- China

- /

- Life Sciences

- /

- SHSE:688114

Optimistic Investors Push MGI Tech Co., Ltd. (SHSE:688114) Shares Up 30% But Growth Is Lacking

MGI Tech Co., Ltd. (SHSE:688114) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

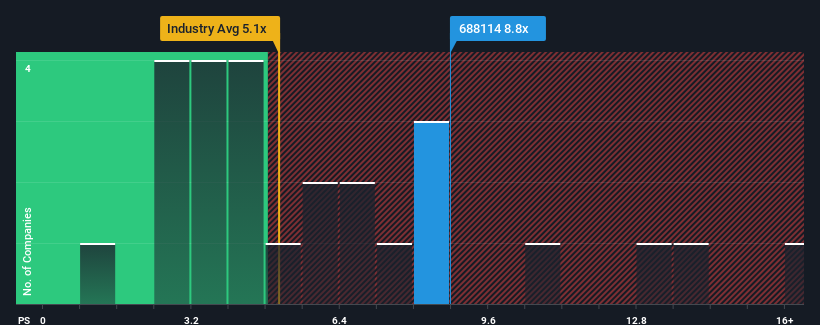

Since its price has surged higher, you could be forgiven for thinking MGI Tech is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 8.8x, considering almost half the companies in China's Life Sciences industry have P/S ratios below 5.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for MGI Tech

How MGI Tech Has Been Performing

With revenue that's retreating more than the industry's average of late, MGI Tech has been very sluggish. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on MGI Tech will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

MGI Tech's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. As a result, revenue from three years ago have also fallen 34% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 10% per annum as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% per year, which is not materially different.

With this information, we find it interesting that MGI Tech is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On MGI Tech's P/S

The strong share price surge has lead to MGI Tech's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given MGI Tech's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Having said that, be aware MGI Tech is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688114

MGI Tech

Engages in the research, development, production, and sale of DNA sequencing instruments, reagents, and related products for precision medicine, agriculture, healthcare, and other relevant industries in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives