- China

- /

- Electronic Equipment and Components

- /

- SZSE:002600

High Growth Tech Stocks To Watch In October 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape, recent developments such as the European Central Bank's rate cuts and strong performances in U.S. indices like the S&P 500 and Nasdaq Composite have captured investor attention, particularly with small-cap stocks showing resilience. In this context of shifting economic indicators and market sentiment, identifying high-growth tech stocks involves looking for companies that demonstrate robust earnings potential and adaptability to technological advancements, especially given the renewed interest in AI-related sectors.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 43.83% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Seagate Technology Holdings (NasdaqGS:STX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Seagate Technology Holdings plc specializes in providing data storage technology and infrastructure solutions across Singapore, the United States, the Netherlands, and globally, with a market cap of approximately $23.60 billion.

Operations: Seagate Technology Holdings generates revenue primarily through the manufacture and distribution of storage solutions, totaling $6.55 billion.

Seagate Technology Holdings has demonstrated a robust turnaround in its financial performance, with a notable increase in sales to $1.89 billion and net income soaring to $513 million for Q4 2024, contrasting sharply with a net loss the previous year. This resurgence is underpinned by strategic R&D investments, which have consistently aligned with revenue growth, ensuring the company remains at the forefront of innovation in data storage solutions. Moreover, Seagate's proactive approach at recent industry conferences underscores its commitment to maintaining relevance in evolving tech landscapes. With expected revenue growth of 13.1% annually and earnings forecasted to expand by 25.5%, Seagate's strategic positioning suggests potential for sustained growth amidst dynamic market conditions.

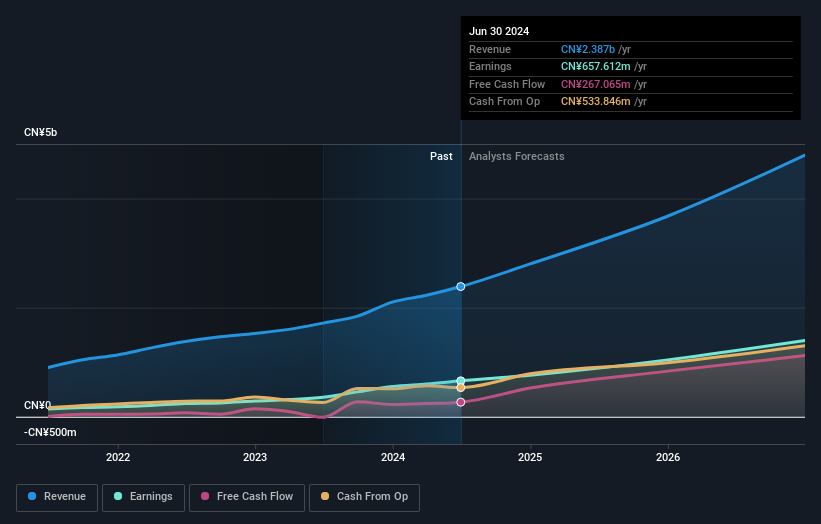

Xiamen Amoytop Biotech (SHSE:688278)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xiamen Amoytop Biotech Co., Ltd. specializes in the manufacture, marketing, and sale of recombinant protein drugs in China with a market cap of CN¥33.85 billion.

Operations: Amoytop Biotech generates revenue primarily from its biologics segment, amounting to CN¥2.39 billion. The company's focus on recombinant protein drugs positions it within the biotechnology sector in China.

Xiamen Amoytop Biotech is capturing attention with its aggressive R&D strategy, dedicating 28.0% of its revenue to research and development, a move that's fostering rapid advancements in biotechnology. This investment has propelled the company’s earnings growth by an impressive 85% over the past year, significantly outpacing the industry average of 10.1%. Furthermore, Amoytop’s strategic collaboration for clinical trials in China underscores its commitment to innovation and market expansion, particularly in chronic hepatitis B treatments through novel therapies like PEGBING®. With forecasted annual revenue and profit growth rates at 28% and 30.8%, respectively, Amoytop is well-positioned to leverage its R&D prowess for sustained impact in biotech solutions.

- Take a closer look at Xiamen Amoytop Biotech's potential here in our health report.

Learn about Xiamen Amoytop Biotech's historical performance.

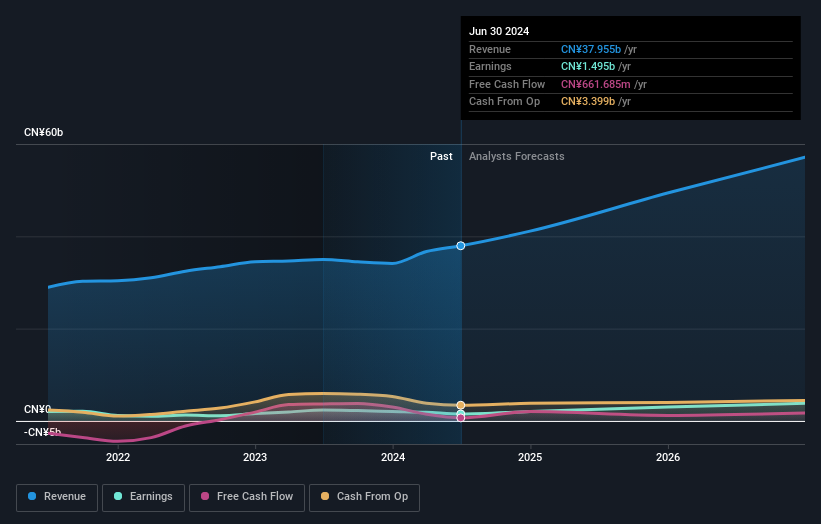

Lingyi iTech (Guangdong) (SZSE:002600)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lingyi iTech (Guangdong) Company offers smart manufacturing services and solutions, with a market cap of CN¥58.90 billion.

Operations: The company generates revenue primarily from its Precision Functional Parts, Structural Parts and Modules segment, contributing CN¥27.50 billion. Other significant segments include Charger and Boutique Assembly at CN¥6.44 billion and Automotive Products at CN¥2.00 billion.

Lingyi iTech (Guangdong) has demonstrated a robust commitment to innovation, with R&D expenses rising to capture 14.4% of its revenue, aligning with its strategic focus on enhancing technological capabilities. Despite a challenging year with net income dropping to CNY 692.31 million from CNY 1,248.10 million, the company is poised for recovery with projected earnings growth of 27.2% annually. This growth trajectory is underscored by recent corporate actions including special shareholder meetings focused on governance and incentive plans, signaling proactive management in steering future expansions and potentially stabilizing its volatile share price.

Taking Advantage

- Click here to access our complete index of 1266 High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002600

Lingyi iTech (Guangdong)

Provides smart manufacturing services and solutions.

Excellent balance sheet with reasonable growth potential.