- China

- /

- Entertainment

- /

- SZSE:001330

High Growth Tech Stocks Including Bonree Data Technology And 2 Others

Reviewed by Simply Wall St

In recent weeks, global markets have experienced volatility due to geopolitical tensions and concerns over consumer spending, with key indices like the S&P 500 showing fluctuations amid tariff fears and economic data releases. As investors navigate these uncertain times, identifying high-growth tech stocks can be crucial; companies that demonstrate strong innovation potential and adaptability may offer opportunities for growth even in challenging market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Travere Therapeutics | 28.04% | 65.55% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.67% | 58.73% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1193 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Bonree Data Technology (SHSE:688229)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bonree Data Technology Co., Ltd offers application performance management services for enterprises in China, with a market cap of CN¥2.69 billion.

Operations: Bonree Data Technology Co., Ltd specializes in application performance management services targeting enterprises within China. The company's revenue streams are primarily derived from providing these specialized services, reflecting its focus on enhancing enterprise software performance.

Bonree Data Technology, amid a volatile market, showcases promising growth with an expected revenue increase of 25.5% annually, outpacing the CN market's 13.4%. Despite current unprofitability, forecasts suggest a robust profit surge at an annual rate of 88%, positioning the firm for potential profitability within three years. This growth trajectory is supported by significant R&D investments that fuel innovation and competitiveness in the tech sector. As industries increasingly rely on data analytics and cloud services, Bonree's focus on these areas could substantially benefit its future market standing.

- Take a closer look at Bonree Data Technology's potential here in our health report.

Assess Bonree Data Technology's past performance with our detailed historical performance reports.

Bona Film Group (SZSE:001330)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bona Film Group Co., Ltd. is involved in film production and distribution in China, with a market capitalization of CN¥6.88 billion.

Operations: The company focuses on film production and distribution within China. It operates with a market capitalization of CN¥6.88 billion, positioning itself as a significant player in the Chinese entertainment industry.

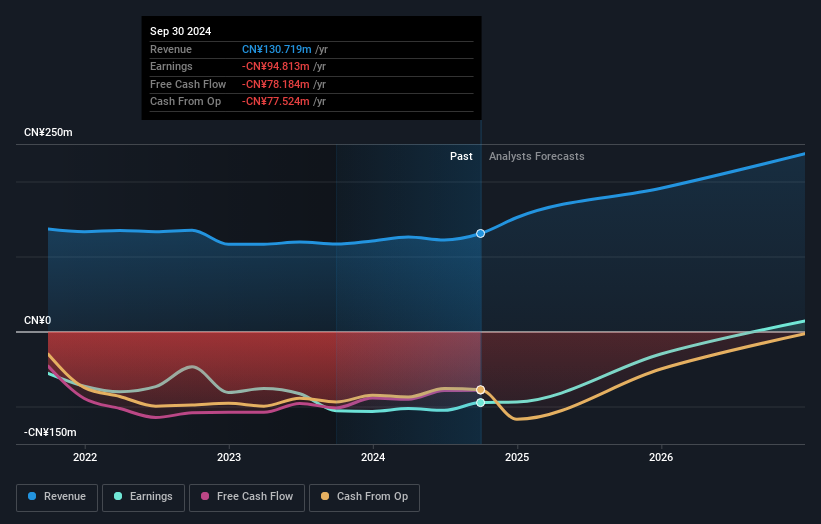

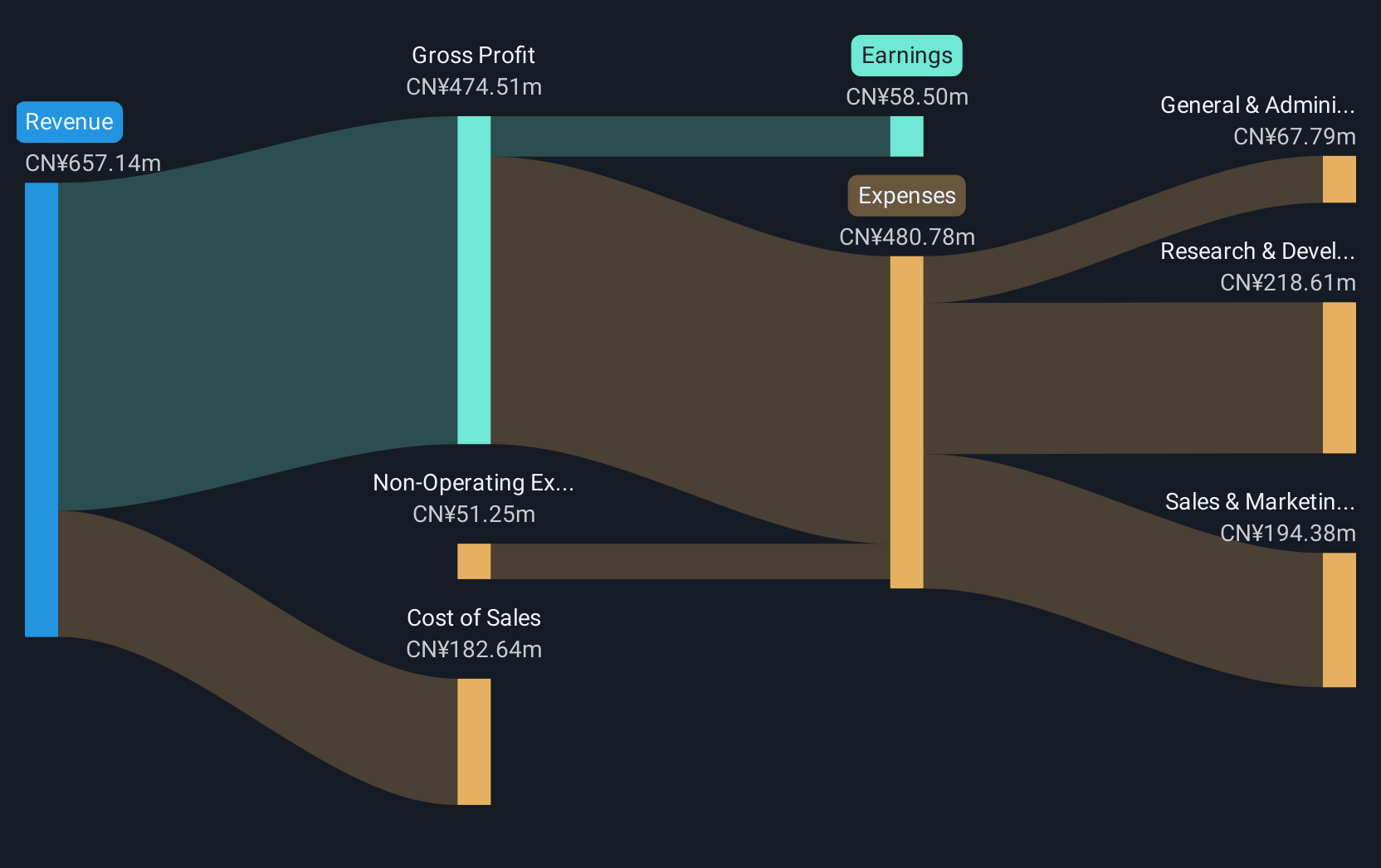

Bona Film Group, amidst a dynamic entertainment landscape, is poised for substantial growth with its revenue forecast to surge by 42.9% annually, significantly outstripping the industry norm. This impressive expansion is underpinned by an anticipated earnings growth of 117.4% per year, reflecting robust market demand and operational efficiency. The company's commitment to innovation is evident in its R&D investments, which are crucial for maintaining competitive edge and fueling future developments in a sector increasingly driven by digital consumption trends.

Shenzhen Sinovatio Technology (SZSE:002912)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Sinovatio Technology Co., Ltd. specializes in network visualization, data and network security, and big data analysis, with a market cap of CN¥4.89 billion.

Operations: Sinovatio Technology focuses on providing solutions in network visualization, data security, and big data analysis. The company operates with a market cap of CN¥4.89 billion, reflecting its significant presence in the tech industry.

Shenzhen Sinovatio Technology is navigating a challenging yet promising trajectory in the tech sector. Despite being dropped from the S&P Global BMI Index recently, its revenue growth outlook remains robust at 23.9% annually, outpacing the Chinese market's average of 13.4%. This growth is supported by an expected surge in earnings by approximately 104.6% per year over the next three years as it transitions towards profitability. The company's strategic focus on R&D, crucial for maintaining competitiveness and fostering innovation in its offerings, underscores its potential to capitalize on emerging tech trends despite current unprofitability.

Next Steps

- Embark on your investment journey to our 1193 High Growth Tech and AI Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bona Film Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001330

Bona Film Group

Engages in the film production and distribution business in China.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives