What Chengdu Olymvax Biopharmaceuticals Inc.'s (SHSE:688319) 26% Share Price Gain Is Not Telling You

Chengdu Olymvax Biopharmaceuticals Inc. (SHSE:688319) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. But the last month did very little to improve the 51% share price decline over the last year.

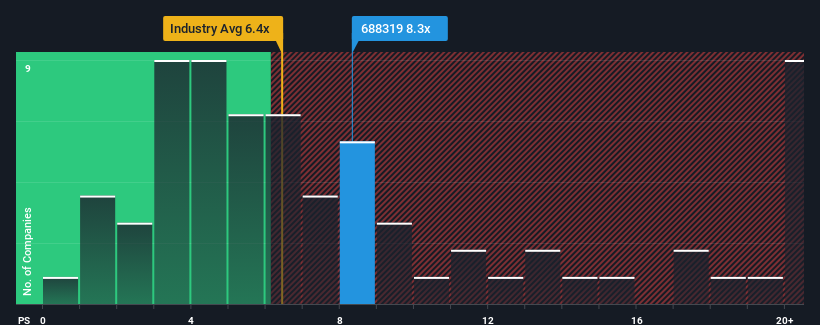

Since its price has surged higher, you could be forgiven for thinking Chengdu Olymvax Biopharmaceuticals is a stock not worth researching with a price-to-sales ratios (or "P/S") of 8.3x, considering almost half the companies in China's Biotechs industry have P/S ratios below 6.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Chengdu Olymvax Biopharmaceuticals

What Does Chengdu Olymvax Biopharmaceuticals' P/S Mean For Shareholders?

Chengdu Olymvax Biopharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Chengdu Olymvax Biopharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

Chengdu Olymvax Biopharmaceuticals' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. Still, the latest three year period has seen an excellent 53% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 40% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 255% growth, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Chengdu Olymvax Biopharmaceuticals' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Chengdu Olymvax Biopharmaceuticals' P/S Mean For Investors?

Chengdu Olymvax Biopharmaceuticals' P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Chengdu Olymvax Biopharmaceuticals trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Chengdu Olymvax Biopharmaceuticals, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688319

Chengdu Olymvax Biopharmaceuticals

Engages in the research and development, production, and sales of vaccines for human use in China.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.