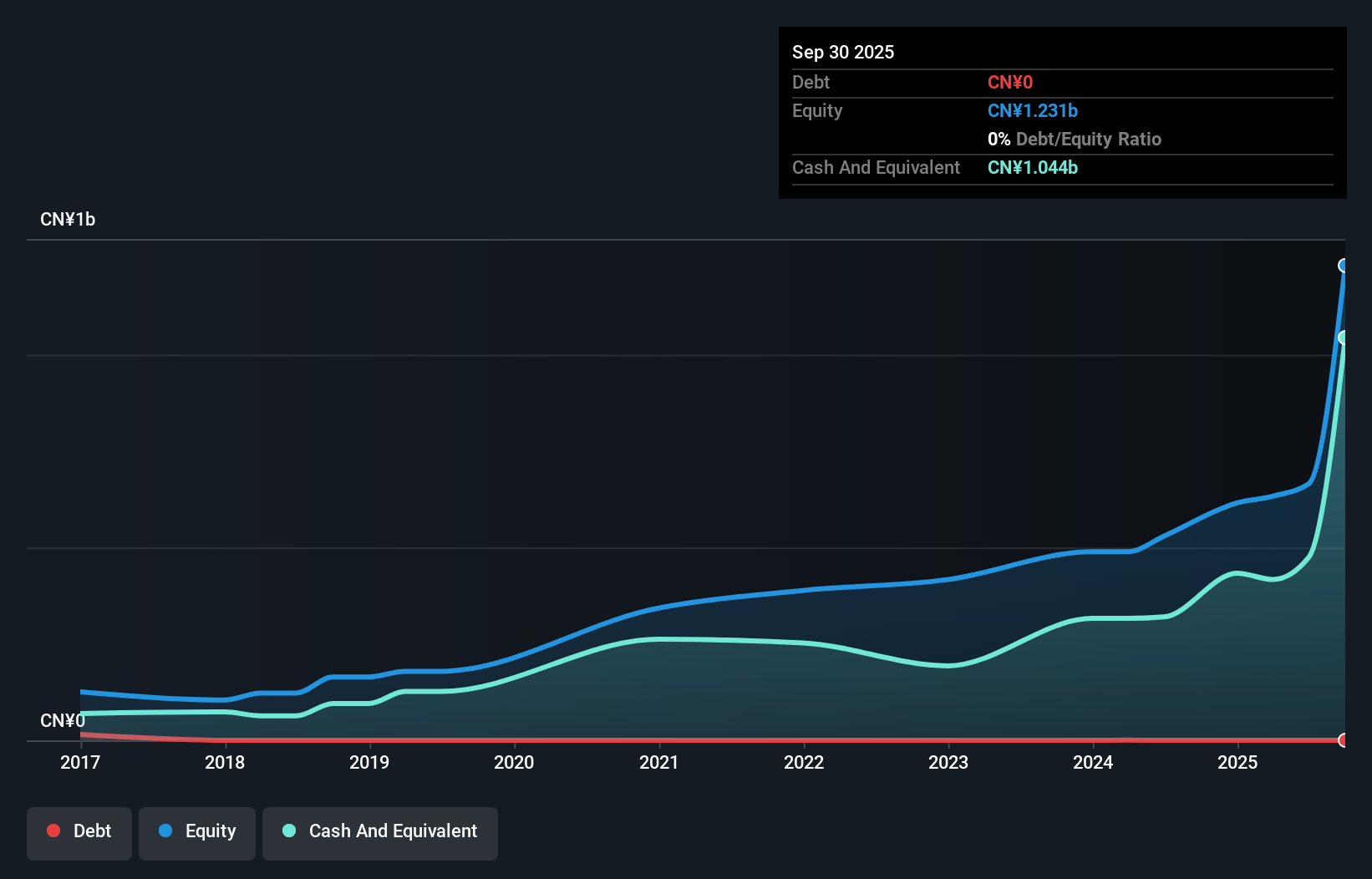

Overview: Shandong University Electric Power Technology Co., Ltd. is engaged in the development and provision of electric power technology solutions, with a market cap of CN¥2.39 billion.

Operations: Shandong University Electric Power Technology generates revenue primarily through its electric power technology solutions. The company has a market capitalization of CN¥2.39 billion, indicating its scale within the industry.

Shandong University Electric Power Technology, a nimble player in the electrical industry, has demonstrated impressive earnings growth of 19.4% over the past year, outpacing the industry average of -1.2%. This company stands debt-free and trades at 21.1% below its estimated fair value, indicating potential undervaluation in the market. Recently completing an IPO worth CNY 537 million with shares priced at CNY 14.66 each, it seems poised for further expansion despite its highly illiquid shares and lack of recent financial data updates. With high-quality earnings reported, this firm presents an intriguing opportunity amidst its current challenges.

Make It Happen

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 3163 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northeast Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000597

Northeast Pharmaceutical Group

Engages in chemical pharmaceuticals preparations, pharmaceutical business, pharmaceutical engineering, biopharmaceuticals, and other businesses in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives