Top Chinese Growth Companies With High Insider Ownership In October 2024

Reviewed by Simply Wall St

The Chinese market has recently experienced a surge, buoyed by robust stimulus measures aimed at revitalizing the economy. As global investors look to capitalize on this momentum, growth companies with high insider ownership are gaining attention for their potential resilience and alignment of interests between management and shareholders. In the context of these favorable market conditions, stocks with significant insider ownership can offer unique advantages. High insider stakes often signal confidence in the company's future prospects and can drive more strategic decision-making aligned with long-term growth objectives.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 23% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Nanjing Vazyme Biotech (SHSE:688105)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Vazyme Biotech Co., Ltd provides technology solutions in life science, biomedicine, and in vitro diagnostics, with a market cap of CN¥9.61 billion.

Operations: Nanjing Vazyme Biotech Co., Ltd generates revenue through its offerings in life science, biomedicine, and in vitro diagnostics.

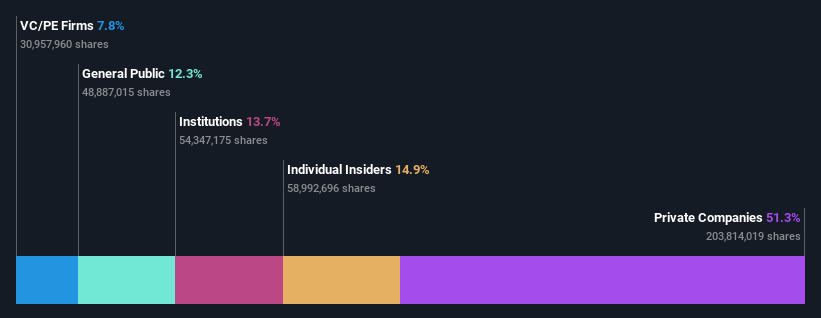

Insider Ownership: 14.9%

Revenue Growth Forecast: 22.9% p.a.

Nanjing Vazyme Biotech has shown promising growth, with recent earnings indicating a return to profitability, reporting CNY 16.16 million net income for the half year ended June 30, 2024. The company's revenue is forecasted to grow at 22.9% annually, outpacing the Chinese market average of 13.2%. Despite high share price volatility and low future return on equity projections (7.4%), its earnings are expected to grow significantly at an annual rate of over 70%.

- Click here and access our complete growth analysis report to understand the dynamics of Nanjing Vazyme Biotech.

- Our valuation report here indicates Nanjing Vazyme Biotech may be overvalued.

Shanghai Sinyang Semiconductor Materials (SZSE:300236)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Sinyang Semiconductor Materials Co., Ltd. operates in the semiconductor materials industry with a market capitalization of CN¥11.15 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for Shanghai Sinyang Semiconductor Materials Co., Ltd.

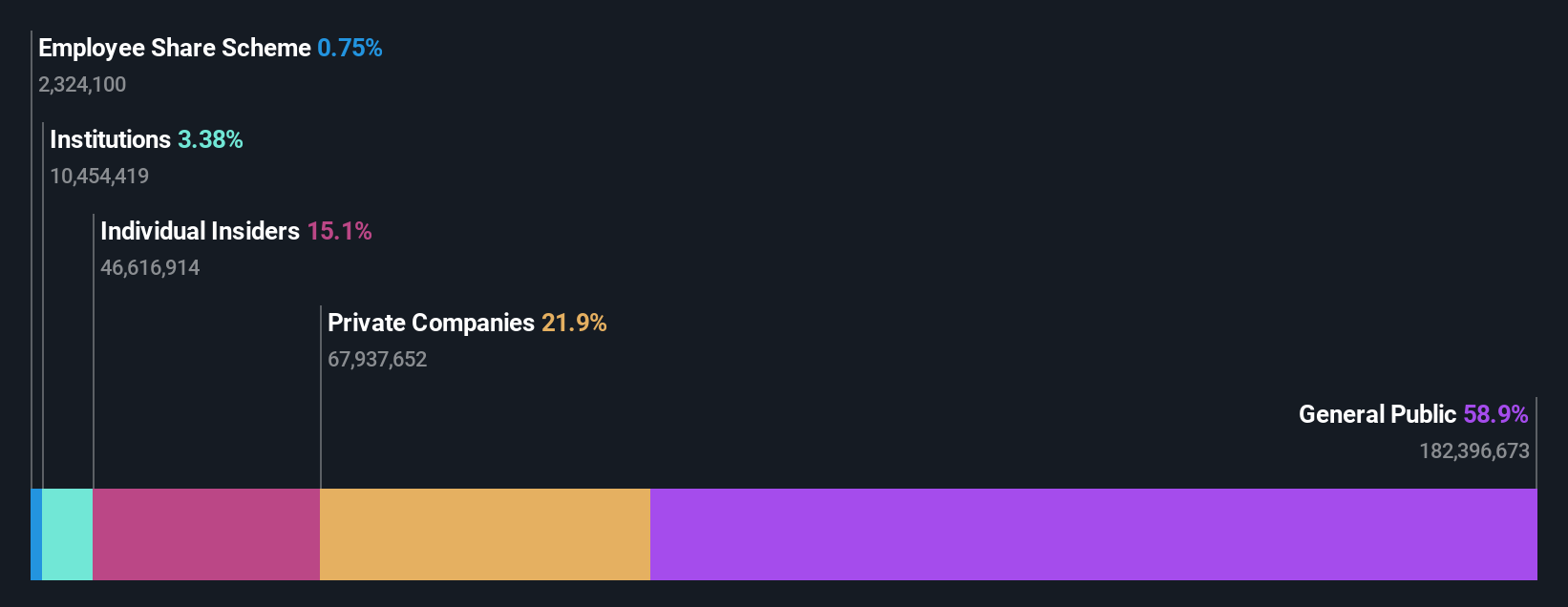

Insider Ownership: 15.1%

Revenue Growth Forecast: 26.6% p.a.

Shanghai Sinyang Semiconductor Materials has demonstrated solid revenue growth, with sales reaching CNY 657.42 million for the first half of 2024, up from CNY 548.05 million the previous year. However, net income declined to CNY 58.9 million from CNY 86.81 million. Despite this dip in profitability, earnings are projected to grow at an impressive annual rate of over 35%, and revenue is expected to increase by more than 26% per year, significantly outpacing market averages.

- Take a closer look at Shanghai Sinyang Semiconductor Materials' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Shanghai Sinyang Semiconductor Materials is trading beyond its estimated value.

Semitronix (SZSE:301095)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Semitronix Corporation offers characterization and yield improvement solutions for the semiconductor industry both in China and internationally, with a market cap of CN¥9.81 billion.

Operations: Revenue Segments (in millions of CN¥): Characterization Solutions: 1,200; Yield Improvement: 800; International Operations: 500.

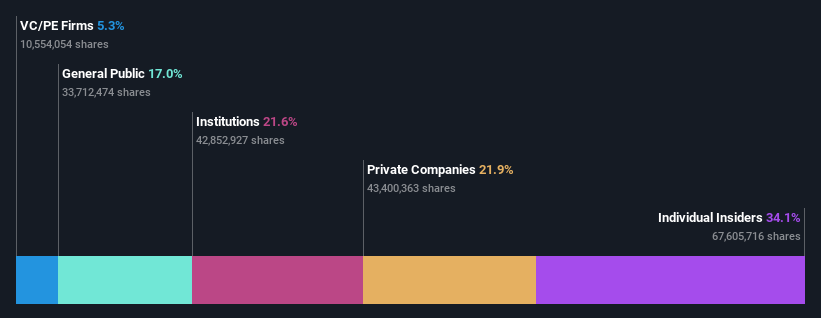

Insider Ownership: 34.1%

Revenue Growth Forecast: 35.4% p.a.

Semitronix has shown significant revenue growth, with sales increasing to CNY 171.66 million for the first half of 2024 from CNY 127.38 million a year earlier. Despite a decline in net income to CNY 2.54 million, earnings are forecasted to grow at over 43% annually, surpassing market averages. The company completed a share buyback worth CNY 86.89 million, reflecting strong insider confidence despite reduced profit margins and low return on equity forecasts.

- Click here to discover the nuances of Semitronix with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Semitronix is priced higher than what may be justified by its financials.

Next Steps

- Click through to start exploring the rest of the 378 Fast Growing Chinese Companies With High Insider Ownership now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Vazyme Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688105

Nanjing Vazyme Biotech

Offers technology solutions for life science, biomedicine, and in vitro diagnostics.

High growth potential with adequate balance sheet.