- China

- /

- Communications

- /

- SZSE:002583

High Growth Tech In China Featuring Beijing Wantai Biological Pharmacy Enterprise And Two Other Dynamic Stocks

Reviewed by Simply Wall St

As global markets show signs of recovery, Chinese stocks have faced recent declines due to weak inflation data and ongoing economic concerns. Despite this, the tech sector in China remains a focal point for investors seeking high-growth opportunities. In today's market conditions, identifying strong stocks often involves looking at companies with robust fundamentals and innovative capabilities that can navigate economic challenges effectively.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 32.64% | 31.77% | ★★★★★★ |

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Zhongji Innolight | 32.38% | 31.76% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Eoptolink Technology | 43.76% | 42.52% | ★★★★★★ |

| Wanma Technology | 35.58% | 47.75% | ★★★★★★ |

| Huayi Brothers Media | 40.13% | 103.97% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Beijing Wantai Biological Pharmacy Enterprise (SHSE:603392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Wantai Biological Pharmacy Enterprise Co., Ltd. (SHSE:603392) specializes in the development, production, and sale of diagnostic reagents and vaccines, with a market cap of CN¥88.56 billion.

Operations: The company's revenue primarily comes from the sale of diagnostic reagents and vaccines. With a market cap of CN¥88.56 billion, it operates in the biotechnology sector focusing on healthcare solutions.

Beijing Wantai Biological Pharmacy Enterprise has shown a notable uptick in its strategic maneuvers, notably completing a share repurchase of 3,084,225 shares for CNY 200.08 million as of September 2024, signaling confidence in its own growth prospects. Despite a significant drop in revenue to CNY 1.37 billion from last year's CNY 4.16 billion and net income falling to CNY 260.48 million from CNY 1.70 billion, the company is poised for recovery with forecasts suggesting an impressive revenue growth rate of 49.4% per year and profitability expected within three years. This pivot is underpinned by substantial investment in R&D which not only underscores its commitment to innovation but also aligns with anticipated sectoral expansions driven by technological advancements in biotechnology. The company’s future trajectory appears robust with earnings potentially increasing by an estimated 95.6% annually, placing it well above many peers within the Chinese market where average growth hovers around 13%. Such vigorous financial health could be pivotal as Beijing Wantai navigates through the complexities of biotech innovations while maintaining operational agility to leverage emerging market opportunities effectively.

Guangzhou Haige Communications Group (SZSE:002465)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Haige Communications Group Incorporated Company, along with its subsidiaries, operates in the wireless communications, Beidou navigation, aerospace, and digital intelligence ecology sectors in China with a market cap of CN¥21.24 billion.

Operations: The company operates across multiple sectors including wireless communications, Beidou navigation, aerospace, and digital intelligence ecology. It generates revenue primarily from these diversified business segments within China.

Guangzhou Haige Communications Group, despite a recent dip in sales and net income as per the latest half-yearly report, is setting a brisk pace with an expected revenue growth of 21.7% per year. This outpaces the broader Chinese market's average of 13.1%, showcasing its potential to capture more market share. Additionally, the company's earnings are projected to surge by 30.2% annually, reflecting robust operational enhancements and market positioning. In light of these figures, Guangzhou Haige is actively expanding its business scope and amending its articles of association, which could further solidify its stance in high-growth tech sectors within China.

Hytera Communications (SZSE:002583)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hytera Communications Corporation Limited offers communications technologies and solutions globally under the Hytera brand name, with a market cap of CN¥7.16 billion.

Operations: Hytera generates revenue primarily from the Professional Wireless Communication Equipment Manufacturing Industry, contributing CN¥4.94 billion, and OEM services amounting to CN¥1.20 billion. The company's market cap stands at CN¥7.16 billion.

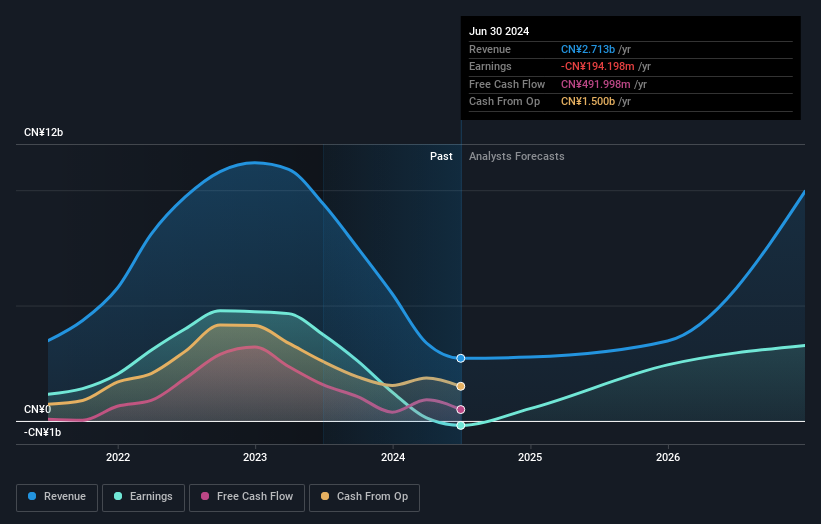

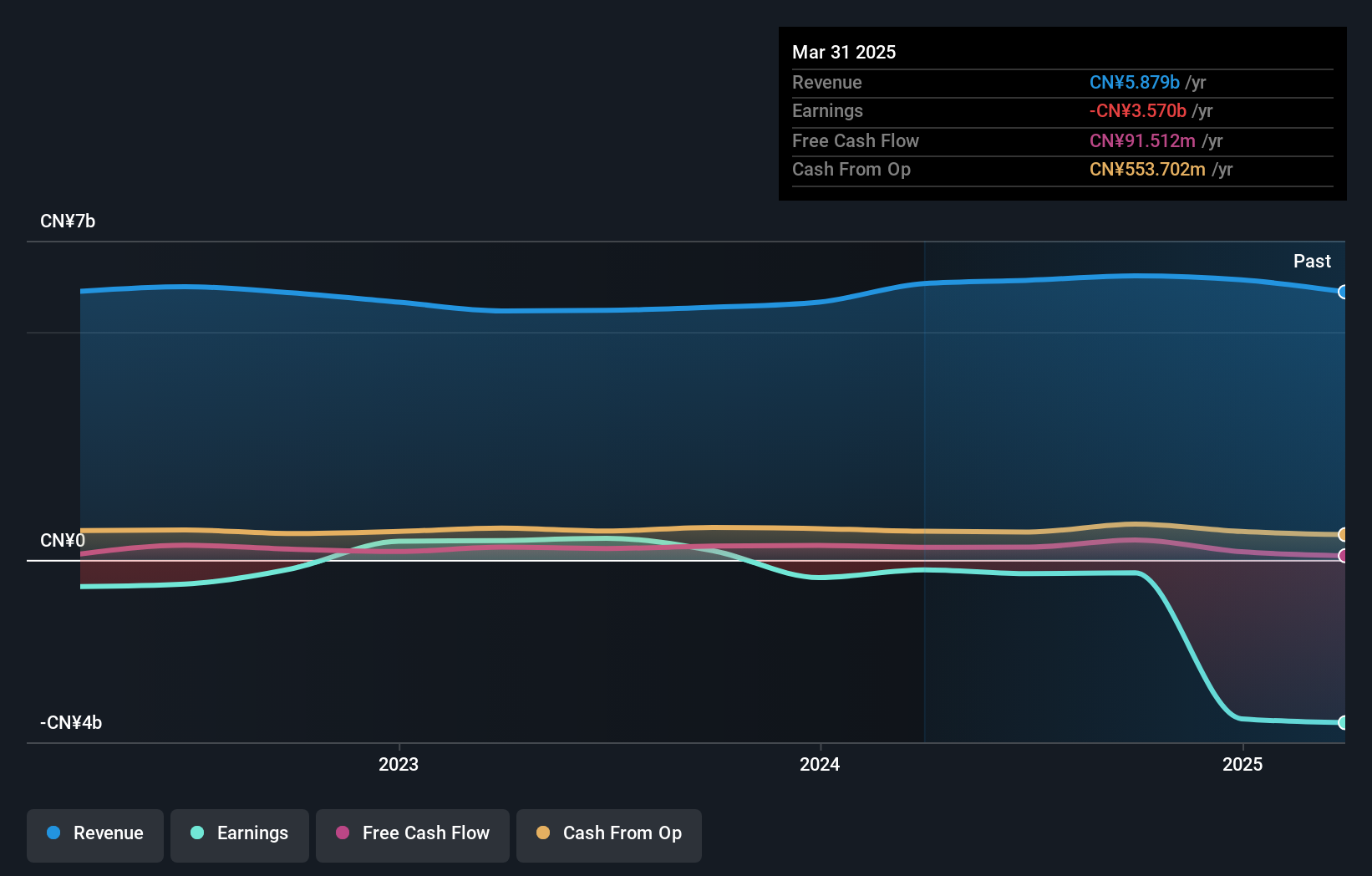

Hytera Communications has demonstrated significant financial growth with a 21.2% increase in sales, reaching CNY 2.74 billion in the first half of 2024 compared to the previous year. This surge is coupled with a doubling of net income to CNY 162.39 million, reflecting strong operational efficiency and market demand for its communication solutions. Additionally, strategic alliances like the recent partnership with VST ECS Phils Inc., enhance Hytera's distribution capabilities and access to new markets, positioning it well amidst evolving tech landscapes. With earnings projected to grow by an impressive 82.9% annually, Hytera is poised for robust expansion in high-tech sectors within China despite broader industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of Hytera Communications.

Gain insights into Hytera Communications' past trends and performance with our Past report.

Taking Advantage

- Take a closer look at our Chinese High Growth Tech and AI Stocks list of 260 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hytera Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002583

Hytera Communications

Provides communications technologies and solutions under the Hytera brand name in China and internationally.

Flawless balance sheet with reasonable growth potential.