- China

- /

- Entertainment

- /

- SZSE:002354

High Growth Tech Stocks to Watch in Asia April 2025

Reviewed by Simply Wall St

As the global trade tensions show signs of easing, Asian markets are experiencing a period of cautious optimism, with key indices like China's CSI 300 and Japan's Nikkei 225 posting gains amid expectations of economic stimulus to counteract U.S. tariffs. In this environment, high-growth tech stocks in Asia present intriguing opportunities for investors seeking to capitalize on technological advancements and government support initiatives aimed at bolstering innovation and consumption.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.31% | 28.32% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 30.19% | 28.84% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Tianyu Digital Technology (Dalian) Group (SZSE:002354)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tianyu Digital Technology (Dalian) Group Co., Ltd. operates in the digital technology sector and has a market capitalization of approximately CN¥10.85 billion.

Operations: The company generates revenue primarily from its digital technology operations. It has a market capitalization of approximately CN¥10.85 billion, reflecting its position in the industry.

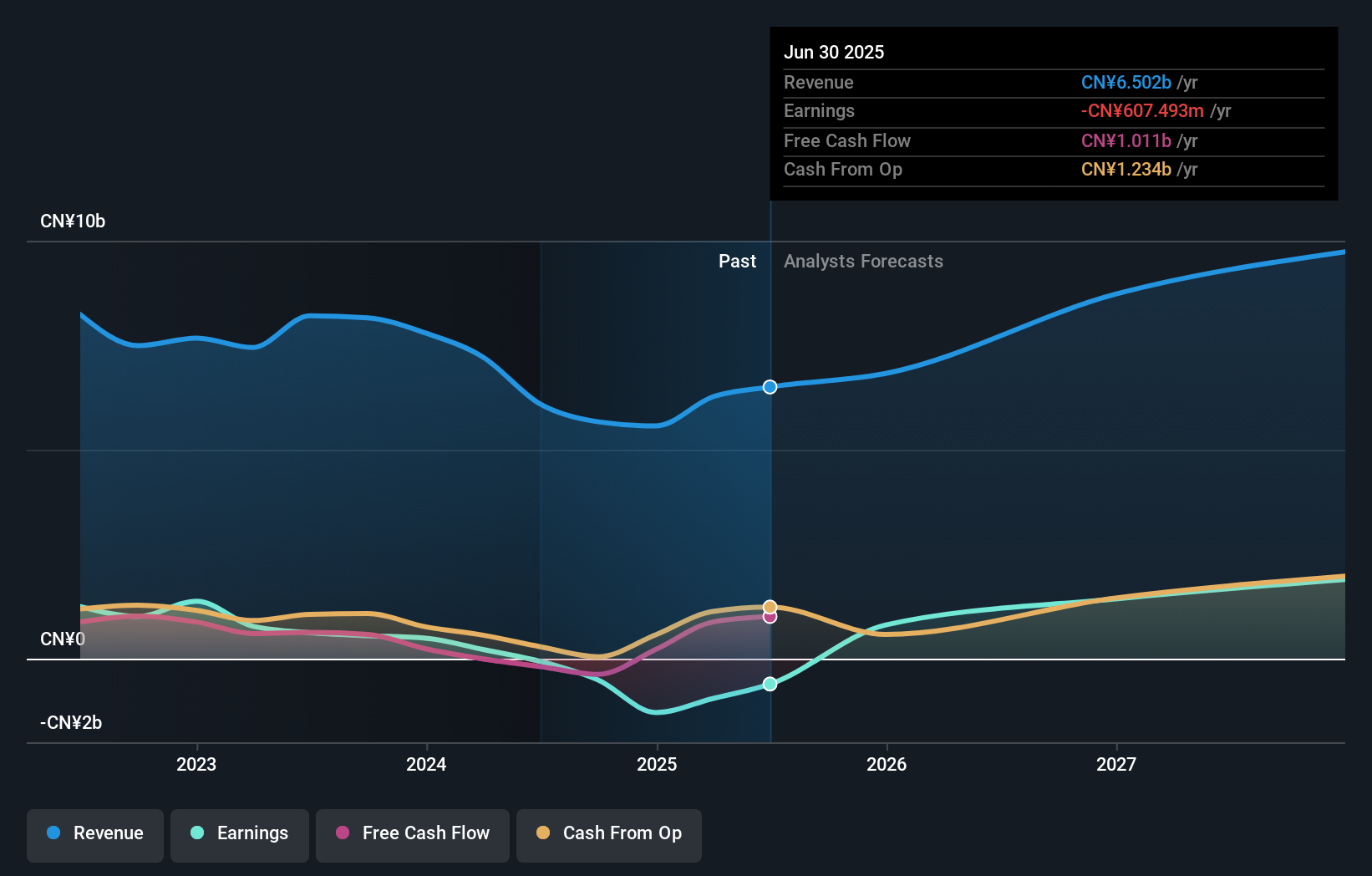

Tianyu Digital Technology (Dalian) Group has demonstrated a notable resilience and potential within the tech sector, especially considering its recent earnings results. Despite a dip in net income from CNY 13.31 million to CNY 5.24 million year-over-year, the company's sales surged from CNY 369.82 million to CNY 485 million in the first quarter of 2025, reflecting a robust revenue growth rate of 12.7% annually. This performance is slightly above the Chinese market average of 12.6%, signaling competitive strength in revenue generation amidst challenging market conditions. Furthermore, with an expected annual earnings growth rate of an impressive 125.35%, Tianyu Digital is positioning itself for profitability within three years, underscoring its potential for rapid financial improvement and stakeholder value creation in the burgeoning Asian tech landscape.

Perfect World (SZSE:002624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Perfect World Co., Ltd. focuses on the research, development, distribution, and operation of online games both in China and internationally, with a market cap of CN¥25.90 billion.

Operations: The company generates revenue primarily through the research, development, distribution, and operation of online games in China and internationally.

Perfect World has demonstrated a significant turnaround in its financial performance, with first-quarter sales soaring to CNY 2.02 billion from CNY 1.33 billion year-over-year, marking an impressive revenue growth of 52%. This surge is complemented by a swing to a net income of CNY 302.19 million, recovering from a net loss just the previous year. The company's commitment to innovation is evident in its R&D spending, which remains robust, underlining its pursuit of market-leading technologies and services in the competitive gaming and entertainment sectors. With earnings projected to grow by an annual rate of 112.6% and revenue expected to increase by 19.5% annually, Perfect World is positioning itself as a resilient contender in Asia's tech landscape despite past volatility.

- Unlock comprehensive insights into our analysis of Perfect World stock in this health report.

Explore historical data to track Perfect World's performance over time in our Past section.

Micro-Star International (TWSE:2377)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Micro-Star International Co., Ltd. is a global manufacturer and seller of motherboards, interface cards, notebook computers, and other electronic products with a market cap of NT$117.01 billion.

Operations: The company primarily generates revenue from its Computer and Peripherals segment, amounting to NT$197.83 billion.

Micro-Star International (MSI) recently showcased its innovative AI platforms at GTC 2025, emphasizing its commitment to cutting-edge technology in high-performance computing and AI. Despite a slight dip in net income from TWD 7.53 billion to TWD 6.79 billion year-over-year, MSI's sales grew to TWD 197.87 billion, marking a solid performance in a competitive sector. The company's strategic focus on scalable AI server solutions positions it well within the tech industry's evolving landscape, especially as it continues to invest in R&D and adapt to market demands effectively. This approach is likely to keep MSI relevant and competitive, navigating through the challenges of tech innovation and market shifts.

Summing It All Up

- Discover the full array of 494 Asian High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianyu Digital Technology (Dalian) Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002354

Tianyu Digital Technology (Dalian) Group

Tianyu Digital Technology (Dalian) Group Co., Ltd.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives