As global markets experience a mix of optimism and caution, with U.S. indexes approaching record highs and geopolitical tensions casting shadows, investors are increasingly focusing on companies where insiders have significant ownership stakes. In such an environment, growth companies with high insider ownership can be particularly appealing as they often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 43.2% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's dive into some prime choices out of the screener.

Beijing Wantai Biological Pharmacy Enterprise (SHSE:603392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Wantai Biological Pharmacy Enterprise Co., Ltd. operates in the biotechnology sector, focusing on the development and production of diagnostic reagents and vaccines, with a market cap of CN¥91.66 billion.

Operations: I'm sorry, but it seems that the revenue segments for Beijing Wantai Biological Pharmacy Enterprise Co., Ltd. were not provided in the text you shared. If you have that information, I can help summarize it for you.

Insider Ownership: 24.2%

Earnings Growth Forecast: 113.8% p.a.

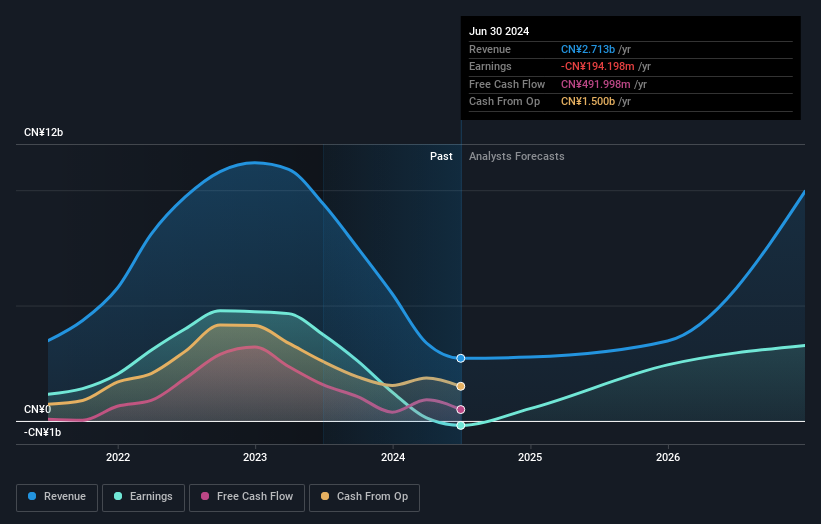

Beijing Wantai Biological Pharmacy Enterprise has seen a significant decline in recent earnings, with net income dropping to CNY 266.65 million for the first nine months of 2024 from CNY 1,808.36 million a year ago. Despite this, analysts forecast robust revenue growth at over 60% annually, outpacing the Chinese market's average. The company completed a buyback of shares worth CNY 200.08 million and is expected to achieve profitability within three years, although return on equity remains low at an estimated future rate of 17.9%.

- Delve into the full analysis future growth report here for a deeper understanding of Beijing Wantai Biological Pharmacy Enterprise.

- The analysis detailed in our Beijing Wantai Biological Pharmacy Enterprise valuation report hints at an inflated share price compared to its estimated value.

QuantumCTek (SHSE:688027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. specializes in manufacturing quantum information technology-based security products and services for the information and communication technology sector in China, with a market cap of CN¥24.03 billion.

Operations: QuantumCTek Co., Ltd. generates its revenue from the production and provision of security products and services that leverage quantum information technology within China's information and communication technology sector.

Insider Ownership: 15.7%

Earnings Growth Forecast: 106.5% p.a.

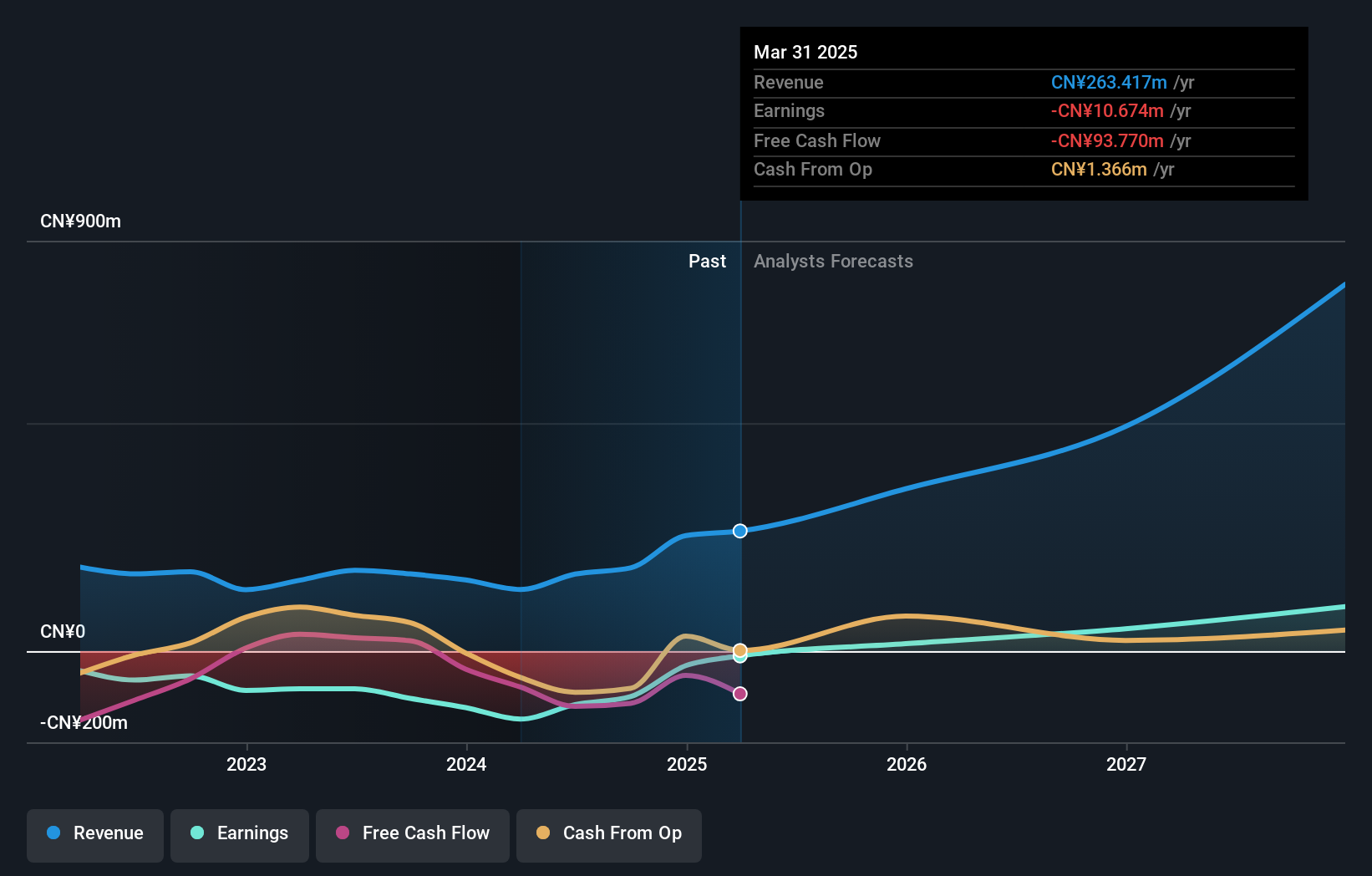

QuantumCTek reported a revenue increase to CNY 99.71 million for the first nine months of 2024, up from CNY 73.26 million the previous year, while reducing its net loss to CNY 55.12 million. Analysts expect its revenue to grow at over 24% annually, surpassing market averages, and project profitability within three years despite low forecasted return on equity of 2.3%. The company's share price has been highly volatile recently, with no significant insider trading activity noted in the past three months.

- Dive into the specifics of QuantumCTek here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, QuantumCTek's share price might be too optimistic.

Shijiazhuang Shangtai Technology (SZSE:001301)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shijiazhuang Shangtai Technology Co., Ltd. operates in the technology sector and has a market cap of approximately CN¥19.82 billion.

Operations: Unfortunately, I cannot provide a summary of the company's revenue segments as the specific details were not included in the provided text.

Insider Ownership: 39.9%

Earnings Growth Forecast: 21.1% p.a.

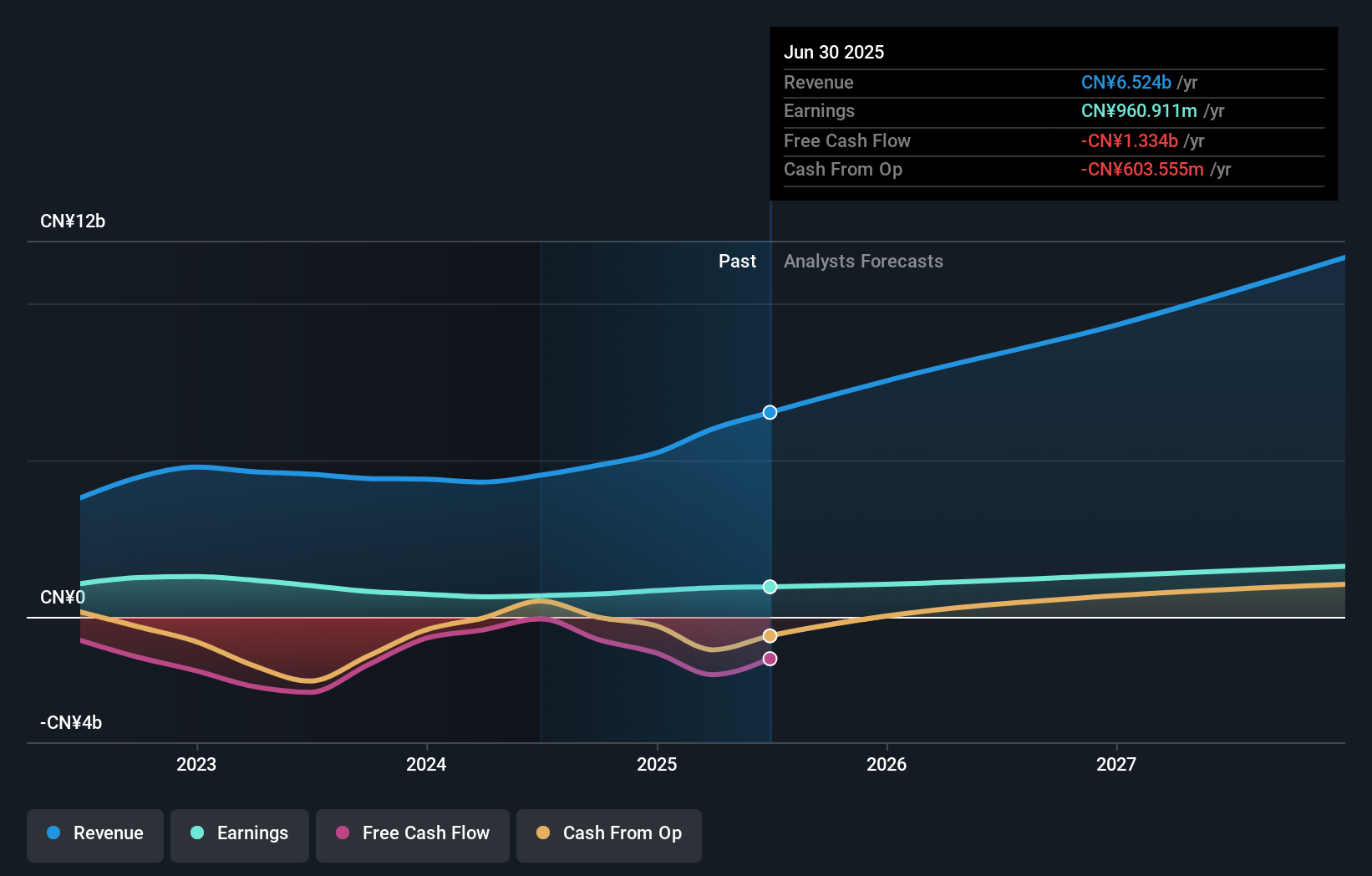

Shijiazhuang Shangtai Technology reported a revenue increase to CNY 3.62 billion for the first nine months of 2024, up from CNY 3.17 billion a year earlier, with net income slightly rising to CNY 577.82 million. The company's earnings are forecasted to grow significantly at over 20% annually, though slower than the market average. Despite this growth potential, its return on equity is expected to remain low at around 15%. Recent shareholder meetings focused on share repurchase plans indicate strategic financial maneuvers without substantial recent insider trading activities.

- Navigate through the intricacies of Shijiazhuang Shangtai Technology with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Shijiazhuang Shangtai Technology is priced higher than what may be justified by its financials.

Summing It All Up

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1512 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Wantai Biological Pharmacy Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603392

Beijing Wantai Biological Pharmacy Enterprise

Beijing Wantai Biological Pharmacy Enterprise Co., Ltd.

High growth potential with excellent balance sheet.