- China

- /

- Electronic Equipment and Components

- /

- SZSE:300007

High Growth Tech Stocks in Asia for July 2025

Reviewed by Simply Wall St

Amidst a backdrop of muted global market reactions to new U.S. tariffs and mixed economic signals, Asian markets have shown resilience, with Chinese indices rising on hopes for further stimulus measures. In this environment, identifying high-growth tech stocks in Asia involves looking for companies that can navigate trade tensions and leverage regional economic dynamics to drive innovation and expansion.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.41% | 29.66% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Fositek | 29.16% | 36.17% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 26.95% | 29.93% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Chinasoft International (SEHK:354)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chinasoft International Limited operates in the development and provision of IT solutions, IT outsourcing, and training services across several countries including China, the United States, Malaysia, Japan, Singapore, India, and Saudi Arabia with a market capitalization of approximately HK$14.32 billion.

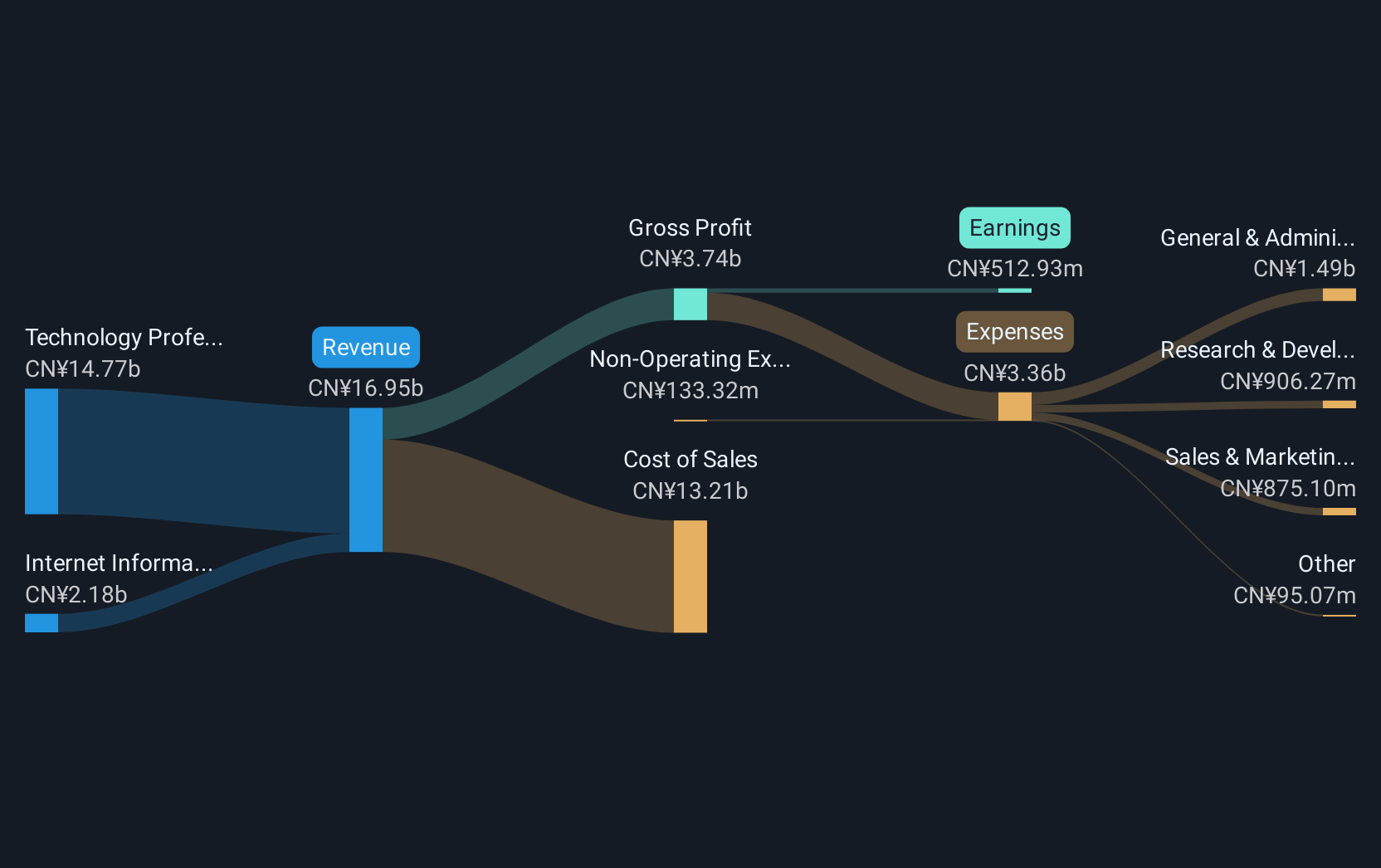

Operations: The company generates revenue primarily through its Technology Professional Services Group, contributing CN¥14.77 billion, and its Internet Information Technology Services Group, which adds CN¥2.18 billion.

Chinasoft International has demonstrated robust growth in the tech sector, notably with a 9.6% annual revenue increase and an impressive 20.5% rise in earnings per year, outpacing the Hong Kong market averages of 8.1% and 10.4%, respectively. The company's strategic focus on R&D is evident from its allocation of substantial resources; however, specific figures were not provided for this analysis. Recent strategic alliances, like the one with Beijing SiliconFlow Technology Co., underline Chinasoft’s commitment to enhancing enterprise digital transformations through advanced AI platforms and solutions, positioning it well for future industry demands despite broader market challenges.

Jinyu Bio-technology (SHSE:600201)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jinyu Bio-technology Co., Ltd. focuses on the research, development, production, and sale of veterinary products in China with a market capitalization of approximately CN¥10.65 billion.

Operations: The company operates in the veterinary sector, emphasizing research, development, and production of animal health products. With a market capitalization of around CN¥10.65 billion, it generates revenue primarily through the sale of these products within China.

Jinyu Bio-technology, amidst a challenging landscape, has managed to post a 14.3% annual revenue growth and an impressive 32.4% surge in earnings per annum, outstripping the broader Chinese market's averages of 12.5% and 23.4%, respectively. The company's dedication to innovation is underscored by its R&D spending trends which reveal strategic investments aimed at enhancing its competitive edge in biotechnology—a sector poised for significant advancements. Despite recent dips in dividends and a one-off gain of CN¥53.8M affecting financial outcomes, Jinyu’s robust growth metrics signal strong underlying business dynamics that could shape its trajectory in the high-growth tech arena of Asia.

- Get an in-depth perspective on Jinyu Bio-technology's performance by reading our health report here.

Hanwei Electronics Group (SZSE:300007)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hanwei Electronics Group Corporation, along with its subsidiaries, specializes in providing gas sensors and instruments both in China and internationally, with a market capitalization of CN¥14.32 billion.

Operations: The company focuses on the production and distribution of gas sensors and instruments, catering to both domestic and international markets. It operates with a market capitalization of CN¥14.32 billion, emphasizing its significant presence in the industry.

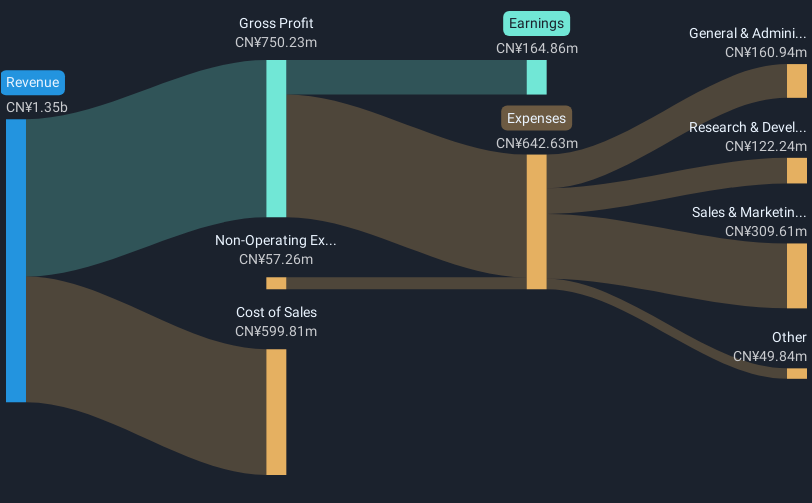

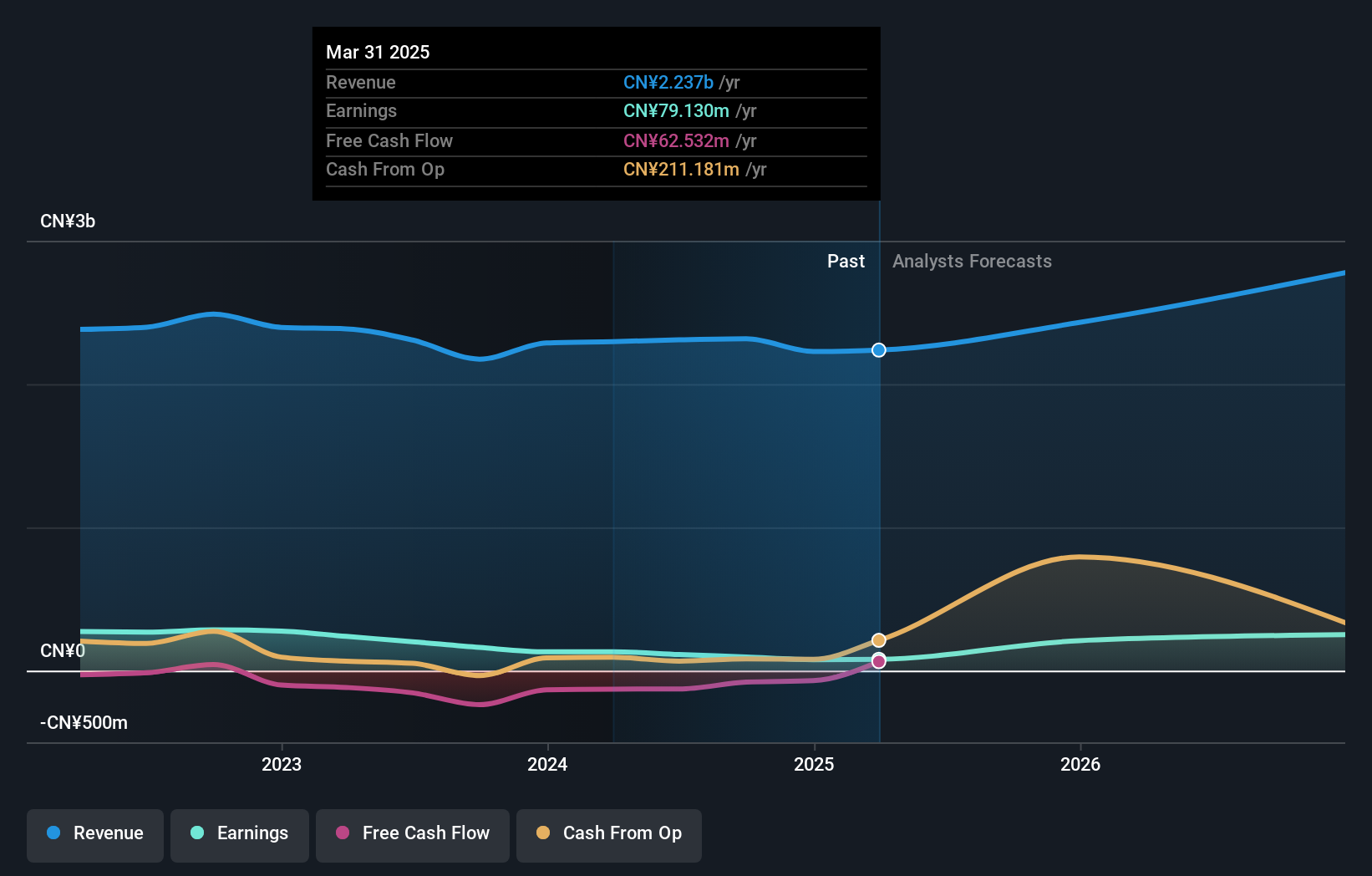

Hanwei Electronics Group has demonstrated resilience in a competitive market, with a notable 1.5% increase in quarterly sales, reaching CNY 602.57 million, and a growth in net income to CNY 16.94 million from the previous year's CNY 14.49 million. This performance is underpinned by an impressive forecast of annual earnings growth at 52.9%, significantly outpacing the broader Chinese market's average of 23.4%. Despite recent adjustments in dividend payouts, Hanwei’s strategic focus on enhancing shareholder value and its robust financial health suggest promising prospects for its role in Asia’s tech sector.

Turning Ideas Into Actions

- Embark on your investment journey to our 478 Asian High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanwei Electronics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300007

Hanwei Electronics Group

Provides gas sensors and instruments in China and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success