After Leaping 28% Guangzhou Frontop Digital Creative Technology Corporation (SZSE:301313) Shares Are Not Flying Under The Radar

Despite an already strong run, Guangzhou Frontop Digital Creative Technology Corporation (SZSE:301313) shares have been powering on, with a gain of 28% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

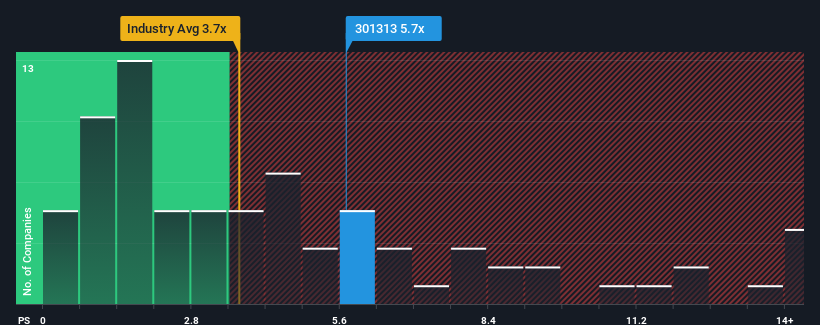

Following the firm bounce in price, given around half the companies in China's Media industry have price-to-sales ratios (or "P/S") below 3.7x, you may consider Guangzhou Frontop Digital Creative Technology as a stock to avoid entirely with its 5.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Guangzhou Frontop Digital Creative Technology

How Has Guangzhou Frontop Digital Creative Technology Performed Recently?

Guangzhou Frontop Digital Creative Technology certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Guangzhou Frontop Digital Creative Technology will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Guangzhou Frontop Digital Creative Technology's to be considered reasonable.

Retrospectively, the last year delivered a decent 4.0% gain to the company's revenues. Still, lamentably revenue has fallen 25% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 75% over the next year. That's shaping up to be materially higher than the 13% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Guangzhou Frontop Digital Creative Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Guangzhou Frontop Digital Creative Technology's P/S

Shares in Guangzhou Frontop Digital Creative Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Guangzhou Frontop Digital Creative Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Guangzhou Frontop Digital Creative Technology (1 is a bit unpleasant!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301313

Guangzhou Frontop Digital Creative Technology

Engages in the exploration and research of digital multimedia display services and technology in China and internationally.

Mediocre balance sheet minimal.

Market Insights

Community Narratives