In the wake of a turbulent week for global markets, marked by AI competition fears and fluctuating corporate earnings, the Nasdaq Composite experienced significant volatility while other indices showed mixed performance. As investors navigate these uncertain times, identifying high growth tech stocks that can withstand competitive pressures and deliver robust financial results becomes crucial for those seeking opportunities in this dynamic sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1230 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Guangdong Aofei Data Technology (SZSE:300738)

Simply Wall St Growth Rating: ★★★★☆☆

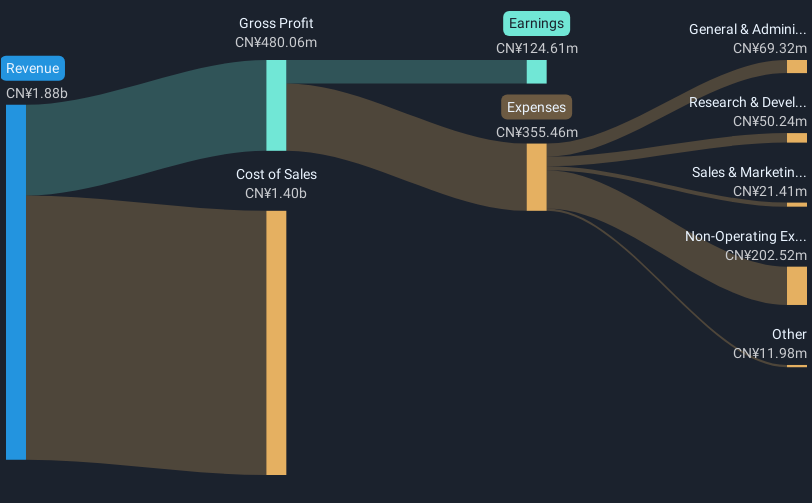

Overview: Guangdong Aofei Data Technology Co., Ltd. operates in the data technology sector and has a market capitalization of CN¥12.67 billion.

Operations: Guangdong Aofei Data Technology Co., Ltd. focuses on the data technology sector, generating revenue through various specialized services and solutions. The company strategically allocates resources to optimize its operations within this industry, aiming to leverage technological advancements for growth.

Guangdong Aofei Data Technology, despite a challenging year with a profit decline to 6.6% from 13.5%, shows promising growth prospects with expected revenue and earnings growth at 16.1% and 32% per annum respectively, outpacing the Chinese market averages of 13.3% for revenue and 25% for earnings growth. The company's significant investment in R&D could be a pivotal factor in maintaining its competitive edge in the tech sector, especially given its strategic focus on expanding through capital increases and controlled subsidiary developments as discussed in their recent shareholders meeting. This approach might bolster future performance, although current financial leverage concerns due to poorly covered interest payments suggest caution.

Beijing Zhidemai Technology (SZSE:300785)

Simply Wall St Growth Rating: ★★★★☆☆

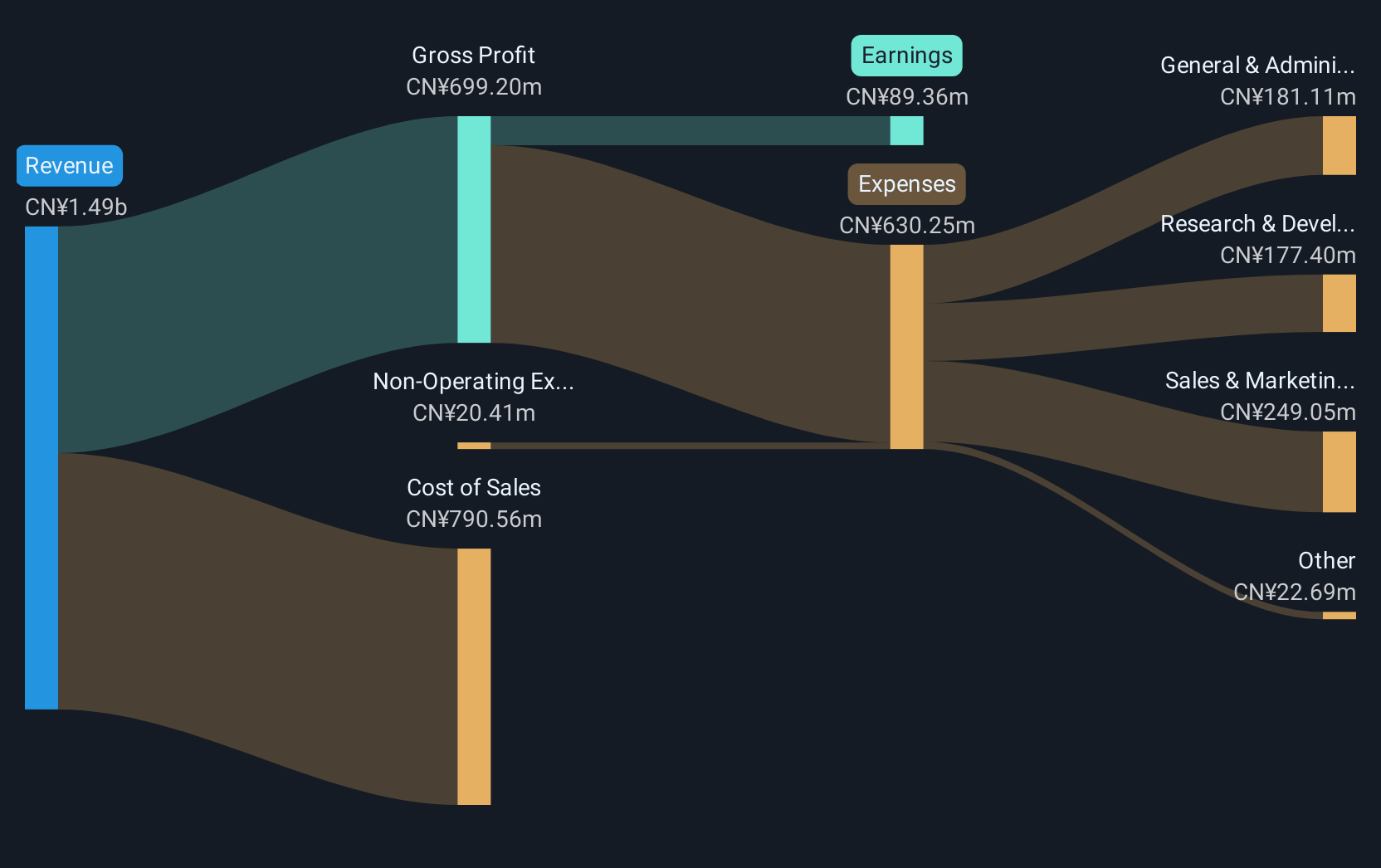

Overview: Beijing Zhidemai Technology Co., Ltd. is involved in Internet information promotion activities both in China and internationally, with a market cap of CN¥7.49 billion.

Operations: Zhidemai focuses on internet information promotion, leveraging digital platforms to reach audiences in China and abroad. The company generates revenue primarily through online advertising and related services.

Beijing Zhidemai Technology, despite its recent challenges with a negative earnings growth of -11.2% last year, is set for a rebound with projected annual earnings increases of 39.5%. This growth rate surpasses the broader Chinese market's expectation of 25% per annum. The firm's commitment to innovation is evident from its significant R&D investments, which are crucial for maintaining competitiveness in the interactive media and services sector. Moreover, an upcoming special shareholders meeting on December 27, 2024, aims to amend corporate governance structures and enhance senior management accountability through new insurance policies. These strategic initiatives could strengthen the company’s operational framework and bolster future financial performance amidst a highly volatile share price environment.

AcrobiosystemsLtd (SZSE:301080)

Simply Wall St Growth Rating: ★★★★☆☆

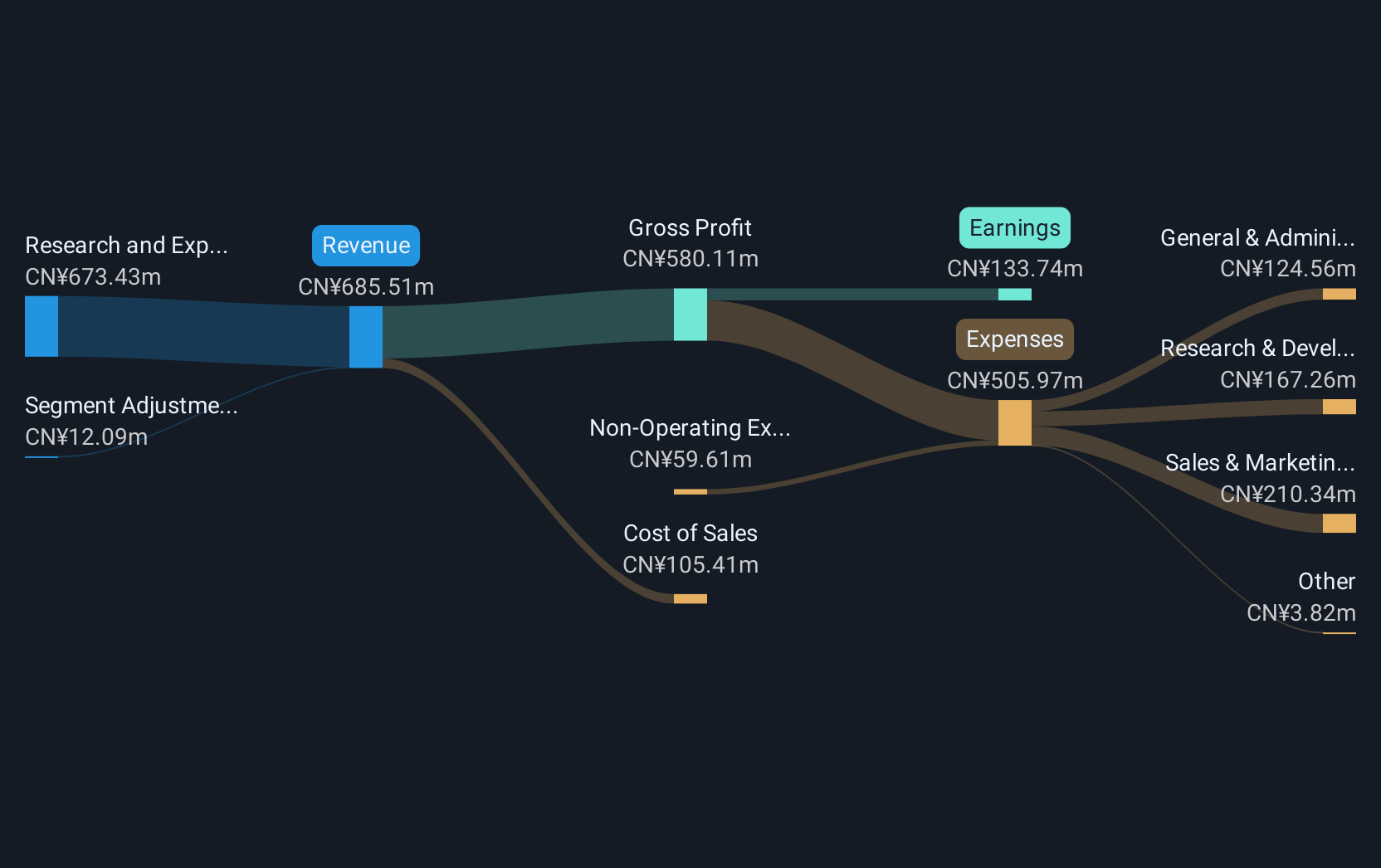

Overview: Acrobiosystems Co., Ltd. specializes in developing and manufacturing recombinant proteins, antibodies, and other biological reagents for pharmaceutical and biotechnology companies as well as scientific research institutions, with a market cap of CN¥5.86 billion.

Operations: Acrobiosystems Co., Ltd. generates revenue primarily from its Research and Experimental Development segment, contributing CN¥583.70 million. The company focuses on providing recombinant proteins, antibodies, and biological reagents tailored for the pharmaceutical and biotechnology sectors and research institutions.

Acrobiosystems Co.,Ltd. has demonstrated a robust commitment to shareholder value through recent actions, including a consistent dividend payout and strategic share buybacks, repurchasing 133,100 shares for CNY 6 million in the last quarter of 2024. Despite facing challenges with a -34.4% earnings growth over the past year, the company is poised for recovery with an anticipated earnings growth of 29.5% per annum, outpacing the broader Chinese market's expectation by over 4%. This rebound is supported by substantial investments in R&D aimed at fostering innovation within its biotech segment—critical as it competes in a rapidly evolving industry where annual revenue growth is expected to surpass market averages at 18.9%.

Summing It All Up

- Embark on your investment journey to our 1230 High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301080

AcrobiosystemsLtd

Engages in the development and manufacture of recombinant proteins, antibodies, and other biological reagents for pharmaceutical and biotechnology companies, and scientific research institutions.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success