Even after rising 15% this past week, Foshan Yowant TechnologyLtd (SZSE:002291) shareholders are still down 75% over the past three years

This week we saw the Foshan Yowant Technology Co.,Ltd (SZSE:002291) share price climb by 15%. But that doesn't change the fact that the returns over the last three years have been stomach churning. The share price has sunk like a leaky ship, down 75% in that time. So it sure is nice to see a bit of an improvement. Of course the real question is whether the business can sustain a turnaround.

While the stock has risen 15% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Foshan Yowant TechnologyLtd

Foshan Yowant TechnologyLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

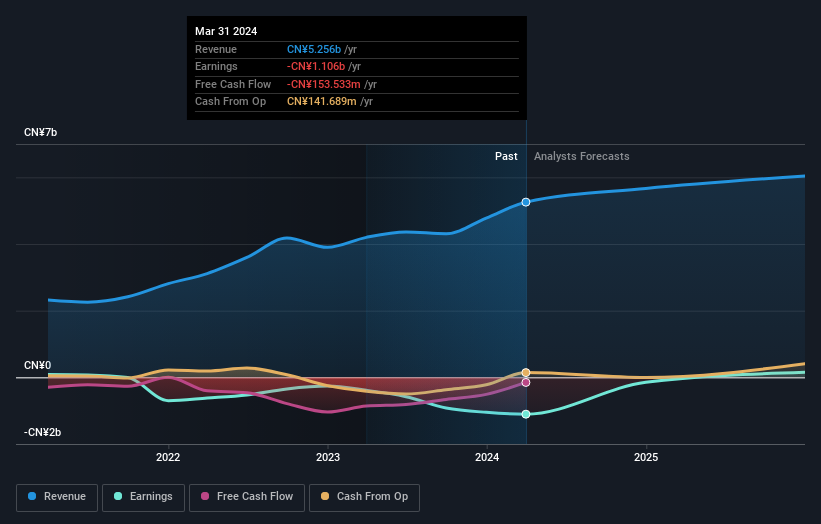

Over three years, Foshan Yowant TechnologyLtd grew revenue at 27% per year. That's well above most other pre-profit companies. So why has the share priced crashed 21% per year, in the same time? You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Foshan Yowant TechnologyLtd's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 20% in the twelve months, Foshan Yowant TechnologyLtd shareholders did even worse, losing 62%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.3% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Foshan Yowant TechnologyLtd , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002291

Foshan Yowant TechnologyLtd

Engages in the digital marketing business in China.

Excellent balance sheet and fair value.