- China

- /

- Interactive Media and Services

- /

- SZSE:300785

Exploring Three High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainties, the tech-heavy Nasdaq Composite has experienced notable losses, reflecting broader apprehensions about whether the substantial investments in AI will yield sufficient returns. In such a volatile environment, identifying high-growth tech stocks requires careful consideration of their potential to innovate and adapt within rapidly evolving sectors.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Pharma Mar | 21.68% | 41.50% | ★★★★★★ |

| Gold Circuit Electronics | 27.07% | 32.59% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 35.29% | 50.71% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Seegene (KOSDAQ:A096530)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Seegene, Inc. is a global manufacturer and seller of molecular diagnostics products with a market cap of ₩1.16 trillion.

Operations: Seegene, Inc. focuses on the global production and distribution of molecular diagnostics products.

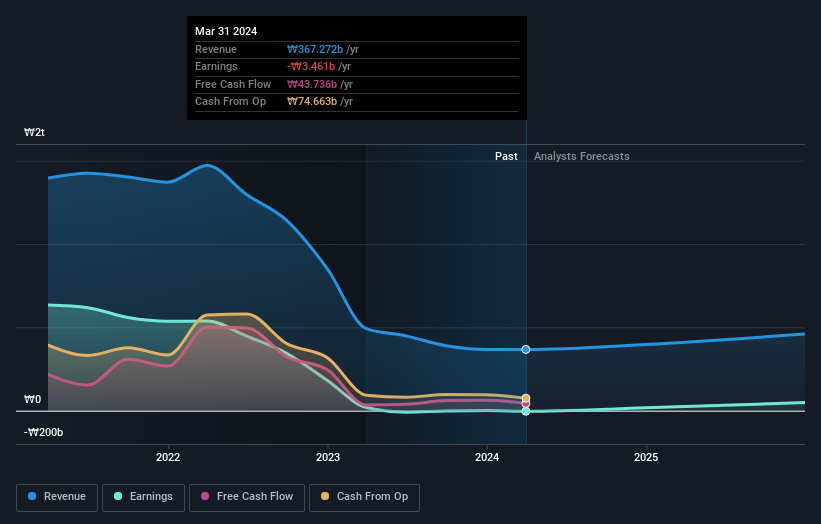

Seegene has demonstrated a robust trajectory in its financial performance, with a notable increase in quarterly sales to KRW 113.54 billion and an impressive surge in net income to KRW 14.56 billion, up from KRW 1.67 billion year-over-year. This growth is underpinned by an annual revenue increase of 13%, outpacing the Korean market's average of 10.3%. Despite currently being unprofitable, Seegene is on a path to profitability within three years, supported by a projected earnings growth of 67.27% per annum and positive free cash flow dynamics. These figures reflect not only Seegene’s resilience but also its potential to capitalize on future market opportunities, positioning it well within the high-growth tech landscape.

- Unlock comprehensive insights into our analysis of Seegene stock in this health report.

Explore historical data to track Seegene's performance over time in our Past section.

Beijing Zhidemai Technology (SZSE:300785)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Zhidemai Technology Co., Ltd. operates in the Internet marketing and data service sectors both within China and internationally, with a market cap of CN¥9.74 billion.

Operations: Zhidemai Technology focuses on Internet marketing and data services, generating revenue from these sectors both domestically and abroad. The company has a market capitalization of CN¥9.74 billion, reflecting its presence in the industry.

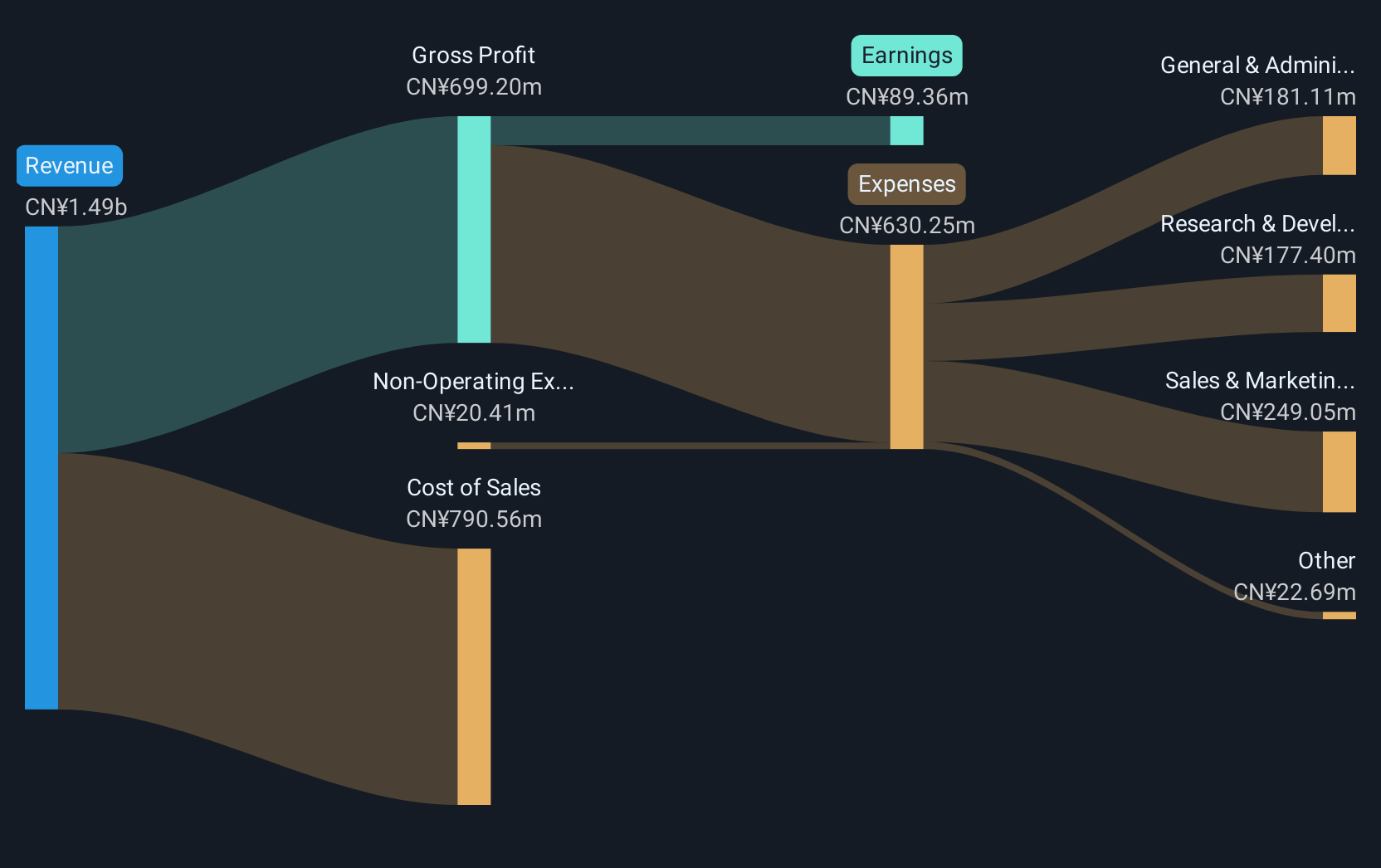

Beijing Zhidemai Technology has shown a promising trajectory with its recent earnings report indicating a substantial rise in net income to CNY 13.45 million from CNY 3.8 million year-over-year, reflecting an impressive growth rate of over 250%. This performance is bolstered by the company's commitment to innovation, as evidenced by its R&D investments aligning with industry trends towards enhanced digital services. With revenue climbing at an annual rate of 24.3%, outpacing the Chinese market average of 14.5%, and earnings projected to grow by nearly 29% annually, Beijing Zhidemai is positioning itself as a resilient contender in the tech sector despite market volatilities and upcoming changes in its corporate governance structure scheduled for discussion in December's EGM.

- Click here and access our complete health analysis report to understand the dynamics of Beijing Zhidemai Technology.

Understand Beijing Zhidemai Technology's track record by examining our Past report.

ASROCK Incorporation (TWSE:3515)

Simply Wall St Growth Rating: ★★★★★★

Overview: ASROCK Incorporation designs, develops, and sells motherboards across Asia, Europe, America, and internationally with a market capitalization of NT$31.20 billion.

Operations: The company generates revenue primarily from the sale of motherboards, contributing NT$43.34 billion to its revenue stream.

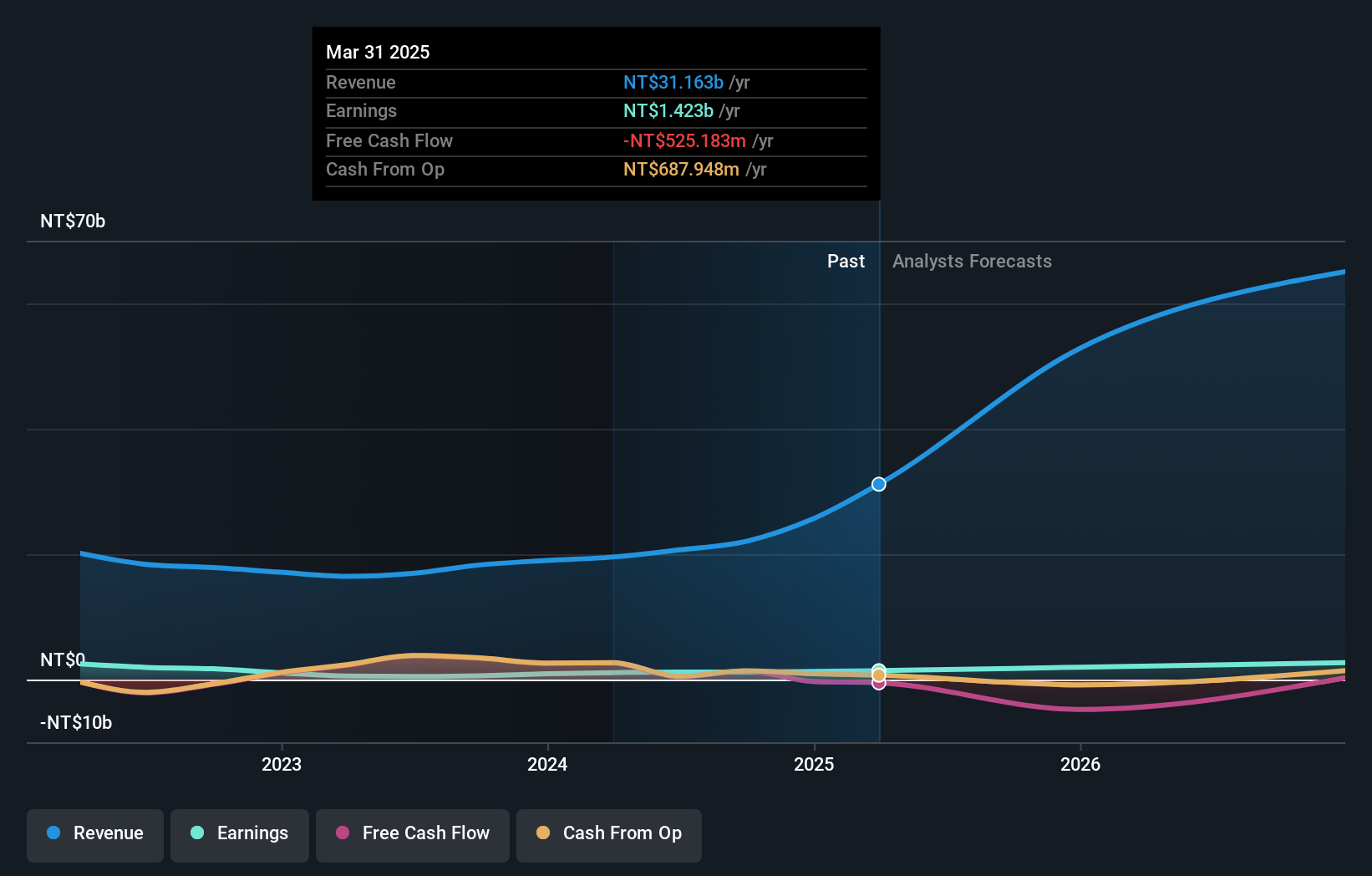

ASROCK Incorporation has demonstrated robust growth, with recent earnings showing a substantial increase in sales to TWD 11,644.79 million from TWD 6,266.03 million year-over-year for Q3 2025, and net income rising to TWD 538.12 million from TWD 305.04 million in the same period. This performance is underpinned by a significant annualized earnings growth rate of 31.7% and revenue growth at an impressive rate of 29.3% per year, outstripping the broader Taiwanese market's average of 13.6%. The company's strategic focus on R&D aligns with its commitment to maintaining a competitive edge in the tech industry, positioning it well for sustained future growth amidst volatile market conditions.

Turning Ideas Into Actions

- Dive into all 253 of the Global High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Zhidemai Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300785

Beijing Zhidemai Technology

Engages in the Internet marketing and data service-related businesses in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success