High Growth Tech Stocks in Asia Featuring Three Prominent Picks

Reviewed by Simply Wall St

As global markets experience a surge, with key indices like the S&P 500 and Nasdaq Composite reaching record highs due to favorable trade deals, the Asian tech sector is also capturing attention amidst hopes for extended tariff truces and economic growth. In this dynamic environment, identifying high-growth tech stocks involves looking at companies that are well-positioned to leverage technological advancements and capitalize on improving trade relations.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.05% | 23.29% | ★★★★★★ |

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 30.51% | 37.34% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.71% | 35.89% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

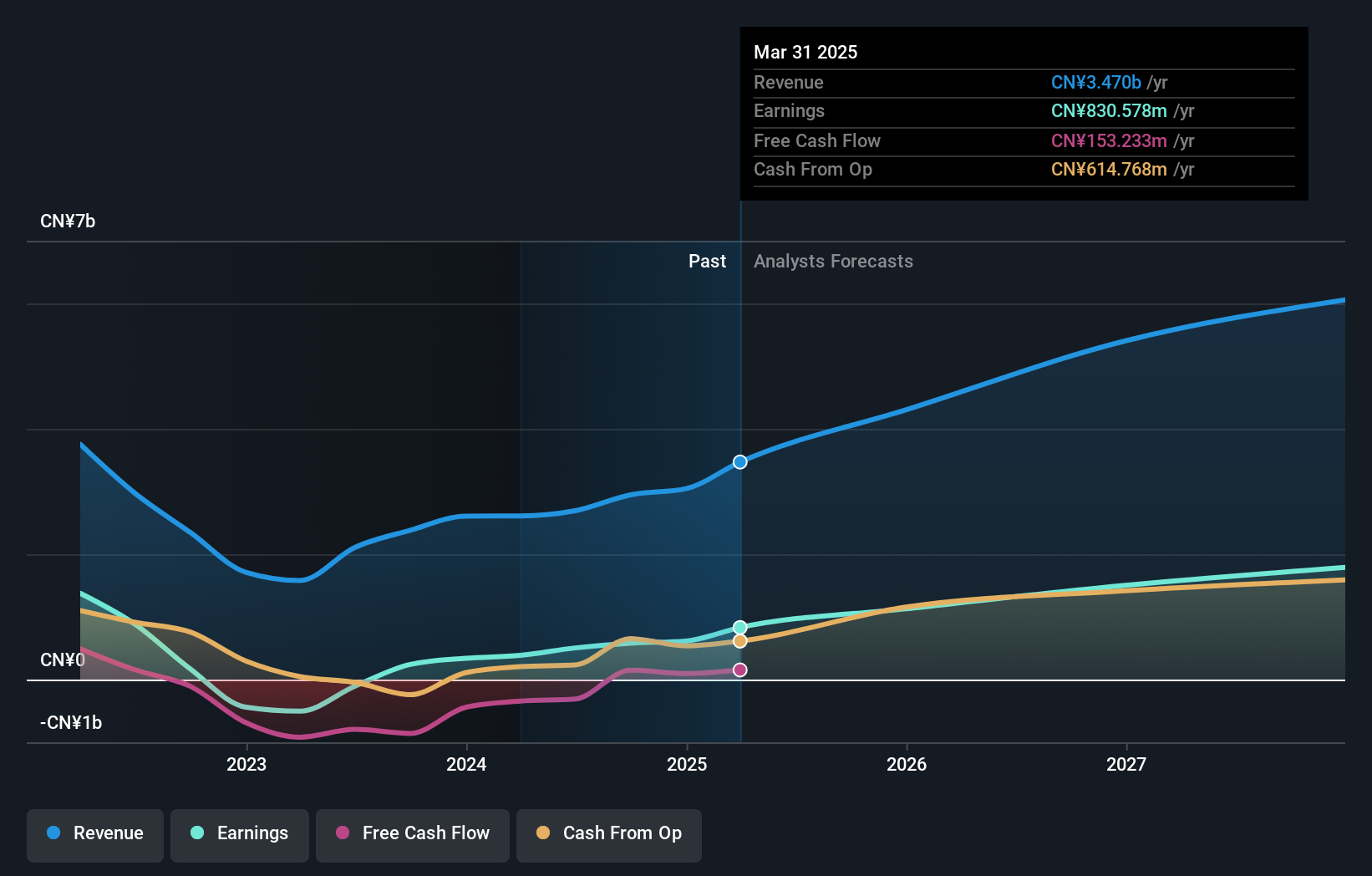

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog APIs and injections in China with a market cap of approximately CN¥36.43 billion.

Operations: Gan & Lee Pharmaceuticals primarily generates revenue through the development, production, and sale of insulin and related products, amounting to approximately CN¥3.47 billion. The company's operations are centered in China, focusing on biopharmaceutical advancements in insulin analogs.

Gan & Lee Pharmaceuticals, a trailblazer in diabetes care, recently secured approval for its insulin aspart injection in Argentina, signaling robust expansion within Latin America's critical healthcare markets. This strategic move aligns with the rising demand for cost-effective diabetes treatments in regions grappling with high diabetes prevalence and healthcare costs. Impressively, Gan & Lee's revenue and earnings have been outpacing the Chinese market with annual increases of 19.5% and 26.8%, respectively. The firm’s commitment to innovation is underscored by its R&D spending, which has consistently amplified its product pipeline and market competitiveness.

- Get an in-depth perspective on Gan & Lee Pharmaceuticals' performance by reading our health report here.

Evaluate Gan & Lee Pharmaceuticals' historical performance by accessing our past performance report.

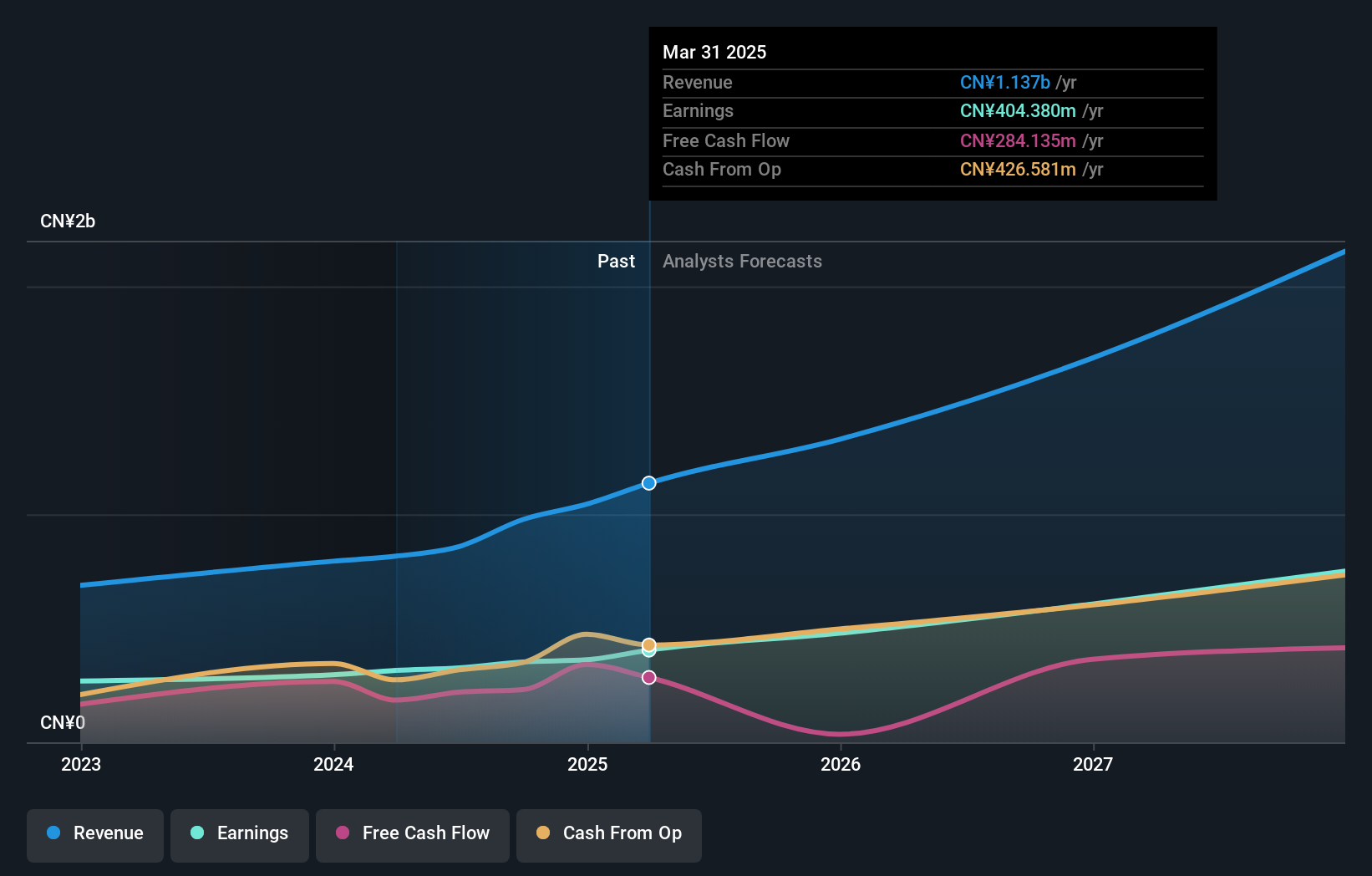

Wuhan Dameng Database (SHSE:688692)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuhan Dameng Database Company Limited specializes in database product development services within China and has a market cap of CN¥26.47 billion.

Operations: The company generates revenue primarily from data processing services, amounting to CN¥1.14 billion.

Wuhan Dameng Database has demonstrated robust growth, with a notable 22.6% annual revenue increase and an earnings surge of 28.3% over the past year, outpacing the broader Chinese software industry's average. This performance is underpinned by strategic shareholder decisions, such as the recent approval of a significant financial cooperation agreement, enhancing its competitive edge in tech innovation. The company also prioritizes R&D investments, ensuring sustained advancement and market relevance in a rapidly evolving digital landscape.

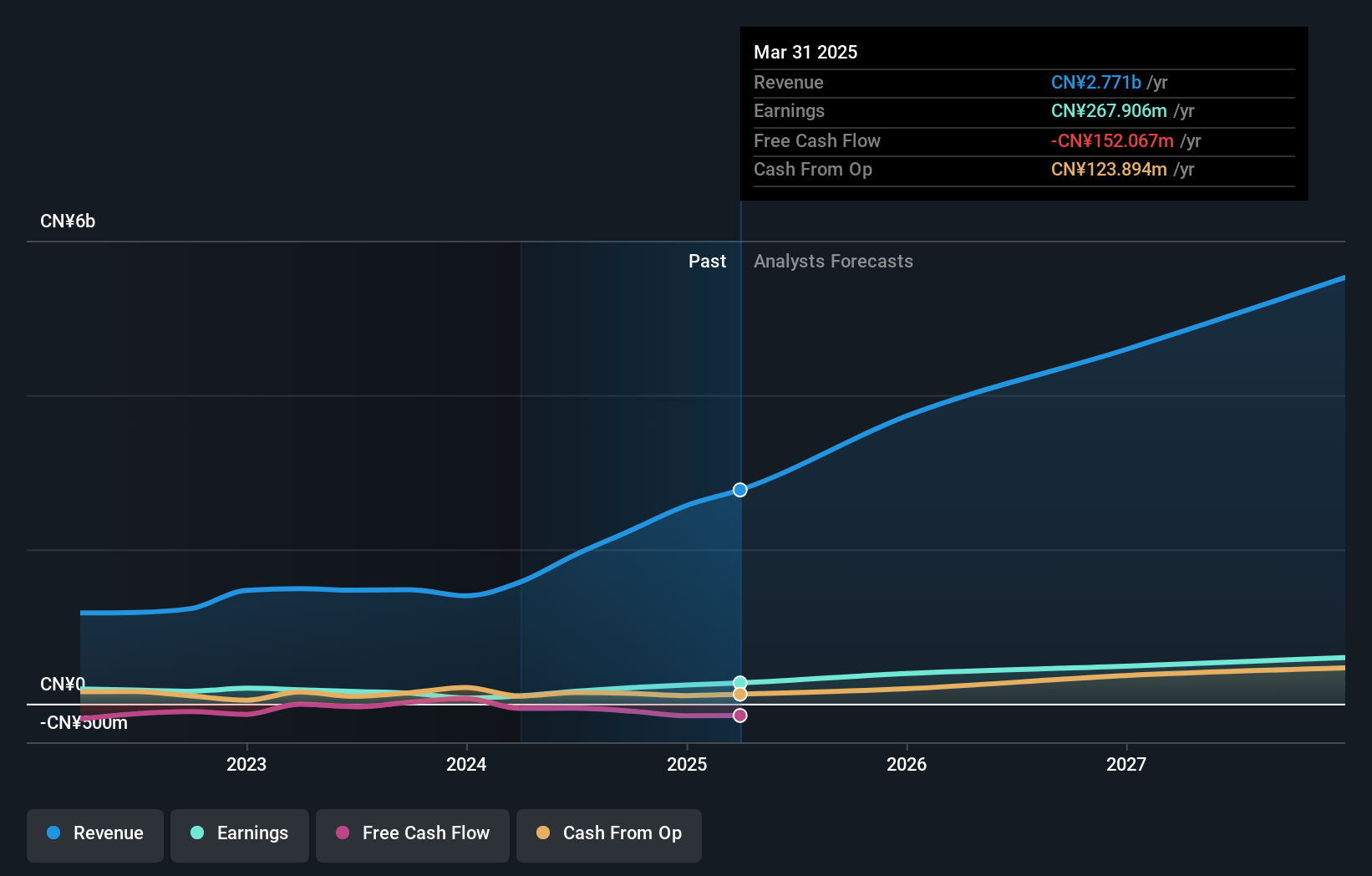

Dongguan Tarry ElectronicsLtd (SZSE:300976)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dongguan Tarry Electronics Co., Ltd. operates in China, producing and distributing precision die cutting products, foam protective film tapes, insulation heat conduction products, EMI shielding products, sewing and high frequency earmuffs, headbands, and assembly automation equipment with a market cap of CN¥7.35 billion.

Operations: The company generates revenue primarily from its manufacturing industry segment, which accounts for CN¥2.77 billion. Its diverse product offerings include precision die cutting products and EMI shielding solutions.

Dongguan Tarry Electronics has carved a niche in the high-growth tech sector in Asia, with a remarkable annual revenue growth of 23.6% and earnings growth of 26.6%. This performance is bolstered by its strategic focus on R&D, spending significantly to stay ahead in innovation within the electronics industry where it outperformed sector growth by over 160% last year. Recent corporate activities including leadership changes and shareholder meetings suggest proactive governance, poised to sustain its competitive edge and drive future growth amidst evolving market demands.

Seize The Opportunity

- Click here to access our complete index of 168 Asian High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603087

Gan & Lee Pharmaceuticals

A biopharmaceutical company, engages in the research, development, production, and sale of insulin analog active pharmaceutical ingredients (APIs) and injections in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives