- China

- /

- Electrical

- /

- SZSE:002823

Discovering February 2025's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets navigate the complexities of geopolitical tensions and consumer spending concerns, major indices like the S&P 500 have experienced fluctuations, with recent declines overshadowing earlier gains. The current environment highlights the importance of identifying stocks that demonstrate resilience and potential for growth amidst economic uncertainties, making it crucial to explore lesser-known opportunities that may offer unique value propositions in today's market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Vilkyskiu pienine | 35.79% | 17.20% | 49.04% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -1.57% | -8.96% | ★★★★☆☆ |

| Wema Bank | 45.02% | 36.14% | 60.04% | ★★★★☆☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| Sichuan Dowell Science and Technology | 34.59% | 12.97% | -14.44% | ★★★★☆☆ |

| Conoil | 65.11% | 21.04% | 44.95% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Societatea Energetica Electrica (BVB:EL)

Simply Wall St Value Rating: ★★★★☆☆

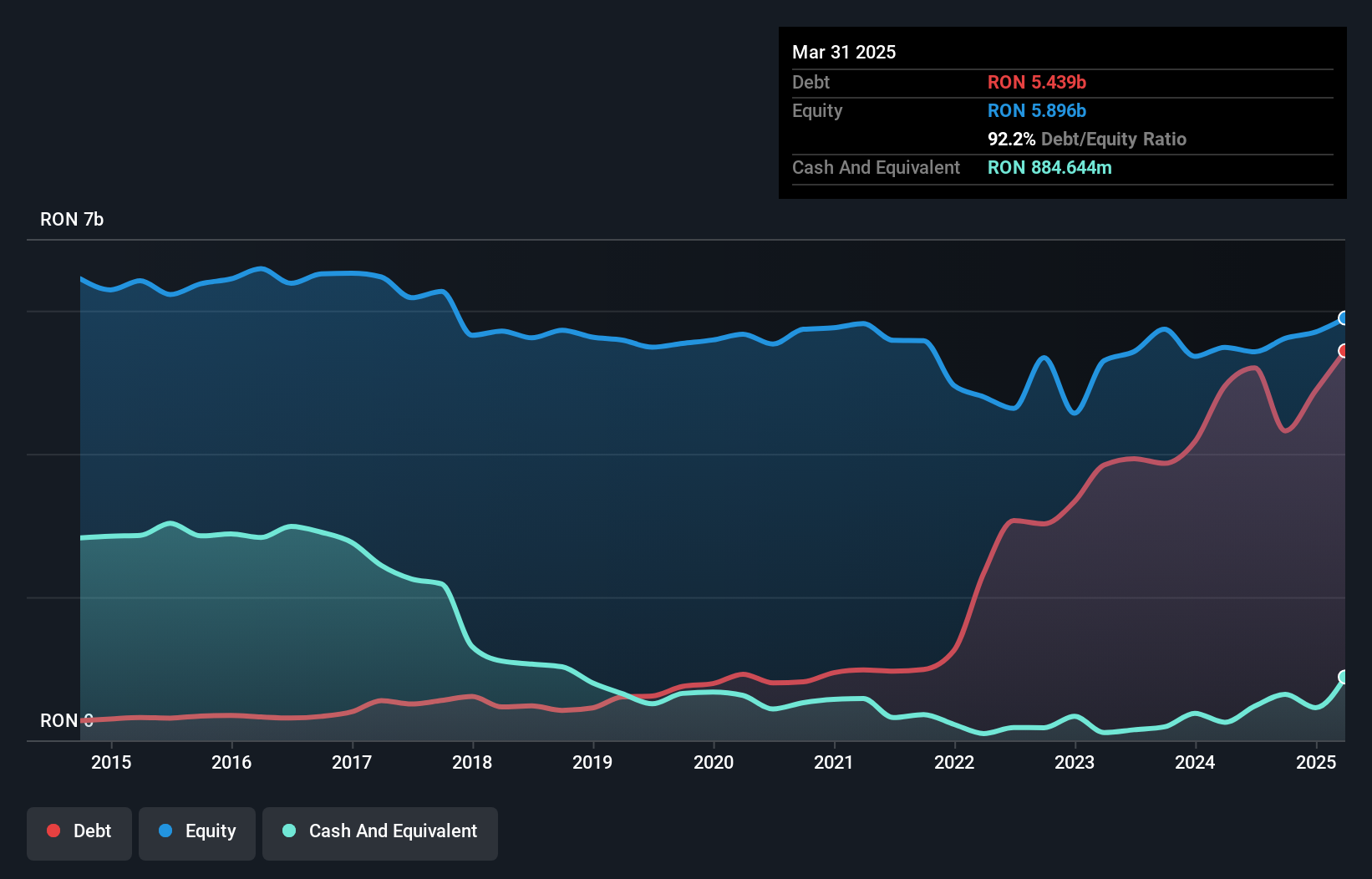

Overview: Societatea Energetica Electrica S.A. operates in Romania, focusing on the operation, construction, and maintenance of electricity distribution networks with a market capitalization of RON5.20 billion.

Operations: Electrica generates revenue primarily from electricity and natural gas supply (RON9.86 billion) and electricity distribution (RON4.82 billion). A notable financial aspect is the consolidation eliminations and adjustments, which reduce total revenue by RON2.24 billion. The company's net profit margin shows an interesting trend, reflecting its efficiency in managing costs relative to its revenue streams.

Electrica, a notable player in the energy sector, has seen its debt to equity ratio rise from 13.6% to 77% over five years, reflecting increased leverage. Despite this high net debt to equity ratio of 65.6%, its interest payments are comfortably covered by EBIT at a multiple of 3.4x, indicating sound financial management amidst industry challenges. Trading at nearly 20% below estimated fair value suggests potential undervaluation compared to peers. Recent board changes with Mihai Diaconu as Chair and strategic committee realignments might steer Electrica towards improved governance and operational efficiency in the coming years.

HitGen (SHSE:688222)

Simply Wall St Value Rating: ★★★★★☆

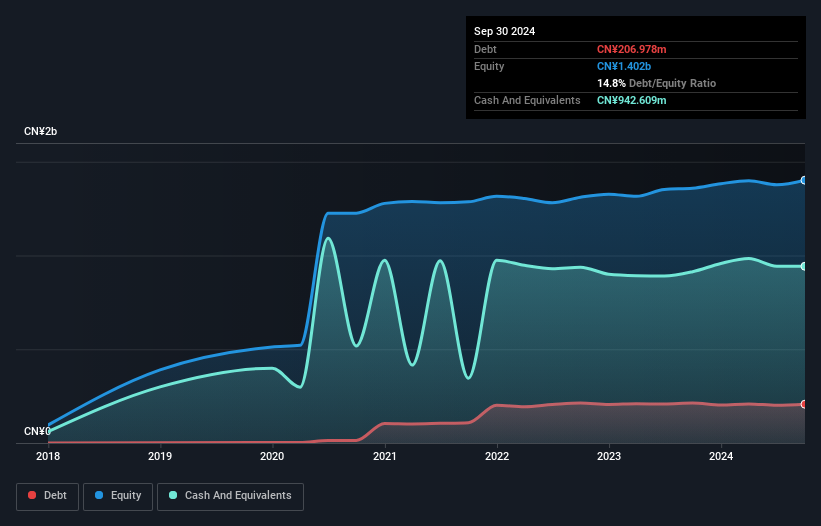

Overview: HitGen Inc. is a drug discovery research platform specializing in small molecules and nucleic acid drugs, with a market cap of CN¥7.26 billion.

Operations: Revenue streams for HitGen primarily include drug discovery services and licensing agreements. The company's gross profit margin is 46.3%, reflecting the profitability of its operations in these areas.

HitGen, a nimble player in the biotech arena, has demonstrated robust earnings growth of 58.7% over the past year, outpacing the broader Life Sciences sector's -13.5%. With high-quality earnings and more cash than total debt, its financial health seems solid. The company's free cash flow turned positive recently at US$101.15 million as of September 2024, reflecting improved operational efficiency despite a volatile share price in recent months. Looking ahead, HitGen's projected annual earnings growth of 20.26% suggests potential for continued expansion within its niche market space.

- Dive into the specifics of HitGen here with our thorough health report.

Evaluate HitGen's historical performance by accessing our past performance report.

Shenzhen Kaizhong Precision Technology (SZSE:002823)

Simply Wall St Value Rating: ★★★★★☆

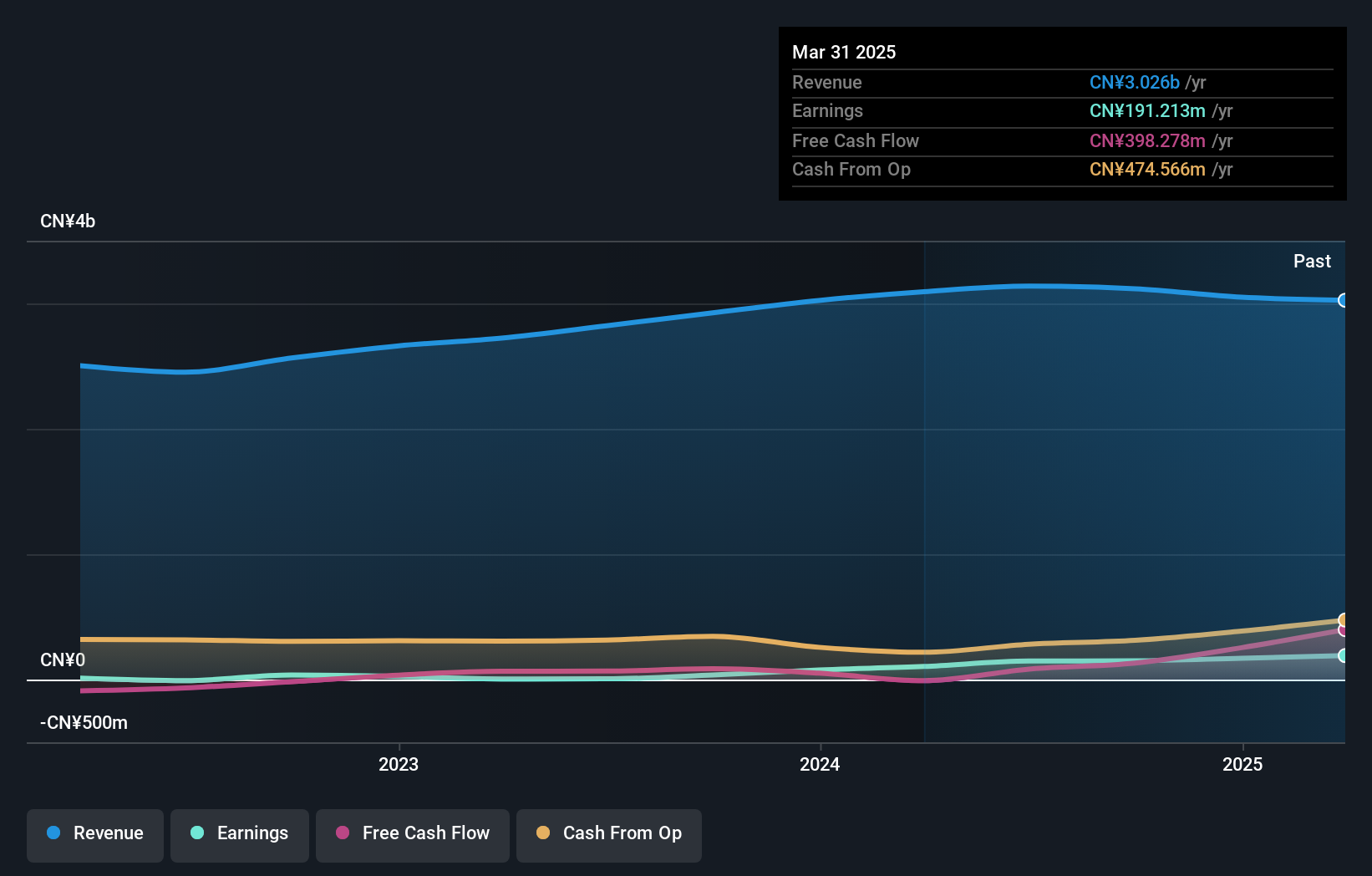

Overview: Shenzhen Kaizhong Precision Technology Co., Ltd. operates in the precision technology sector and has a market capitalization of CN¥4.94 billion.

Operations: Kaizhong Precision Technology generates revenue primarily from its precision technology products. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management over time.

Shenzhen Kaizhong Precision Technology, a smaller player in the market, has shown impressive growth with earnings surging by 317% over the past year, outpacing the Electrical industry's modest 1.3% rise. The company's high-quality earnings and a price-to-earnings ratio of 32.9x, which is favorable compared to the CN market average of 38.1x, suggest potential value for investors. However, it carries a net debt to equity ratio of 50.5%, which is considered high despite reducing from 103.9% over five years. Interest payments are well covered by EBIT at 3.7x coverage, indicating strong financial management amidst its growth trajectory.

- Click here to discover the nuances of Shenzhen Kaizhong Precision Technology with our detailed analytical health report.

Understand Shenzhen Kaizhong Precision Technology's track record by examining our Past report.

Where To Now?

- Delve into our full catalog of 4760 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002823

Shenzhen Kaizhong Precision Technology

Shenzhen Kaizhong Precision Technology Co., Ltd.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives