Asian Growth Stocks With Insider Ownership Expecting Up To 87% Earnings Growth

Reviewed by Simply Wall St

Amidst global market fluctuations and concerns over AI-related stock valuations, Asian markets are navigating their own set of challenges, with investor sentiment being shaped by both regional economic policies and broader macroeconomic trends. In this environment, growth companies with high insider ownership can offer unique insights into potential earnings expansion, as insiders often have a vested interest in the long-term success of their firms.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.9% | 54.1% |

| UTI (KOSDAQ:A179900) | 25.2% | 110.4% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 79.4% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 31.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's review some notable picks from our screened stocks.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Seojin System Co., Ltd specializes in providing telecom equipment, repeaters, mechanical products, and LED and other equipment, with a market cap of ₩1.40 trillion.

Operations: The company generates revenue from its EMS Sector, which contributes ₩1.30 billion, and the Semiconductor Sector, providing ₩243.34 million.

Insider Ownership: 32.4%

Earnings Growth Forecast: 87.7% p.a.

Seojin System Ltd is poised for significant growth with earnings expected to rise by 87.67% annually and revenue forecasted to grow at 28% per year, outpacing the Korean market's average. Despite this, interest payments are not well covered by earnings, and Return on Equity is projected to be modest at 16.5%. The company recently announced a share repurchase program aimed at enhancing shareholder value, reflecting confidence in its valuation potential amidst analyst consensus of a price increase.

- Delve into the full analysis future growth report here for a deeper understanding of Seojin SystemLtd.

- The valuation report we've compiled suggests that Seojin SystemLtd's current price could be quite moderate.

Hangzhou Onechance Tech Crop (SZSE:300792)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou Onechance Tech Crop. specializes in brand online marketing and management services with a market cap of CN¥7.60 billion.

Operations: The company's revenue segment includes CN¥1.12 billion from advertising services.

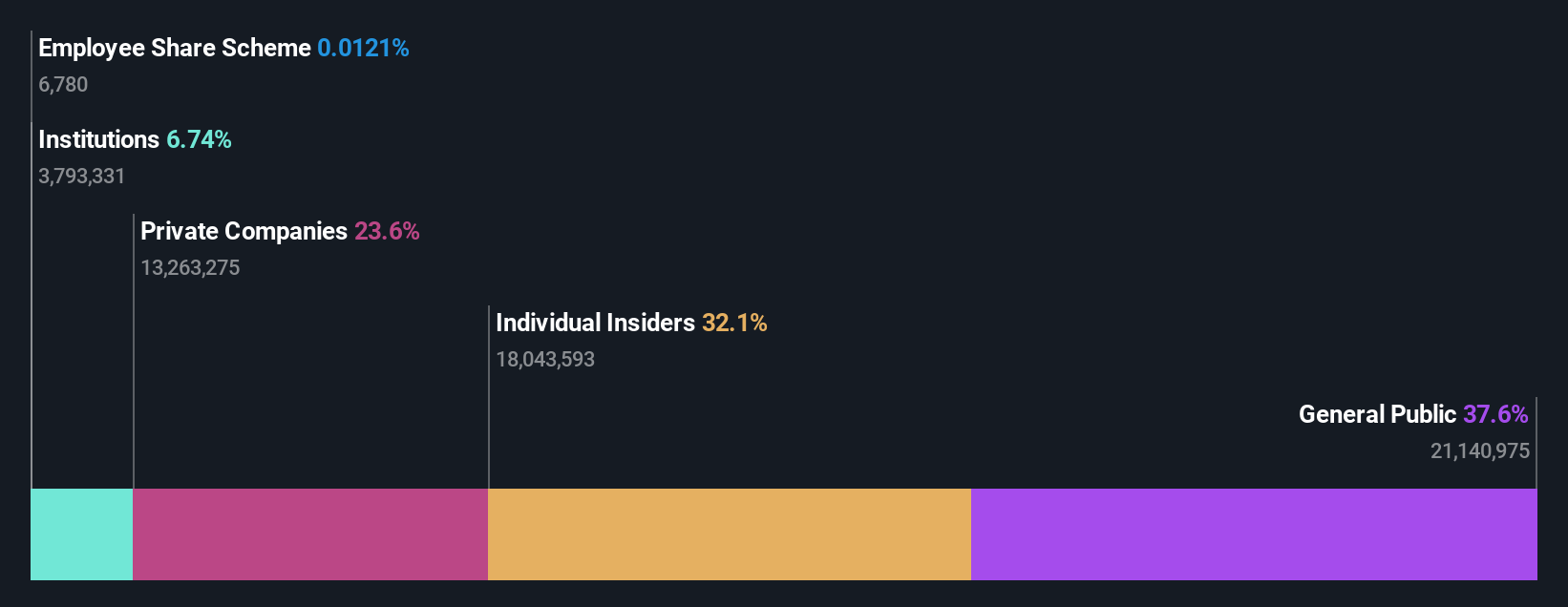

Insider Ownership: 20.6%

Earnings Growth Forecast: 32.2% p.a.

Hangzhou Onechance Tech Crop. is set for significant earnings growth at 32.24% annually, surpassing the Chinese market's average, although revenue growth is slower at 15.6%. Despite recent volatility in share price and low forecasted Return on Equity of 5.6%, the company trades below its estimated fair value by 31.5%. Recent earnings reports show stable net income despite declining sales, with amendments to the company's articles of association indicating strategic shifts underway.

- Click here and access our complete growth analysis report to understand the dynamics of Hangzhou Onechance Tech Crop.

- Upon reviewing our latest valuation report, Hangzhou Onechance Tech Crop's share price might be too pessimistic.

PARK24 (TSE:4666)

Simply Wall St Growth Rating: ★★★★☆☆

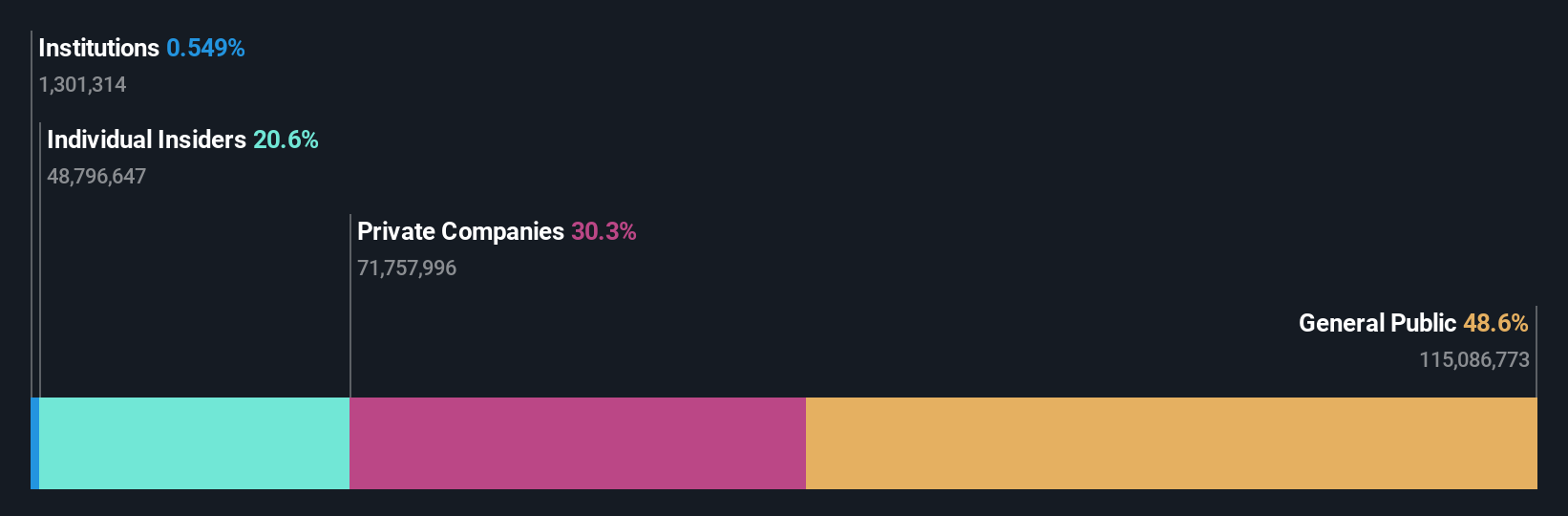

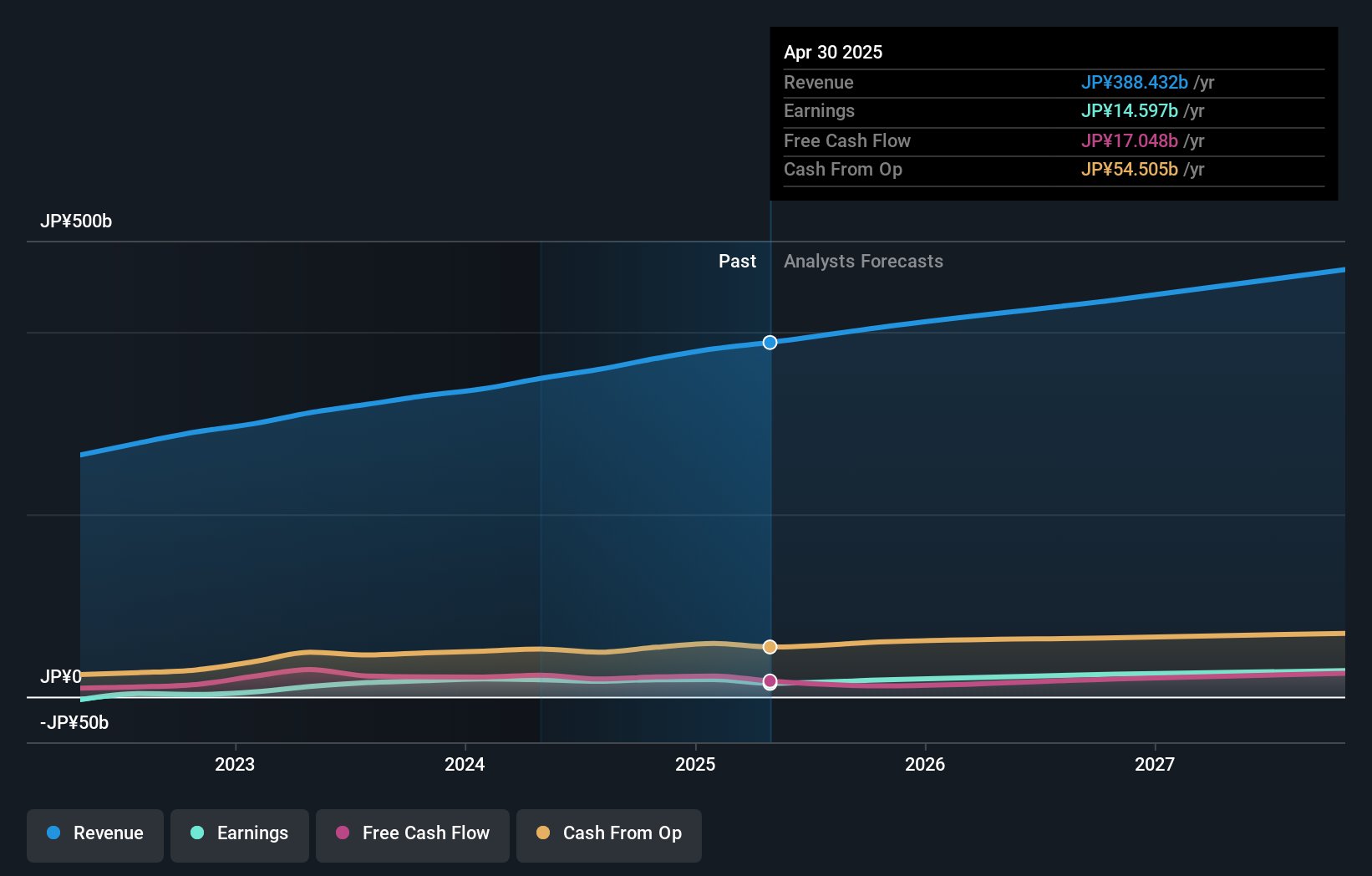

Overview: PARK24 Co., Ltd., along with its subsidiaries, operates and manages parking sites in Japan, the United Kingdom, and internationally, with a market cap of ¥308.65 billion.

Operations: The company's revenue segments consist of the Mobility Business generating ¥123.93 million, Parking Business Japan contributing ¥195.10 million, and Parking Business International adding ¥84.52 million.

Insider Ownership: 10.4%

Earnings Growth Forecast: 18.7% p.a.

PARK24 is poised for robust earnings growth at 18.7% annually, outpacing the Japanese market's average, although revenue growth remains moderate at 6.2%. The company recently resolved to secure JPY 34 billion in long-term borrowings to fund its expansion into a mobility services platform under its FY2027 plan. Despite high debt levels, insider ownership supports strategic initiatives aimed at enhancing service networks and operational capabilities across its core business areas.

- Unlock comprehensive insights into our analysis of PARK24 stock in this growth report.

- Our comprehensive valuation report raises the possibility that PARK24 is priced higher than what may be justified by its financials.

Summing It All Up

- Access the full spectrum of 638 Fast Growing Asian Companies With High Insider Ownership by clicking on this link.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Onechance Tech Crop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300792

Hangzhou Onechance Tech Crop

Provides brand online marketing and management services.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success