- Taiwan

- /

- Semiconductors

- /

- TWSE:6415

3 Asian Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, the Asian market has not been immune to these challenges, experiencing fluctuations amid investor caution. In this climate, growth companies in Asia with high insider ownership are particularly intriguing as they often indicate strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 110.4% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 32.6% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Bora Pharmaceuticals (TWSE:6472) | 11.9% | 20.3% |

We'll examine a selection from our screener results.

Beijing Sun-Novo Pharmaceutical Research (SHSE:688621)

Simply Wall St Growth Rating: ★★★★★★

Overview: Beijing Sun-Novo Pharmaceutical Research Co., Ltd. is a contract research company focused on drug research and development in China, with a market cap of CN¥7.49 billion.

Operations: Beijing Sun-Novo Pharmaceutical Research Co., Ltd. specializes in drug research and development as a contract research organization in China.

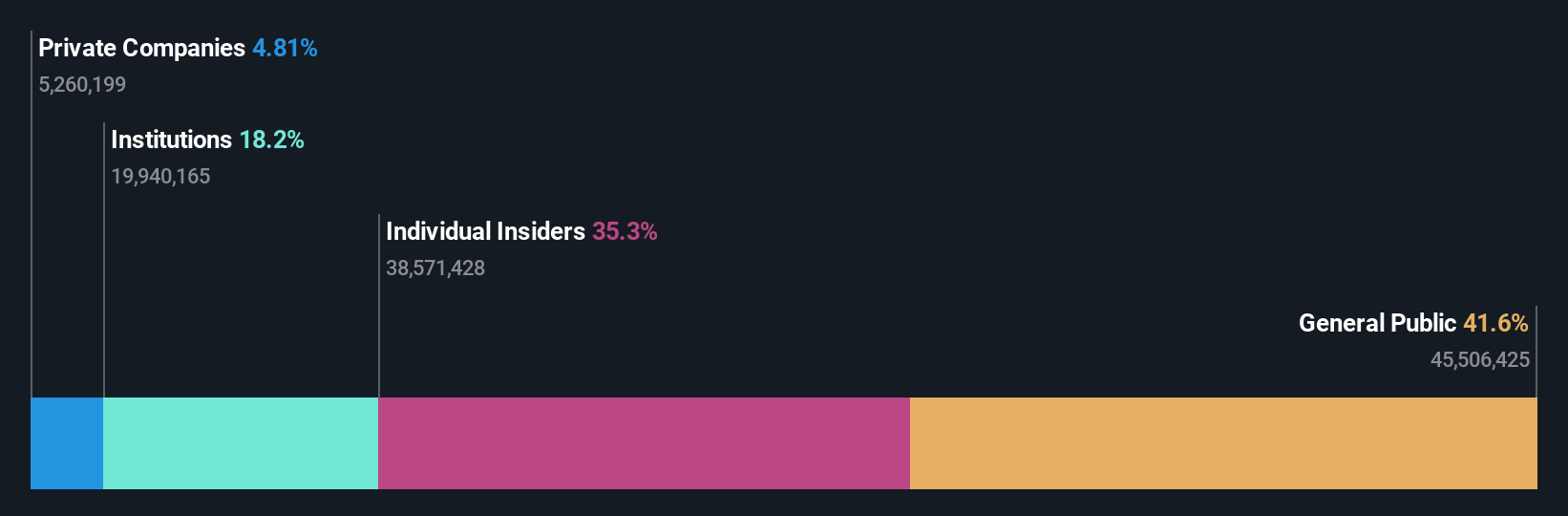

Insider Ownership: 35.3%

Revenue Growth Forecast: 21.7% p.a.

Beijing Sun-Novo Pharmaceutical Research shows strong growth potential, with earnings expected to increase by 33.02% annually, outpacing the Chinese market's 27.6%. Despite a decline in profit margins from 19.1% to 13.1%, revenue is forecasted to grow at a robust 21.7% per year, surpassing market averages. The company’s Return on Equity is projected to reach a high of 24.2%, while its P/E ratio of 56.3x remains below industry norms, suggesting relative value in the sector.

- Unlock comprehensive insights into our analysis of Beijing Sun-Novo Pharmaceutical Research stock in this growth report.

- In light of our recent valuation report, it seems possible that Beijing Sun-Novo Pharmaceutical Research is trading beyond its estimated value.

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd. specializes in developing, producing, and selling alloy soft magnetic powder and components for electronic equipment, with a market cap of CN¥22 billion.

Operations: POCO Holding Co., Ltd. generates revenue from the development, production, and sale of alloy soft magnetic powder, alloy soft magnetic cores, and chip inductance components for electronic equipment users.

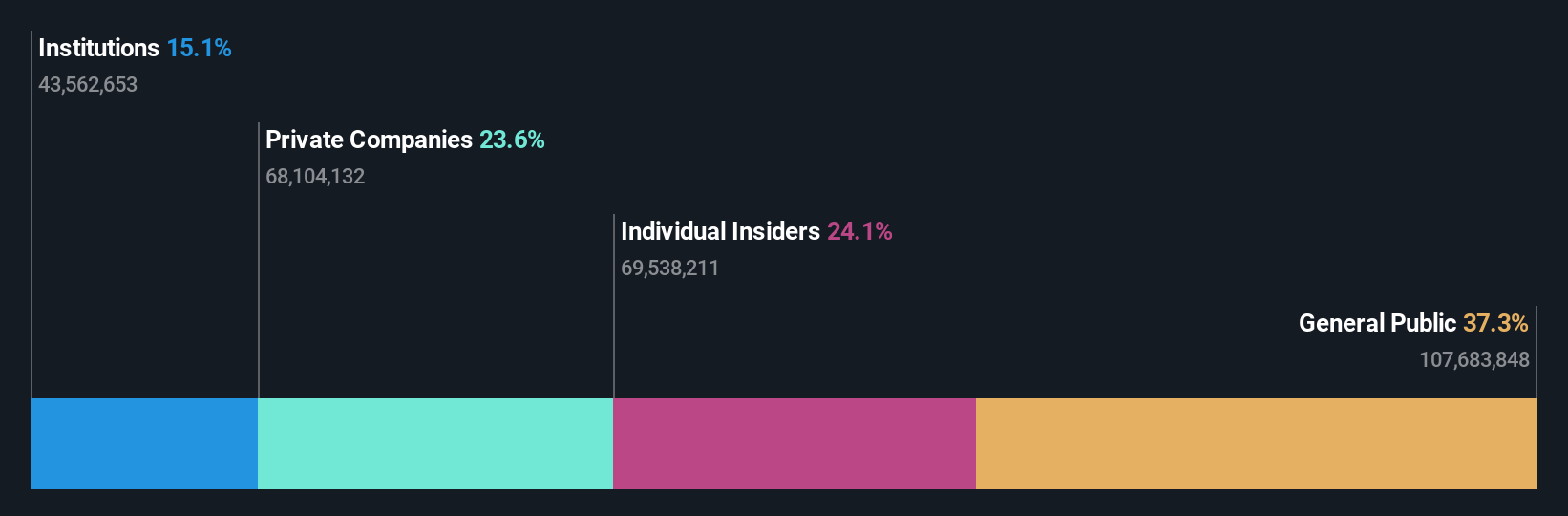

Insider Ownership: 24%

Revenue Growth Forecast: 24.8% p.a.

POCO Holding demonstrates strong growth prospects with earnings expected to grow at 29.7% annually, surpassing the Chinese market's 27.6%. Revenue is forecasted to increase by 24.8% per year, outpacing the market average of 14.4%. Despite a volatile share price recently, the company reported CNY 1.3 billion in revenue for the first nine months of 2025, up from CNY 1.23 billion last year, indicating steady progress in its financial performance.

- Get an in-depth perspective on POCO Holding's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that POCO Holding's share price might be on the expensive side.

Silergy (TWSE:6415)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Silergy Corp. designs, manufactures, and sells integrated circuit products and related technical services both in China and internationally, with a market cap of NT$79.12 billion.

Operations: The company generates revenue primarily from its semiconductors segment, amounting to NT$18.53 billion.

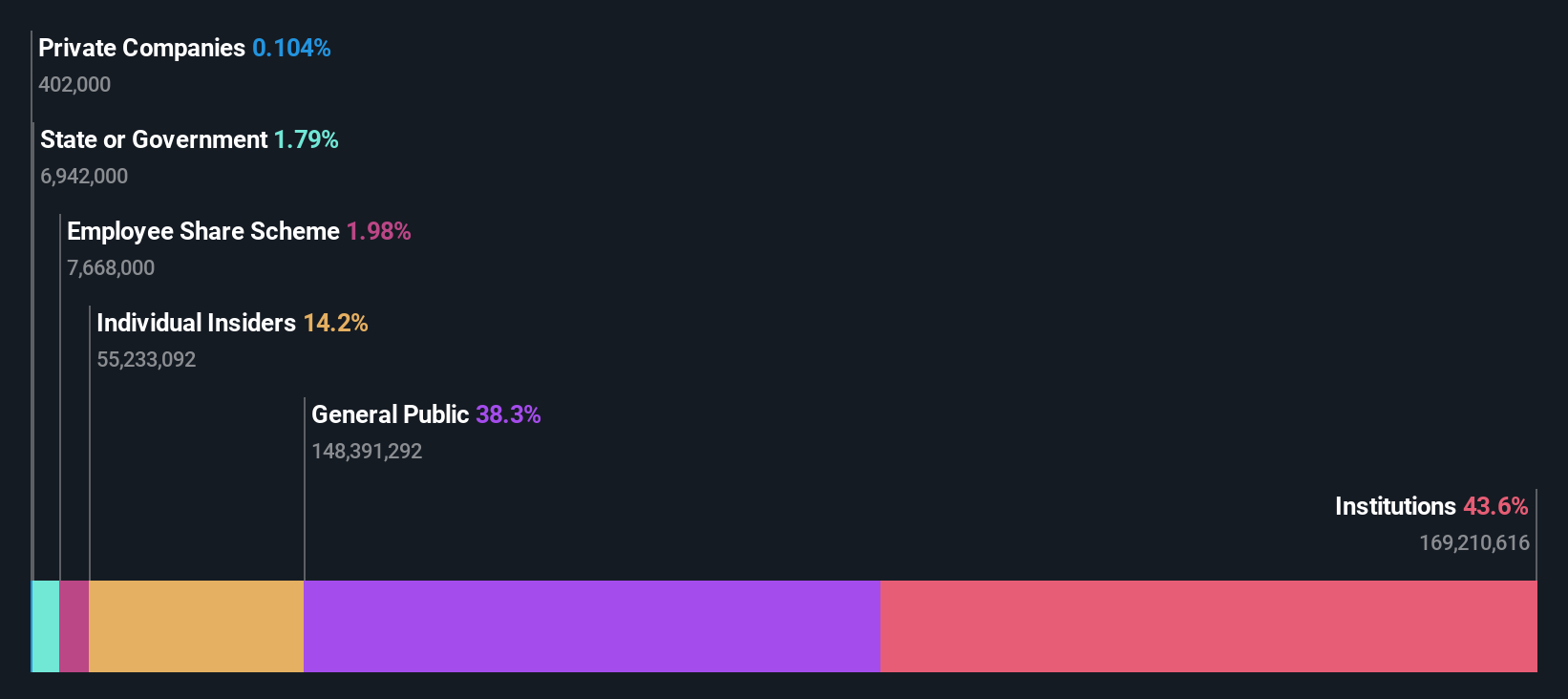

Insider Ownership: 14.2%

Revenue Growth Forecast: 15.5% p.a.

Silergy's growth trajectory is robust, with earnings projected to rise 33.71% annually, outpacing the Taiwanese market's 20.2% forecast. Despite a slight dip in Q3 sales and net income compared to last year, nine-month figures show an increase in net income from TWD 1,391.25 million to TWD 1,668.88 million. Trading at a significant discount to its estimated fair value and lacking recent insider trading activity, Silergy remains an intriguing investment opportunity in Asia's growth sector.

- Click to explore a detailed breakdown of our findings in Silergy's earnings growth report.

- Our valuation report here indicates Silergy may be undervalued.

Summing It All Up

- Investigate our full lineup of 637 Fast Growing Asian Companies With High Insider Ownership right here.

- Interested In Other Possibilities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6415

Silergy

Designs, manufactures, and sales of various integrated circuit products and related technical services in China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success