3 Chinese Exchange Stocks Estimated To Be Trading At Up To 48.4% Below Intrinsic Value

Reviewed by Simply Wall St

China's recent announcement of robust stimulus measures has significantly lifted market sentiment, leading to a surge in Chinese stock indices. This positive momentum presents an opportune moment to explore undervalued stocks within the Chinese market, particularly those trading well below their intrinsic value. In the context of these favorable economic conditions, identifying stocks that are trading at a discount can offer substantial investment potential.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| JinGuan Electric (SHSE:688517) | CN¥14.82 | CN¥29.06 | 49% |

| Sinomine Resource Group (SZSE:002738) | CN¥36.54 | CN¥70.84 | 48.4% |

| Arctech Solar Holding (SHSE:688408) | CN¥83.96 | CN¥159.06 | 47.2% |

| Neusoft (SHSE:600718) | CN¥10.25 | CN¥19.47 | 47.4% |

| Zhejiang Great Shengda PackagingLtd (SHSE:603687) | CN¥7.11 | CN¥14.16 | 49.8% |

| Jiangsu Hualan New Pharmaceutical MaterialLtd (SZSE:301093) | CN¥24.74 | CN¥47.06 | 47.4% |

| Crystal Growth & Energy EquipmentLtd (SHSE:688478) | CN¥29.28 | CN¥56.43 | 48.1% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥29.46 | CN¥55.80 | 47.2% |

| Thunder Software TechnologyLtd (SZSE:300496) | CN¥52.55 | CN¥104.33 | 49.6% |

| Ningbo Jifeng Auto Parts (SHSE:603997) | CN¥13.70 | CN¥25.94 | 47.2% |

We'll examine a selection from our screener results.

Zhejiang Huahai Pharmaceutical (SHSE:600521)

Overview: Zhejiang Huahai Pharmaceutical Co., Ltd. is a pharmaceutical company that operates both in China and internationally, with a market cap of CN¥28.39 billion.

Operations: The company's revenue primarily comes from the Sales of Drug Product at CN¥5.43 billion and Sales of Active Pharmaceutical Ingredients and Intermediate at CN¥3.47 billion, with additional income from Technical Services amounting to CN¥153.16 million and Import and Export Trade generating CN¥3.22 million.

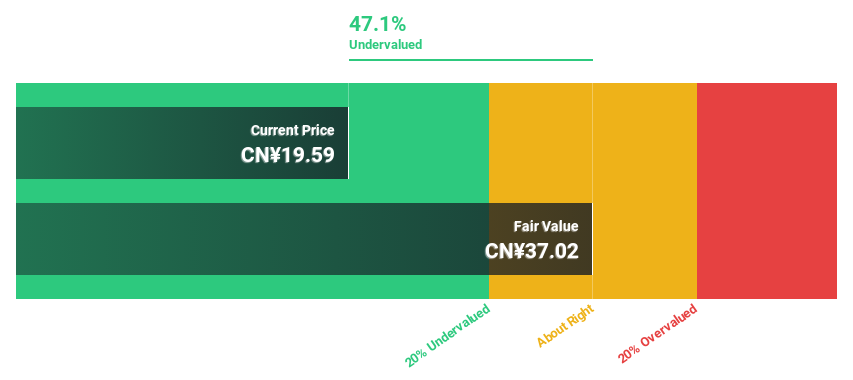

Estimated Discount To Fair Value: 47.1%

Zhejiang Huahai Pharmaceutical, trading at CN¥19.59, is significantly undervalued with a fair value estimate of CN¥37.02. Despite high debt levels and an unstable dividend track record, the company shows strong revenue growth (14.9% annually) and earnings growth (23.9% annually), outpacing the Chinese market averages. Recent H1 2024 results reported sales of CN¥5.10 billion and net income of CN¥748.57 million, reflecting solid financial performance amidst growing market presence.

- Our comprehensive growth report raises the possibility that Zhejiang Huahai Pharmaceutical is poised for substantial financial growth.

- Dive into the specifics of Zhejiang Huahai Pharmaceutical here with our thorough financial health report.

Eyebright Medical Technology (Beijing) (SHSE:688050)

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. is a company focused on developing and manufacturing ophthalmic medical devices, with a market cap of CN¥18.84 billion.

Operations: The company generates revenue from its Medical Products segment, amounting to CN¥1.51 billion.

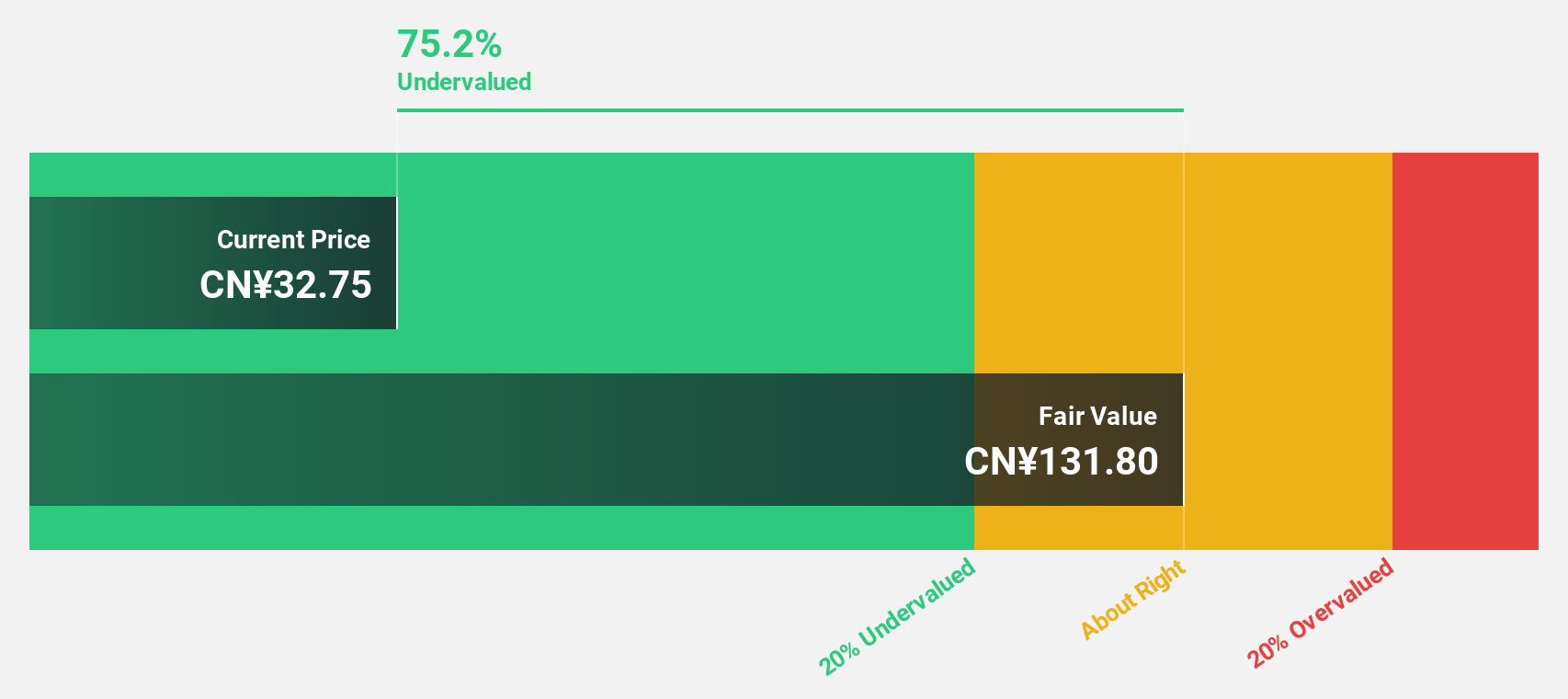

Estimated Discount To Fair Value: 28.0%

Eyebright Medical Technology (Beijing) is trading at CN¥99.4, significantly undervalued with a fair value estimate of CN¥138.14. Recent earnings for H1 2024 showed strong performance, with sales of CN¥680.74 million and net income of CN¥208.04 million, up from last year’s figures. The company’s revenue and earnings are forecast to grow over 27% annually, outpacing the Chinese market averages, despite a low future return on equity (18%).

- Insights from our recent growth report point to a promising forecast for Eyebright Medical Technology (Beijing)'s business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Eyebright Medical Technology (Beijing).

Sinomine Resource Group (SZSE:002738)

Overview: Sinomine Resource Group Co., Ltd. operates as a geological exploration technology services company with a market cap of CN¥26.36 billion.

Operations: The company's revenue is primarily derived from the development and utilization of lithium battery new energy raw materials (CN¥3.14 billion), followed by the development and utilization of rare light metal resources such as cesium and rubidium (CN¥1.06 billion), solid mineral exploration and mineral rights development (CN¥194.61 million), and trade business activities (CN¥350.96 million).

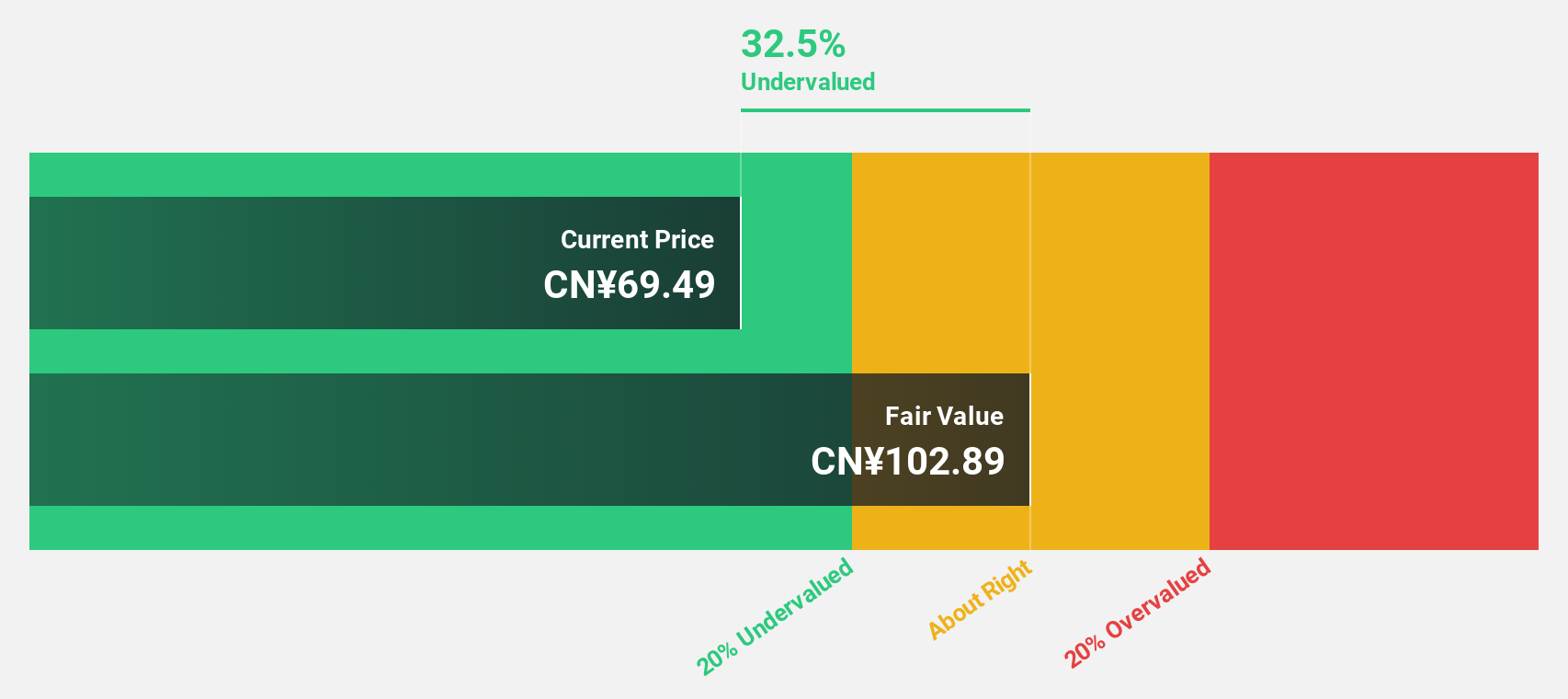

Estimated Discount To Fair Value: 48.4%

Sinomine Resource Group is trading at CN¥36.54, significantly undervalued with a fair value estimate of CN¥70.84, representing a 48.4% discount. Despite a challenging H1 2024 with net income dropping to CNY 472.99 million from CNY 1,502.41 million the previous year, earnings are forecasted to grow over 21% annually, surpassing market averages in revenue growth but facing low future return on equity (10.1%).

- Our earnings growth report unveils the potential for significant increases in Sinomine Resource Group's future results.

- Delve into the full analysis health report here for a deeper understanding of Sinomine Resource Group.

Summing It All Up

- Dive into all 114 of the Undervalued Chinese Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huahai Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600521

Zhejiang Huahai Pharmaceutical

Operates as a pharmaceutical company in China and internationally.

Undervalued with excellent balance sheet and pays a dividend.