As Asian markets navigate a landscape marked by economic uncertainties and shifting monetary policies, investors are keenly observing the performance of regional equities. Amidst this backdrop, growth companies with high insider ownership stand out as potential opportunities, offering a combination of strategic vision and vested interest that can be appealing in times of market volatility.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19.1% | 64.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 84.7% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.3% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 28.4% |

| M31 Technology (TPEX:6643) | 30.7% | 96.8% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 48.5% |

| Ascentage Pharma Group International (SEHK:6855) | 12.7% | 91.9% |

We're going to check out a few of the best picks from our screener tool.

Beijing Konruns PharmaceuticalLtd (SHSE:603590)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Konruns Pharmaceutical Co., Ltd. is involved in the research, development, production, and sale of pharmaceuticals both in China and internationally, with a market cap of CN¥9.84 billion.

Operations: The company generates revenue from its Pharmaceutical Manufacturing segment, amounting to CN¥838.16 million.

Insider Ownership: 32.3%

Revenue Growth Forecast: 26% p.a.

Beijing Konruns Pharmaceutical Ltd. has demonstrated growth with recent half-year earnings showing an increase in sales to CNY 460.87 million and net income rising to CNY 91.05 million. Despite a volatile share price and low profit margins, the company is forecasted for significant revenue growth at 26% annually, outpacing the Chinese market's average. However, return on equity is expected to be low at 5.7%, raising concerns about future profitability sustainability despite high insider ownership levels.

- Get an in-depth perspective on Beijing Konruns PharmaceuticalLtd's performance by reading our analyst estimates report here.

- Our valuation report here indicates Beijing Konruns PharmaceuticalLtd may be overvalued.

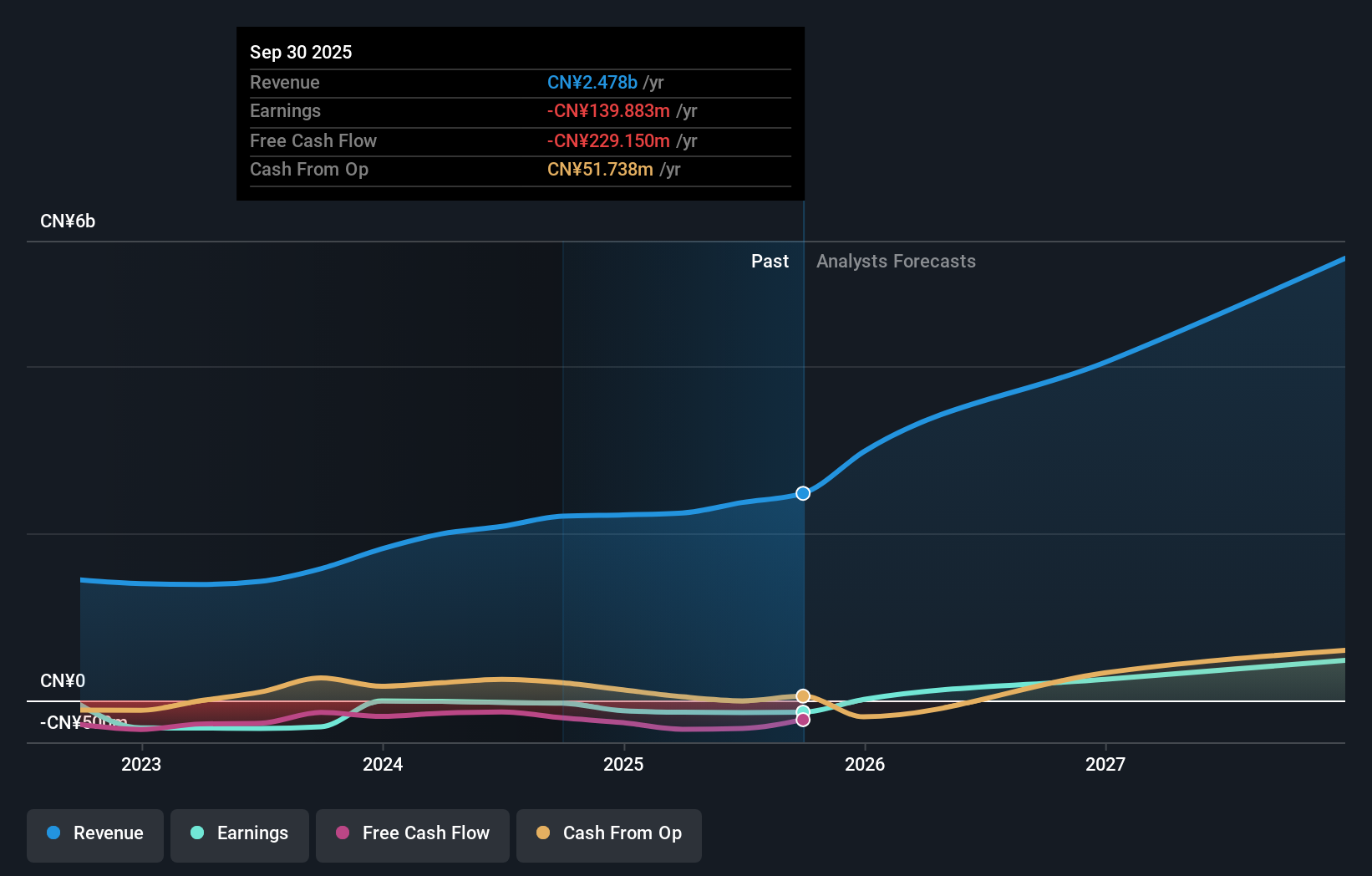

WG TECH (Jiang Xi) (SHSE:603773)

Simply Wall St Growth Rating: ★★★★★★

Overview: WG TECH (Jiang Xi) Co., Ltd. operates in China, offering glass-based circuit boards and related electronic devices, with a market cap of CN¥8.42 billion.

Operations: The company generates revenue from its optoelectronics segment, amounting to CN¥2.24 billion.

Insider Ownership: 28.9%

Revenue Growth Forecast: 30.4% p.a.

WG TECH (Jiang Xi) is expected to achieve profitability within three years, with anticipated annual earnings growth of 102.65%, surpassing the Chinese market average. Revenue is projected to grow at 30.4% per year, significantly outpacing the market's 13.7%. Despite high return on equity forecasts and trading at a good relative value, its financial position is weakened by debt not well-covered by operating cash flow and recent share price volatility may pose risks for investors.

- Delve into the full analysis future growth report here for a deeper understanding of WG TECH (Jiang Xi).

- Insights from our recent valuation report point to the potential undervaluation of WG TECH (Jiang Xi) shares in the market.

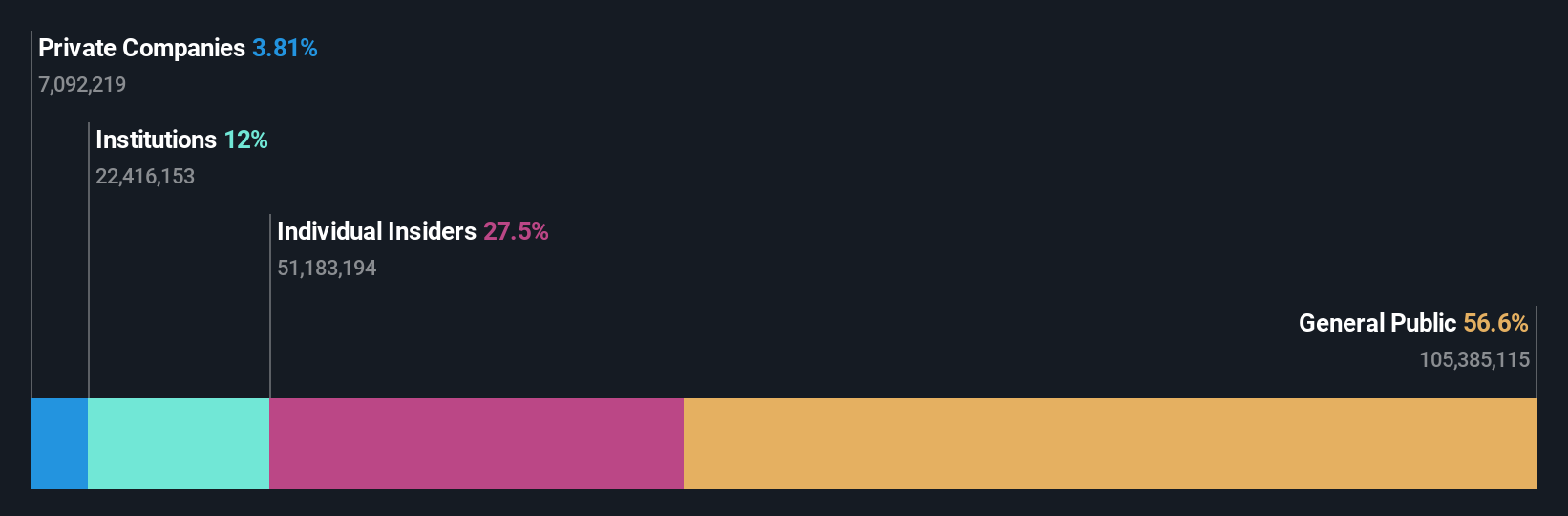

Jiangsu Gian Technology (SZSE:300709)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Gian Technology Co., Ltd. manufactures and sells metal injection molding products both in China and internationally, with a market cap of CN¥10.74 billion.

Operations: Jiangsu Gian Technology generates revenue from the manufacture and sale of metal injection molding products domestically and abroad.

Insider Ownership: 27.5%

Revenue Growth Forecast: 14.0% p.a.

Jiangsu Gian Technology's insider ownership aligns with its strategic growth trajectory, as evidenced by recent amendments to its articles of association and business scope expansion. The company's earnings are forecasted to grow significantly at 26.3% annually, outpacing the Chinese market average. However, revenue growth is slower than desired at 14% per year. The recent CNY 580 million convertible bond issuance indicates proactive capital management but may introduce financial complexities alongside low projected return on equity of 8.4%.

- Dive into the specifics of Jiangsu Gian Technology here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Jiangsu Gian Technology is trading beyond its estimated value.

Next Steps

- Get an in-depth perspective on all 604 Fast Growing Asian Companies With High Insider Ownership by using our screener here.

- Interested In Other Possibilities? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Konruns PharmaceuticalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603590

Beijing Konruns PharmaceuticalLtd

Engages in the research and development, production, and sale of pharmaceuticals in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion