Chengdu Olymvax Biopharmaceuticals Inc. (SHSE:688319) Shares May Have Slumped 25% But Getting In Cheap Is Still Unlikely

Unfortunately for some shareholders, the Chengdu Olymvax Biopharmaceuticals Inc. (SHSE:688319) share price has dived 25% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

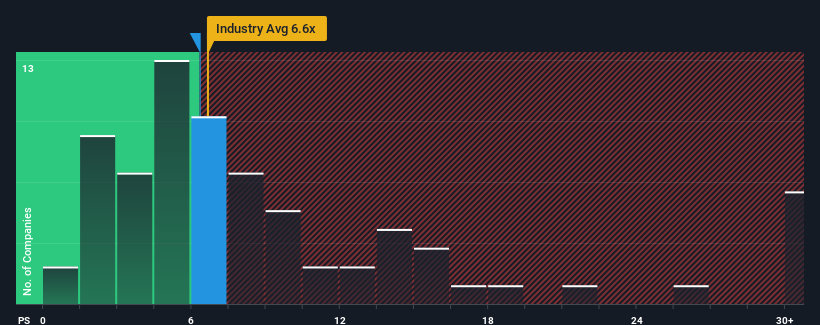

Even after such a large drop in price, there still wouldn't be many who think Chengdu Olymvax Biopharmaceuticals' price-to-sales (or "P/S") ratio of 6.3x is worth a mention when the median P/S in China's Biotechs industry is similar at about 6.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Chengdu Olymvax Biopharmaceuticals

How Has Chengdu Olymvax Biopharmaceuticals Performed Recently?

Chengdu Olymvax Biopharmaceuticals hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Chengdu Olymvax Biopharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

Chengdu Olymvax Biopharmaceuticals' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.4%. Even so, admirably revenue has lifted 55% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 70% over the next year. That's shaping up to be materially lower than the 174% growth forecast for the broader industry.

With this information, we find it interesting that Chengdu Olymvax Biopharmaceuticals is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Chengdu Olymvax Biopharmaceuticals' P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Chengdu Olymvax Biopharmaceuticals looks to be in line with the rest of the Biotechs industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Chengdu Olymvax Biopharmaceuticals' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Chengdu Olymvax Biopharmaceuticals with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688319

Chengdu Olymvax Biopharmaceuticals

Engages in the research and development, production, and sales of vaccines for human use in China.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives