We Think Wuhan Keqian BiologyLtd (SHSE:688526) Can Stay On Top Of Its Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Wuhan Keqian Biology Co.,Ltd (SHSE:688526) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Wuhan Keqian BiologyLtd

How Much Debt Does Wuhan Keqian BiologyLtd Carry?

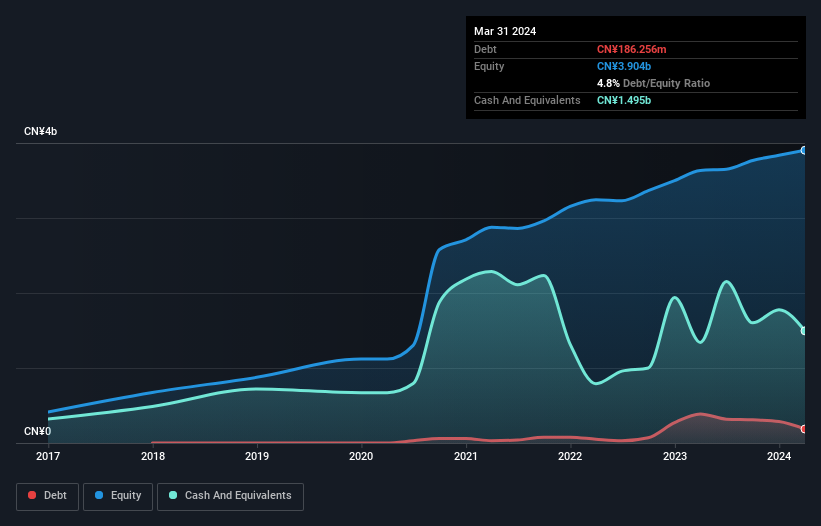

You can click the graphic below for the historical numbers, but it shows that Wuhan Keqian BiologyLtd had CN¥186.3m of debt in March 2024, down from CN¥388.3m, one year before. However, it does have CN¥1.50b in cash offsetting this, leading to net cash of CN¥1.31b.

How Strong Is Wuhan Keqian BiologyLtd's Balance Sheet?

According to the last reported balance sheet, Wuhan Keqian BiologyLtd had liabilities of CN¥637.3m due within 12 months, and liabilities of CN¥77.4m due beyond 12 months. Offsetting this, it had CN¥1.50b in cash and CN¥316.2m in receivables that were due within 12 months. So it can boast CN¥1.10b more liquid assets than total liabilities.

This surplus suggests that Wuhan Keqian BiologyLtd is using debt in a way that is appears to be both safe and conservative. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Succinctly put, Wuhan Keqian BiologyLtd boasts net cash, so it's fair to say it does not have a heavy debt load!

The modesty of its debt load may become crucial for Wuhan Keqian BiologyLtd if management cannot prevent a repeat of the 29% cut to EBIT over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Wuhan Keqian BiologyLtd can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Wuhan Keqian BiologyLtd may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the most recent three years, Wuhan Keqian BiologyLtd recorded free cash flow worth 74% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

While it is always sensible to investigate a company's debt, in this case Wuhan Keqian BiologyLtd has CN¥1.31b in net cash and a decent-looking balance sheet. The cherry on top was that in converted 74% of that EBIT to free cash flow, bringing in CN¥398m. So we are not troubled with Wuhan Keqian BiologyLtd's debt use. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Wuhan Keqian BiologyLtd has 1 warning sign we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Keqian BiologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688526

Wuhan Keqian BiologyLtd

Focuses on the research and development, production, sales, and animal epidemic prevention technical services of veterinary biological products in China.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives