High Growth Tech Stocks to Watch in China This September 2024

Reviewed by Simply Wall St

As global markets react to the recent Federal Reserve rate cut, Chinese equities have shown resilience, with key indices like the Shanghai Composite and CSI 300 posting gains despite mixed economic data. This environment of cautious optimism presents an opportune moment to explore high-growth tech stocks in China, particularly those that demonstrate strong fundamentals and potential for innovation amidst evolving market conditions.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.61% | 31.67% | ★★★★★★ |

| Zhongji Innolight | 32.37% | 31.70% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| T&S CommunicationsLtd | 34.68% | 39.62% | ★★★★★★ |

| Eoptolink Technology | 43.76% | 42.52% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 40.13% | 103.97% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

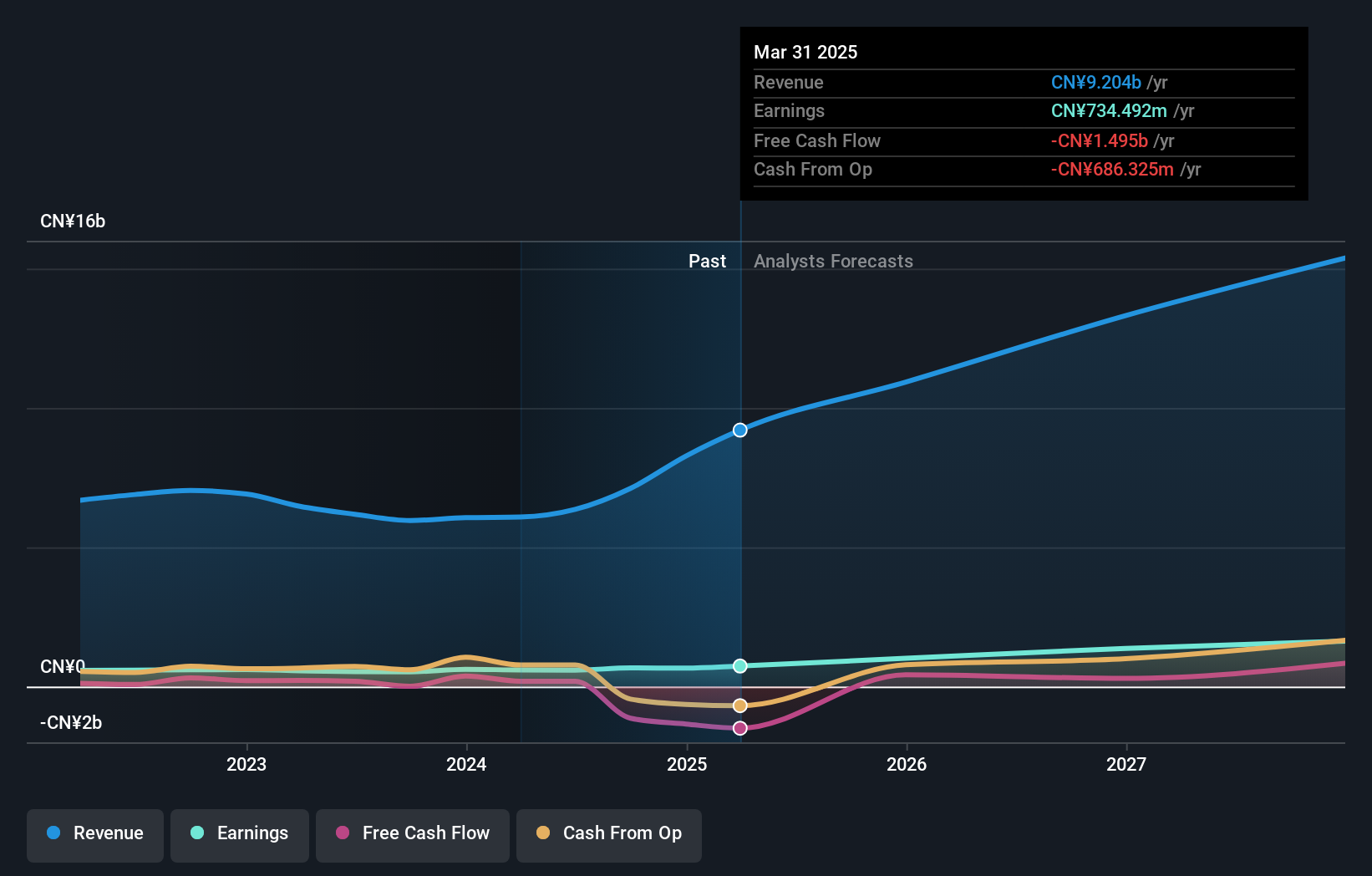

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Accelink Technologies Co., Ltd. engages in the research, development, manufacturing, sales, and technical services of optoelectronic chips, devices, modules, and subsystem products primarily in China with a market cap of CN¥23.16 billion.

Operations: Accelink Technologies Co., Ltd. focuses on the communication equipment manufacturing sector, generating CN¥6.35 billion in revenue from this segment. The company operates primarily within China, offering a range of optoelectronic products and services.

Accelink Technologies CoLtd, recently added to the FTSE All-World Index, showcases robust growth prospects with a forecasted revenue increase of 24.4% per year, outpacing the Chinese market's 13% average. Despite a slight dip in net income from CNY 238.89 million to CNY 208.7 million in the first half of 2024, the company's commitment to innovation is evident in its R&D investments and active participation in global tech conferences like CIOE and ECOC. With earnings expected to surge by 28.6% annually over the next three years—surpassing broader market growth—Accelink is positioning itself as a dynamic contender within China's high-tech landscape, driven by strategic expansions and deepening industry engagements.

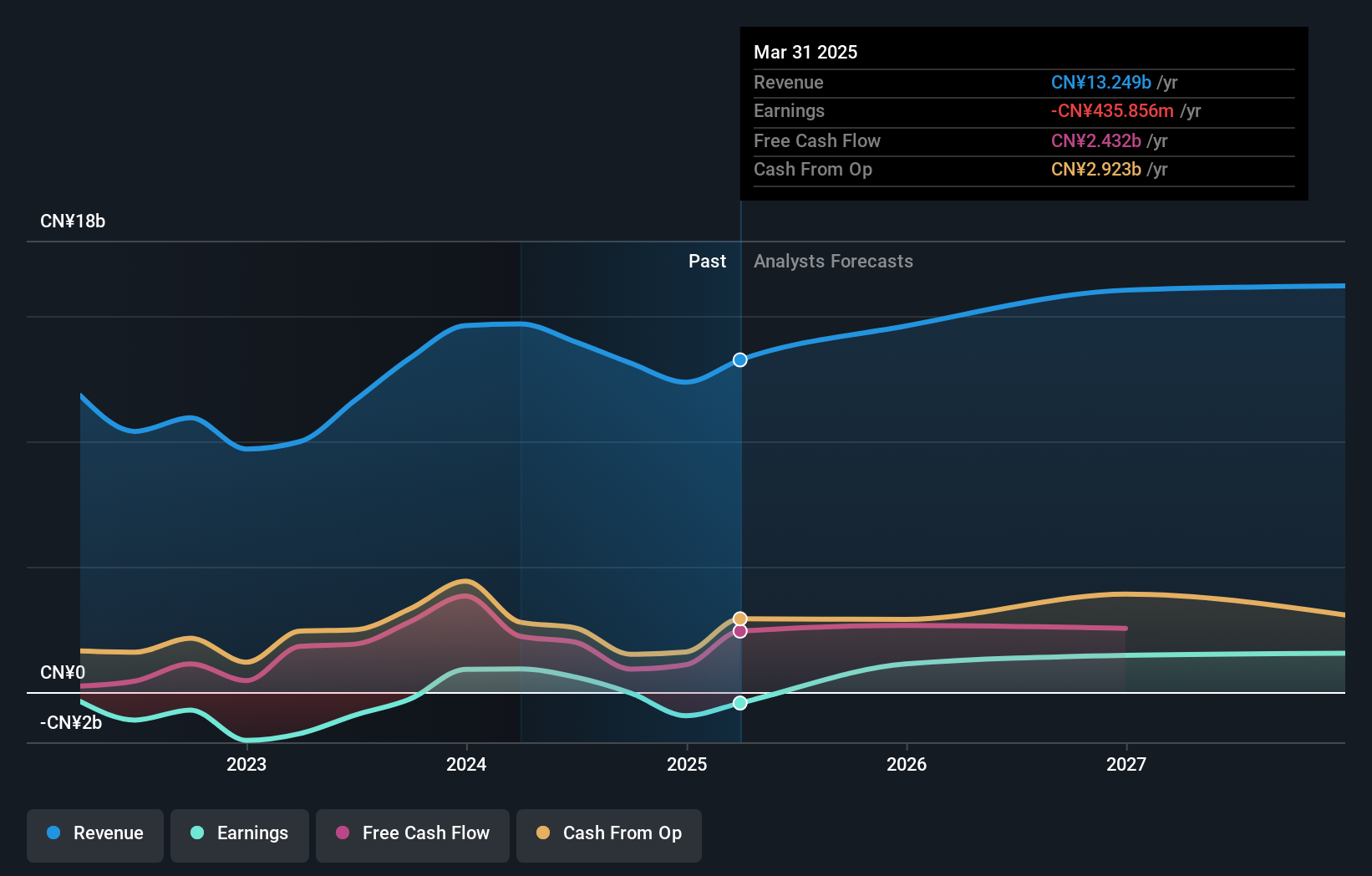

Wanda Film Holding (SZSE:002739)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wanda Film Holding Co., Ltd. engages in the investment, construction, and operation of movie theaters in China, Australia, and New Zealand with a market cap of CN¥22.99 billion.

Operations: Wanda Film Holding Co., Ltd. generates revenue primarily from the operation of movie theaters across China, Australia, and New Zealand. The company focuses on investment and construction activities to expand its theater network.

Wanda Film Holding, navigating a challenging landscape with its recent half-year sales dropping to CNY 5.1 billion from CNY 5.76 billion, still shows potential with an expected revenue growth of 13.1% annually. Despite a substantial dip in net income to CNY 113.39 million, the company's aggressive pursuit of innovation through R&D is set to bolster its market position, as earnings are projected to soar by an impressive 46.8% annually over the next three years. This focus on research and development not only underscores Wanda's commitment to evolving within China's tech scene but also positions it favorably against a backdrop of slower industry growth rates.

- Click here and access our complete health analysis report to understand the dynamics of Wanda Film Holding.

Assess Wanda Film Holding's past performance with our detailed historical performance reports.

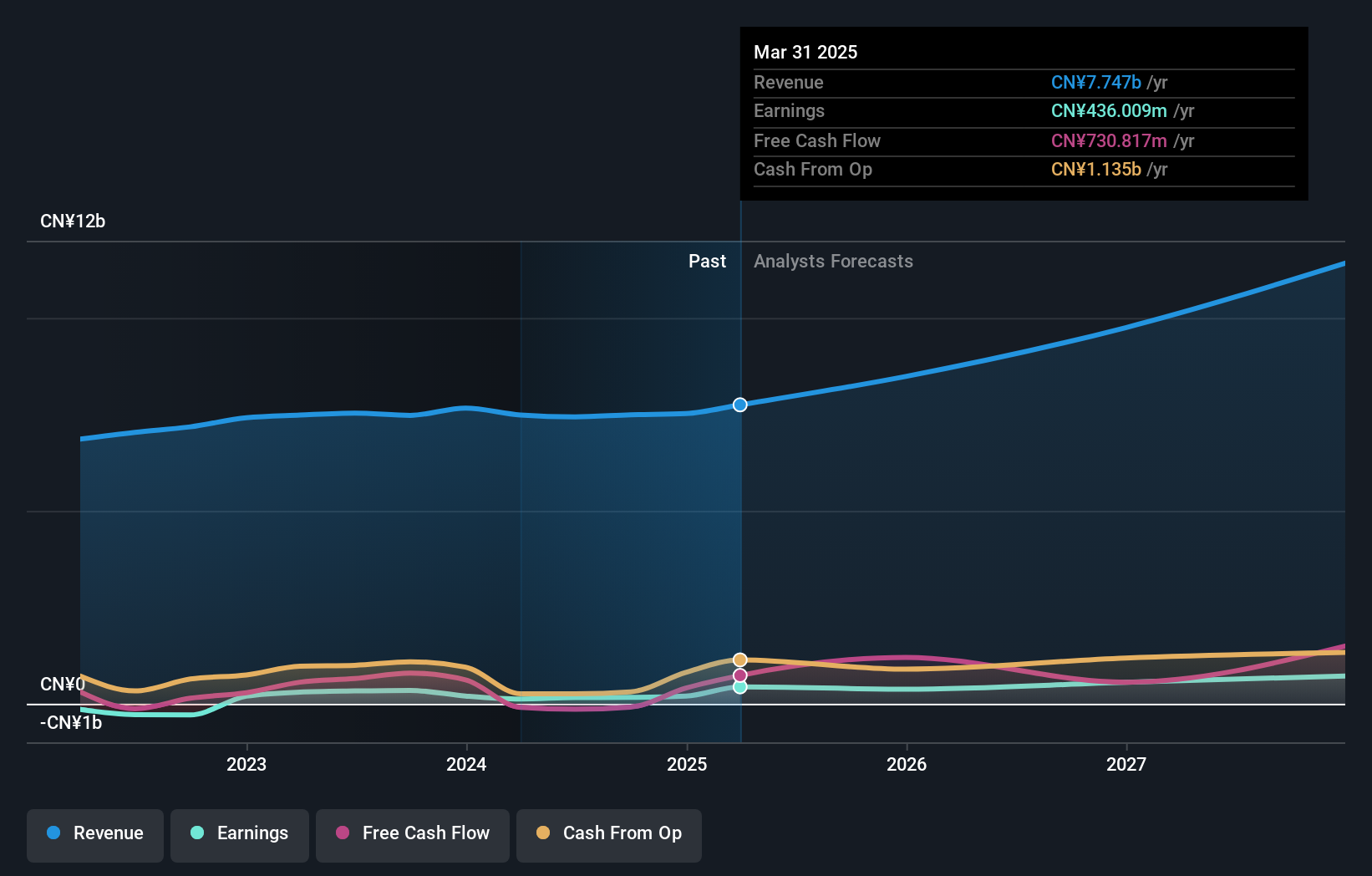

Sangfor Technologies (SZSE:300454)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sangfor Technologies Inc. offers IT infrastructure solutions both in China and internationally, with a market cap of CN¥20.30 billion.

Operations: Sangfor Technologies Inc. focuses on providing IT infrastructure solutions globally. The company generates revenue through its diverse product offerings, including network security, cloud computing, and IT services.

Sangfor Technologies, amidst a challenging financial backdrop with recent half-year sales at CNY 2.71 billion down from CNY 2.93 billion, still presents a dynamic growth outlook. The company's R&D commitment is robust, allocating significant resources despite a net loss widening to CNY 591.95 million from CNY 553.51 million year-over-year. This focus on innovation is crucial as Sangfor aims to outpace the average market growth in China, with revenue expected to increase by 14.4% annually and earnings projected to surge by an impressive 31.5% per year, showcasing its potential resilience and adaptability in the high-tech sector.

- Delve into the full analysis health report here for a deeper understanding of Sangfor Technologies.

Gain insights into Sangfor Technologies' past trends and performance with our Past report.

Taking Advantage

- Delve into our full catalog of 262 Chinese High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300454

Sangfor Technologies

Provides IT infrastructure solutions in China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives