Stock Analysis

- China

- /

- Entertainment

- /

- SZSE:002739

High Growth Tech Stocks To Watch In October 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and a cautious Federal Reserve rate-cutting outlook, small-cap stocks have faced particular challenges, with large-caps and growth stocks showing relative resilience. In this environment, identifying high-growth tech stocks that can capitalize on innovation while weathering macroeconomic pressures is crucial for investors seeking opportunities in an evolving market landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Yangtze Optical Electronic (SHSE:688143)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yangtze Optical Electronic Co., Ltd. is involved in the R&D, production, and sale of optical fibers and cables, photoelectric systems, special optical devices, new materials, high-end equipment, and optoelectronic systems in China with a market cap of CN¥2.78 billion.

Operations: Yangtze Optical Electronic focuses on producing and selling specialized optical fibers, cables, and photoelectric systems. The company also develops high-end equipment and optoelectronic systems within China.

Yangtze Optical Electronic, amidst a challenging market, has demonstrated notable agility in its financial strategies and R&D commitments. With an impressive 47% forecasted annual revenue growth rate outpacing the broader Chinese market's 13.9%, the company is positioned for dynamic expansion. Additionally, earnings are expected to surge by 71.4% annually, reflecting robust operational efficiency and market demand for their products. However, recent financials reveal a dip with a net loss reported in the latest nine-month period compared to profits last year, underscoring potential volatility and execution risks. Despite this setback, Yangtze's aggressive share repurchase program—completing buybacks worth CNY 11.21 million—signals confidence from management in the firm’s value proposition and strategic direction moving forward.

- Unlock comprehensive insights into our analysis of Yangtze Optical Electronic stock in this health report.

Understand Yangtze Optical Electronic's track record by examining our Past report.

Wanda Film Holding (SZSE:002739)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wanda Film Holding Co., Ltd. is involved in the investment, construction, and operation of movie theaters across China, Australia, and New Zealand with a market cap of CN¥25.80 billion.

Operations: Wanda Film Holding Co., Ltd. focuses on the investment, construction, and operation of movie theaters in China, Australia, and New Zealand. The company generates revenue primarily through box office sales and related cinema operations.

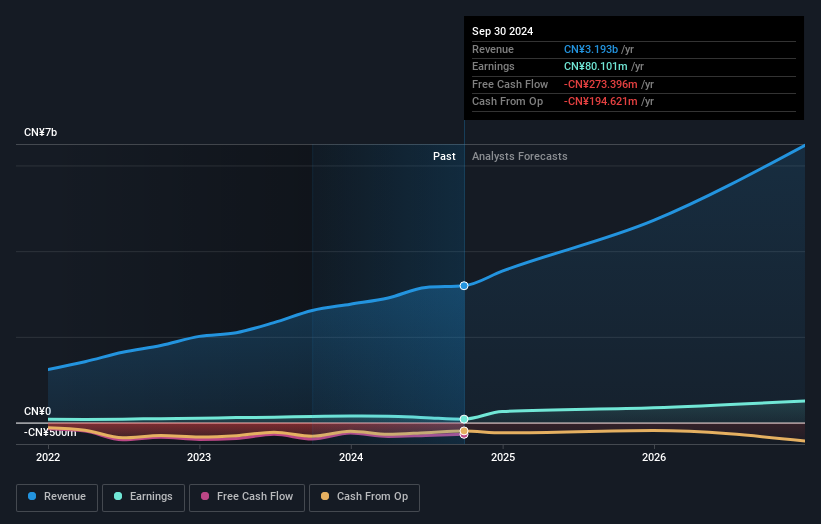

Wanda Film Holding has navigated a challenging landscape with its recent financial performance reflecting a mix of resilience and areas for improvement. Despite a downturn in net income from CNY 1.11 billion last year to CNY 168.69 million, the company's commitment to innovation is evident in its R&D investments, aligning with an industry trend towards enhanced digital and cinematic technologies. The firm's revenue trajectory, growing at 16.3% annually, outpaces the broader Chinese market growth rate of 13.9%, showcasing potential amidst adversity. Moreover, an aggressive forecast suggests earnings could soar by approximately 84.5% annually, positioning Wanda Film potentially as a rebound candidate as it adapts to evolving entertainment consumption patterns and invests in future capabilities.

- Click here and access our complete health analysis report to understand the dynamics of Wanda Film Holding.

Gain insights into Wanda Film Holding's past trends and performance with our Past report.

Suzhou YourBest New-type MaterialsLtd (SZSE:301266)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou YourBest New-type Materials Co. Ltd. operates in the materials industry and has a market capitalization of CN¥4.05 billion.

Operations: Suzhou YourBest New-type Materials Co. Ltd. specializes in the materials industry, focusing on diverse revenue streams within this sector. The company leverages its expertise to cater to various market demands, strategically positioning itself within the industry landscape.

Suzhou YourBest New-type Materials Ltd. demonstrates a dynamic growth trajectory with a reported revenue increase of 21% year-over-year, reaching CNY 2.48 billion. Despite a challenging environment marked by a net income drop to CNY 46.42 million, the firm's commitment to innovation is underscored by substantial R&D investments, which align with the broader trend of tech firms intensifying their development efforts to stay competitive. Notably, the company's revenue growth forecast stands at an impressive 31.1% annually, significantly outpacing the CN market average of 13.9%, while earnings are expected to surge by 55.8% per year, highlighting its potential amidst sector volatility and reinforcing its position in high-growth tech sectors through strategic initiatives like the recent equity incentive plan aimed at bolstering long-term growth and employee alignment with corporate objectives.

Summing It All Up

- Discover the full array of 1282 High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wanda Film Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002739

Wanda Film Holding

Engages in the investment, construction, and operation of movie theaters in China, Australia, and New Zealand.