- China

- /

- General Merchandise and Department Stores

- /

- SHSE:600865

Uncovering 3 Hidden Opportunities In The Stock Market

Reviewed by Simply Wall St

As global markets navigate a landscape of record-high indexes and robust economic indicators, smaller-cap stocks have been capturing attention with their strong performance relative to larger counterparts. In this environment, identifying hidden opportunities requires a keen eye for companies that exhibit resilience and potential amidst broader market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Baida GroupLtd (SHSE:600865)

Simply Wall St Value Rating: ★★★★★★

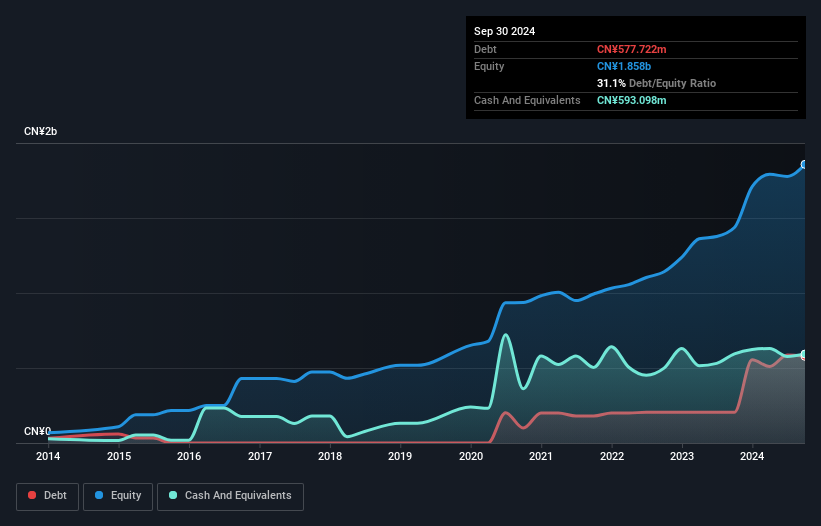

Overview: Baida Group Co., Ltd primarily operates department stores in China and has a market capitalization of CN¥3.55 billion.

Operations: Baida Group Ltd generates revenue predominantly from its commodity retail business, amounting to CN¥207.42 million.

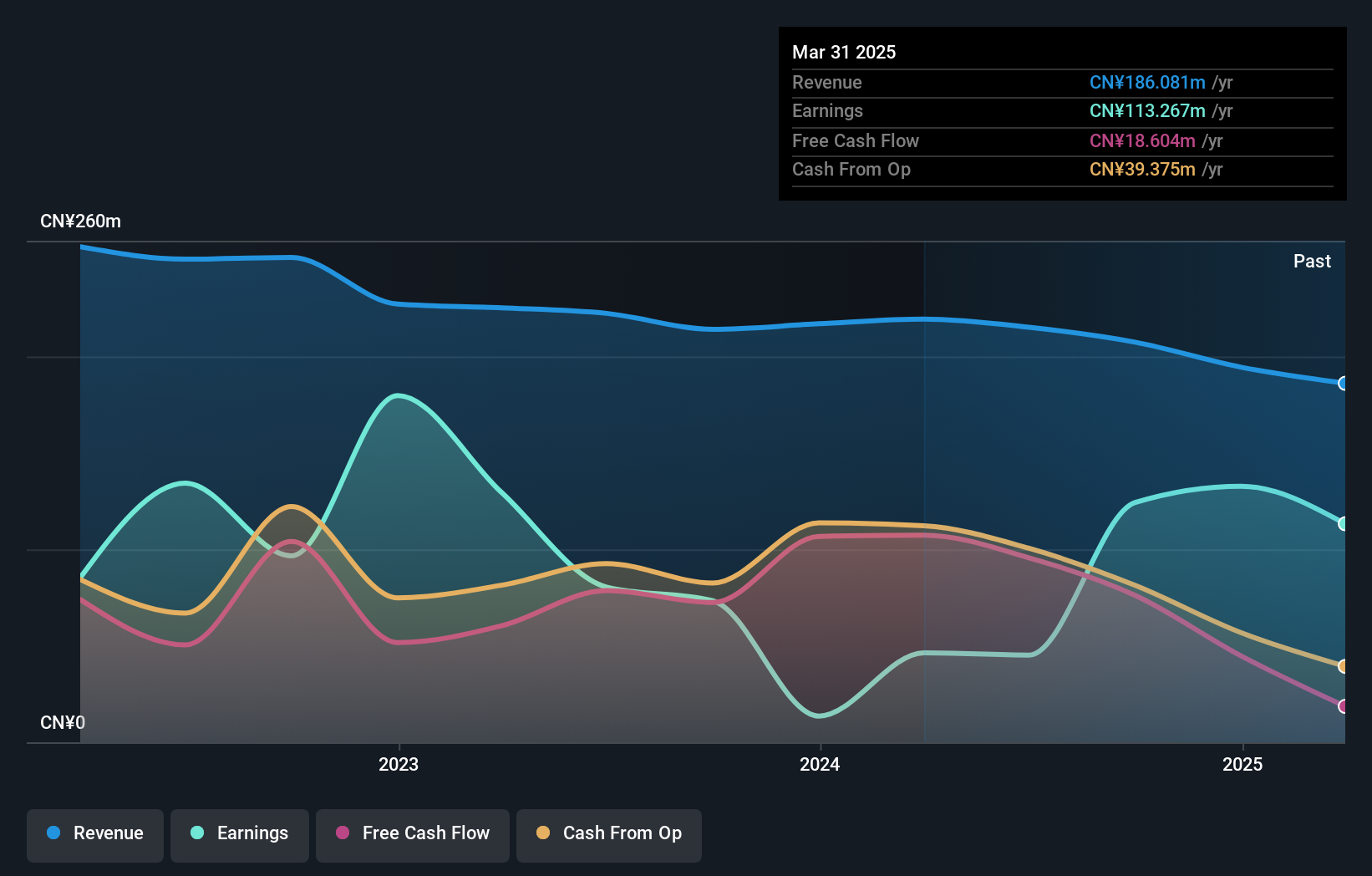

Baida Group has shown impressive earnings growth, with a 69.3% increase over the past year, surpassing the Multiline Retail industry's -6.7%. Despite a yearly earnings decline of 24.7% over five years, recent performance is promising with net income jumping to CN¥131.53 million from CN¥20.81 million compared to last year for the nine months ending September 2024. The company remains debt-free and boasts a price-to-earnings ratio of 28.5x, undercutting the broader CN market's 34.8x ratio, indicating potential value for investors seeking opportunities in this sector.

- Unlock comprehensive insights into our analysis of Baida GroupLtd stock in this health report.

Examine Baida GroupLtd's past performance report to understand how it has performed in the past.

Guizhou Sanli PharmaceuticalLtd (SHSE:603439)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guizhou Sanli Pharmaceutical Ltd is involved in the research, development, production, and marketing of pharmaceutical products with a market cap of CN¥5.68 billion.

Operations: Guizhou Sanli Pharmaceutical generates revenue primarily from its pharmaceutical products. The company reported a market cap of CN¥5.68 billion, reflecting its scale in the industry.

Guizhou Sanli, a nimble entity in the pharmaceutical sector, showcases robust financial health with its earnings growth of 28.7% outpacing the industry average. The company’s price-to-earnings ratio stands attractively at 17.3x, notably below the broader CN market's 34.8x, suggesting potential undervaluation. Recent earnings for nine months ending September 2024 reported sales of CNY 1.45 billion and net income of CNY 194 million, reflecting solid performance compared to last year’s figures. Notably, Guizhou Sanli executed a share buyback worth CNY 99.95 million in September, enhancing shareholder value and capital structure efficiency.

GFC (TPEX:4506)

Simply Wall St Value Rating: ★★★★★☆

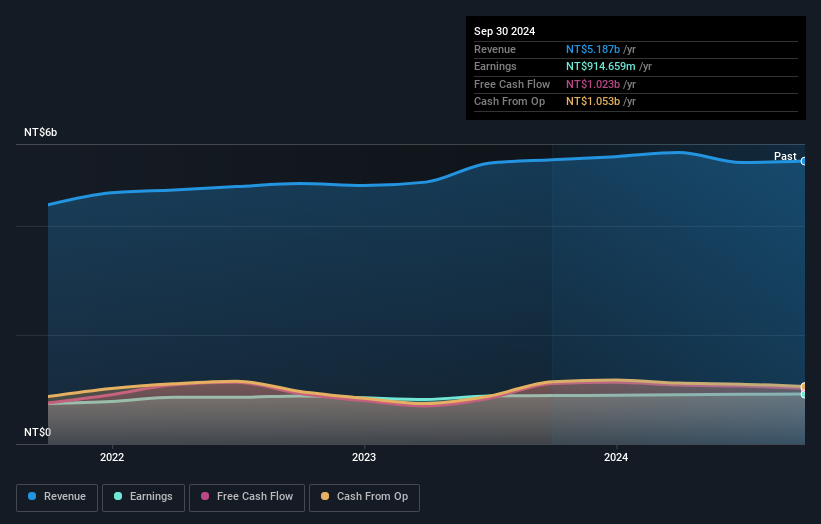

Overview: GFC LTD., along with its subsidiaries, operates in Taiwan manufacturing and selling elevators, escalators, and generators, with a market cap of NT$18.23 billion.

Operations: GFC generates revenue primarily from the sale of elevators, escalators, and generators. The company's net profit margin has shown variability, with recent figures at 7.5%.

GFC has shown steady growth with earnings increasing by 6.9% annually over the past five years, while its debt to equity ratio rose slightly from 0% to 0.9%. The company is comfortably covering interest payments and boasts high-quality earnings, with a price-to-earnings ratio of 19.9x, under the TW market's average of 21.3x, suggesting it might be undervalued. Recent financial results highlight a modest rise in quarterly sales to TWD 1,422 million and net income at TWD 246 million compared to last year’s figures, reflecting stable performance despite challenges in outpacing industry growth rates.

- Dive into the specifics of GFC here with our thorough health report.

Evaluate GFC's historical performance by accessing our past performance report.

Summing It All Up

- Gain an insight into the universe of 4633 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baida GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600865

Flawless balance sheet average dividend payer.