Market Might Still Lack Some Conviction On Xiamen Jihong Technology Co., Ltd. (SZSE:002803) Even After 28% Share Price Boost

Those holding Xiamen Jihong Technology Co., Ltd. (SZSE:002803) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.5% in the last twelve months.

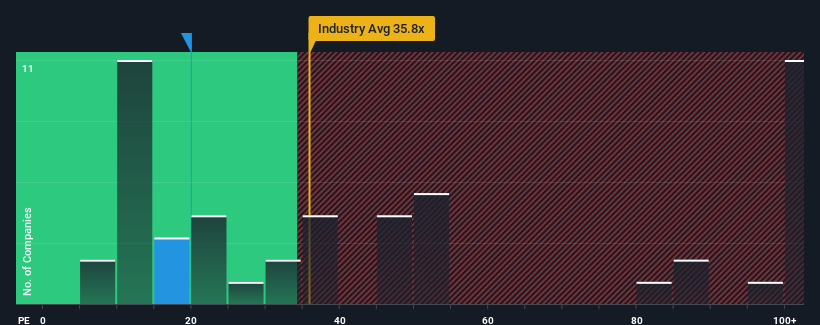

Even after such a large jump in price, Xiamen Jihong Technology's price-to-earnings (or "P/E") ratio of 19.9x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Xiamen Jihong Technology has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Xiamen Jihong Technology

Is There Any Growth For Xiamen Jihong Technology?

There's an inherent assumption that a company should underperform the market for P/E ratios like Xiamen Jihong Technology's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 72% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 43% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 63% as estimated by the only analyst watching the company. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we find it odd that Xiamen Jihong Technology is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Xiamen Jihong Technology's P/E

Despite Xiamen Jihong Technology's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Xiamen Jihong Technology's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Xiamen Jihong Technology that you should be aware of.

Of course, you might also be able to find a better stock than Xiamen Jihong Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002803

Xiamen Jihong

Engages in the cross-border social e-commerce and paper packaging solutions business.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives