- China

- /

- Paper and Forestry Products

- /

- SZSE:002247

Zhejiang Juli Culture Development Co.,Ltd. (SZSE:002247) Looks Inexpensive After Falling 28% But Perhaps Not Attractive Enough

Unfortunately for some shareholders, the Zhejiang Juli Culture Development Co.,Ltd. (SZSE:002247) share price has dived 28% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

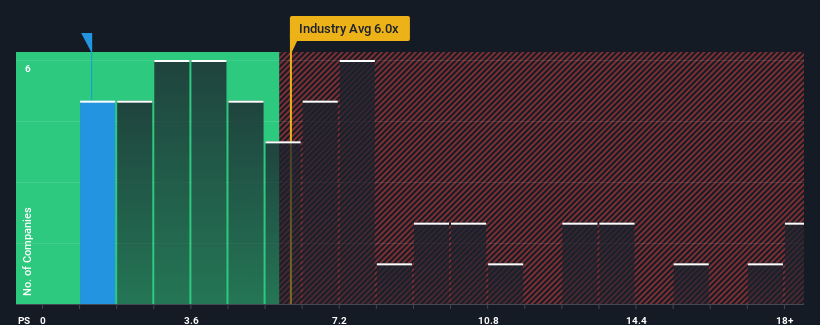

After such a large drop in price, Zhejiang Juli Culture DevelopmentLtd may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.2x, considering almost half of all companies in the Entertainment industry in China have P/S ratios greater than 6x and even P/S higher than 9x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Zhejiang Juli Culture DevelopmentLtd

What Does Zhejiang Juli Culture DevelopmentLtd's P/S Mean For Shareholders?

It looks like revenue growth has deserted Zhejiang Juli Culture DevelopmentLtd recently, which is not something to boast about. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. Those who are bullish on Zhejiang Juli Culture DevelopmentLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhejiang Juli Culture DevelopmentLtd's earnings, revenue and cash flow.How Is Zhejiang Juli Culture DevelopmentLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Zhejiang Juli Culture DevelopmentLtd would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 5.1% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 28% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Zhejiang Juli Culture DevelopmentLtd's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Shares in Zhejiang Juli Culture DevelopmentLtd have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that Zhejiang Juli Culture DevelopmentLtd maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Zhejiang Juli Culture DevelopmentLtd with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Zhejiang Juli Culture DevelopmentLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Juli Culture DevelopmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002247

Zhejiang Juli Culture DevelopmentLtd

Zhejiang Juli Culture Development Co.,Ltd.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives