Stock Analysis

High Growth Tech Stocks Including None With Promising Potential

Reviewed by Simply Wall St

As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps, positive sentiment is being driven by strong labor market data and encouraging home sales reports in the U.S. This environment sets a promising backdrop for high-growth tech stocks, where investors often look for companies that demonstrate robust innovation potential and adaptability to rapidly changing market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Shanghai OPM Biosciences (SHSE:688293)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai OPM Biosciences Co., Ltd. is engaged in providing cell culture media and CDMO services both domestically in China and internationally, with a market capitalization of CN¥4.85 billion.

Operations: The company focuses on producing cell culture media and offering CDMO services, targeting both domestic and international markets. Its business model leverages these two primary revenue streams to drive growth.

Shanghai OPM Biosciences is navigating a challenging landscape with its recent earnings showing a dip in net income to CNY 27.23 million from last year's CNY 43.18 million, despite an increase in revenue to CNY 215.86 million. The company's commitment to innovation is evident from its R&D spending, crucial for staying competitive in the biotech sector where rapid advancements are the norm. However, it faces volatility with a highly fluctuating share price and earnings impacted by significant one-off items totaling CN¥9.5M. Looking ahead, while its projected annual earnings growth of 60% outpaces the Chinese market forecast of 26.1%, maintaining this momentum could be challenging given the current financial complexities and market conditions.

Bona Film Group (SZSE:001330)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bona Film Group Co., Ltd. is a company focused on film production and distribution in China, with a market capitalization of CN¥8.98 billion.

Operations: The company generates revenue mainly through film production and distribution activities within China. With a market capitalization of CN¥8.98 billion, it focuses on creating and distributing films, contributing significantly to its financial performance.

Despite a challenging year with revenues dropping to CNY 960 million from last year's CNY 1,321.38 million, Bona Film Group is actively managing its capital through strategic share repurchases, totaling CNY 47 million for 8.639 million shares. This approach underscores their commitment to stabilizing share price amidst financial turbulence marked by a net loss increase to CNY 354.36 million. Looking forward, the company's aggressive revenue growth forecast at an annual rate of 55.3% and earnings expected to surge by 105.18% annually signal potential recovery and expansion in the entertainment sector where innovation and market adaptation are critical.

- Dive into the specifics of Bona Film Group here with our thorough health report.

Gain insights into Bona Film Group's past trends and performance with our Past report.

Topsec Technologies Group (SZSE:002212)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Topsec Technologies Group Inc., along with its subsidiaries, offers cybersecurity, big data, and cloud services in China and has a market capitalization of approximately CN¥7.99 billion.

Operations: The company primarily generates revenue through its cybersecurity segment, which accounts for CN¥3.06 billion.

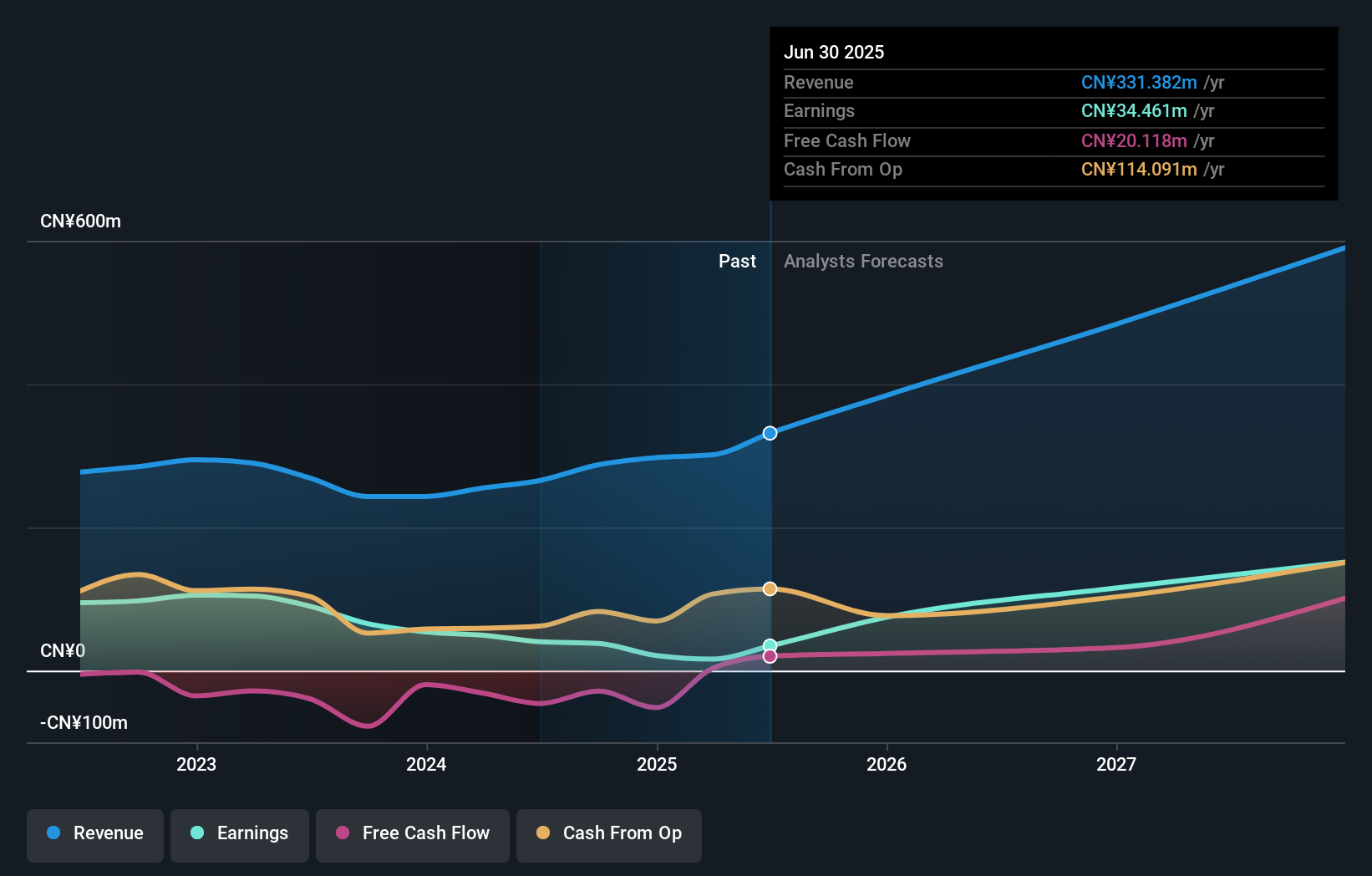

Topsec Technologies Group, amidst a challenging market, reported a significant reduction in net loss to CNY 169.28 million from CNY 248.31 million year-over-year, showcasing resilience and potential for recovery. With sales reaching CNY 1,582.45 million despite a slight decrease from the previous year's CNY 1,648.08 million, the company's strategic adjustments appear to be yielding results. The commitment to shareholder returns is evident from their recent interim profit distribution of CNY 0.18 per share and an active approach during extraordinary meetings to refine audit processes and corporate structure promises enhanced governance ahead. The firm's R&D investment strategy aligns with its long-term vision for growth in the tech sector; however, specific figures on recent R&D expenses were not disclosed in the latest reports. This focus on innovation could be crucial as Topsec aims to transition into profitability within three years—a prospect underscored by an expected annual earnings growth of 73.67%. This projection alongside a revenue forecast growing annually at 15%—outpacing the Chinese market average—suggests that Topsec is positioning itself strategically within its industry despite current unprofitability.

- Unlock comprehensive insights into our analysis of Topsec Technologies Group stock in this health report.

Understand Topsec Technologies Group's track record by examining our Past report.

Make It Happen

- Discover the full array of 1288 High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topsec Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002212

Topsec Technologies Group

Provides cyber security, big data, and cloud services in China.