Southern Publishing and Media Co.,Ltd. (SHSE:601900) Shares Fly 26% But Investors Aren't Buying For Growth

Southern Publishing and Media Co.,Ltd. (SHSE:601900) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 57% in the last year.

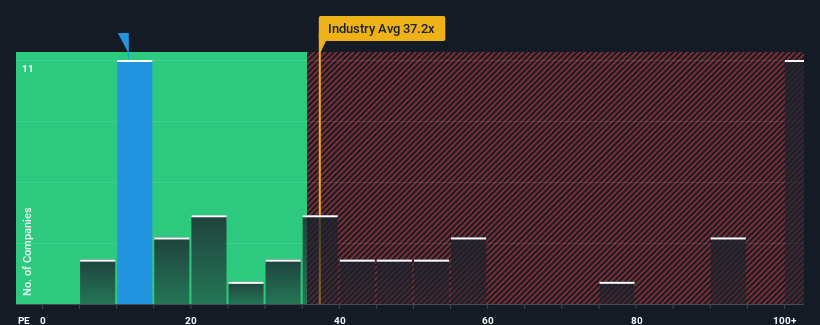

Although its price has surged higher, Southern Publishing and MediaLtd's price-to-earnings (or "P/E") ratio of 11.4x might still make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 31x and even P/E's above 56x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Southern Publishing and MediaLtd has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Southern Publishing and MediaLtd

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Southern Publishing and MediaLtd's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 45%. Pleasingly, EPS has also lifted 68% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 9.2% during the coming year according to the only analyst following the company. Meanwhile, the rest of the market is forecast to expand by 41%, which is noticeably more attractive.

With this information, we can see why Southern Publishing and MediaLtd is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Southern Publishing and MediaLtd's P/E

Shares in Southern Publishing and MediaLtd are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Southern Publishing and MediaLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Southern Publishing and MediaLtd you should be aware of.

Of course, you might also be able to find a better stock than Southern Publishing and MediaLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601900

Southern Publishing and MediaLtd

Southern Publishing and Media Co., Ltd. operates as a publishing company in China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026